Between all of the blogs, podcasts, YouTube shows and media appearances produced by our content team at Ritholtz Wealth Management, we get a lot of questions from our audience.

So we set up an email exclusively for those questions.

Sometimes, people reach out with specific questions about taxes, investing, saving, and all of the other finance-related questions they have about their money.

But I’ve noticed that most of the personal questions tend to be related to the big life events — graduating college, starting a new job, getting married, buying a house, having kids, divorce, retirement, and death.

Many people who work in the wealth management industry assume prospective clients will contact them when they need help with their finances, and that is the case for some people.

However, most people seek financial advice when life intervenes.

Recently, we received an email from a guy in his late-40s who dropped a bombshell:

Married, both 47, no kids. We both got our lives upended by two major, long-term, life-altering health diagnoses in the last two years. Unless science really pulls a rabbit out of a hat, it’s a matter of when, not if, we’ll both be forced to stop working.

We’re all living on borrowed time but some people are more aware of their countdown clock than others.

I feel for this couple.

Sometimes life forces your hand and you don’t have a say in the matter.

The last thing you want to worry about in these types of moments is money. Luckily, this couple gave themselves a big margin of safety when it comes to their finances. They saved a ton of money and shouldn’t have to worry about their financial plan.

There are so many elements of the financial planning process that are out of your hands — market returns, interest rates, inflation, tax rates, the timing of bull/bear markets, etc.

When it comes to your health, sometimes that’s out of your control too.

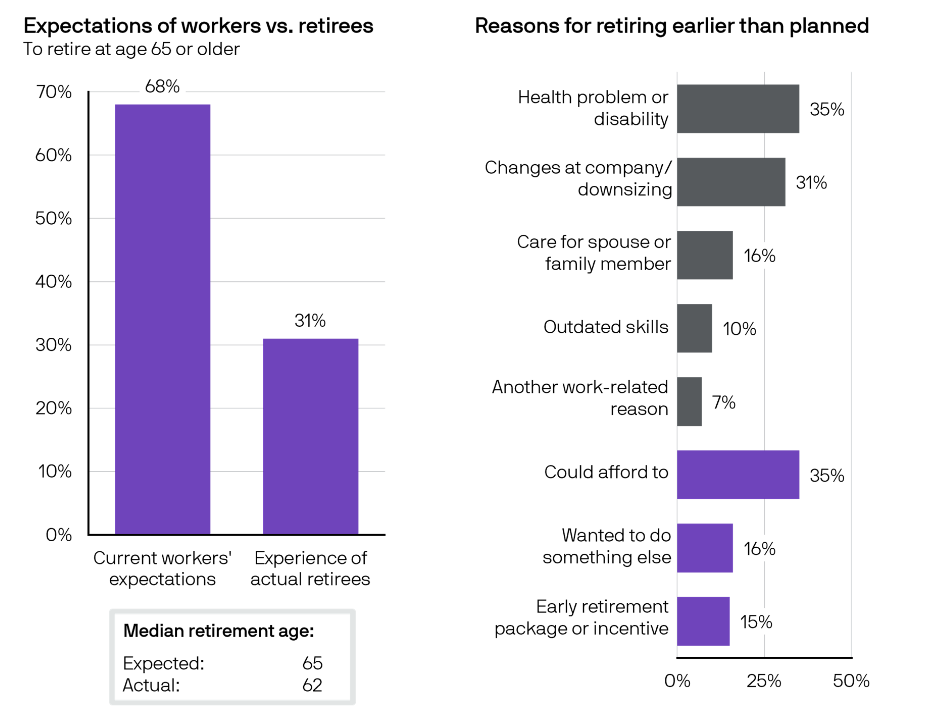

JP Morgan has some data that shows the expectations vs. reality when it comes to the timing of retirement:

Many retirees end up hanging it up a few years earlier than expected due to health, work, financial or other reasons.

Setting realistic expectations is a helpful part of the planning process but oftentimes those expectations get upended.

Life is unexpected and often unfair in many ways.

You can do all the right things and plan for a host of eventualities but sometimes it doesn’t matter. Life can get in the way regardless of your plans.

So you do the best you can. You save. You give yourself a margin of safety. You enjoy yourself today while planning for tomorrow.

Then you roll with the punches depending on what life throws your way.

If you have a question, email us here: askthecompoundshow@gmail.com

Check out the latest edition of Ask the Compound for more information on this question:

Is Private Equity Buying All the Houses?