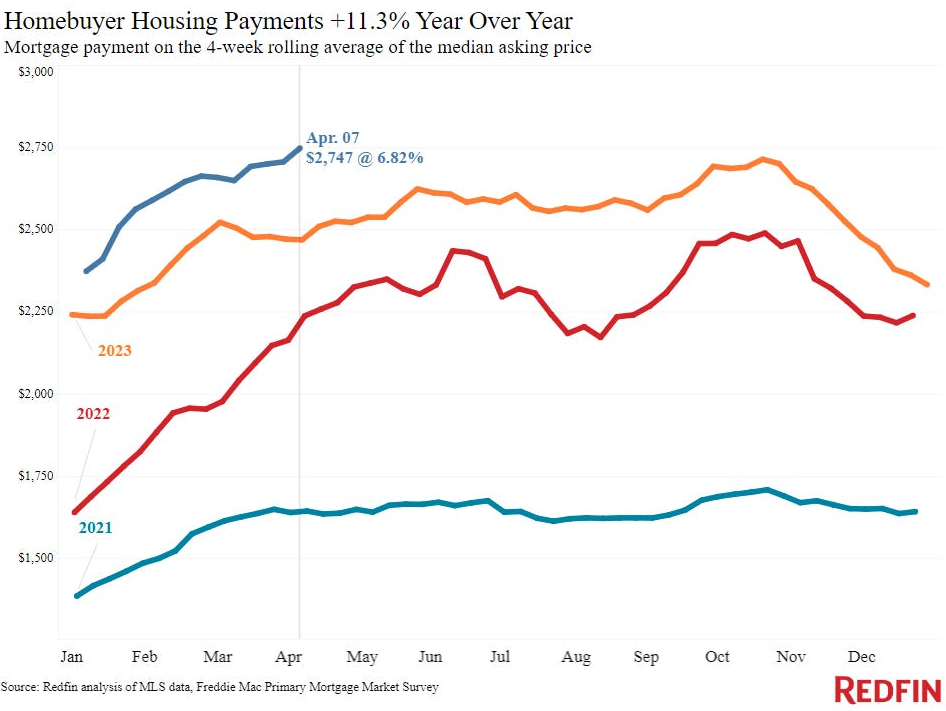

According to Redfin, we just hit another new all-time high in the median monthly payment (based on current home prices and mortgage rates):

The median payment for a new purchase has doubled since 2021.

Mortgage rates were back up to 7.4% this week. Nationwide housing prices are still are all-time highs and up around 50% since the end of 2019.

There has been this feeling of something has to give for a while now but nothing is giving.

All of which begs the question — who in the hell is still buying a house in this market?

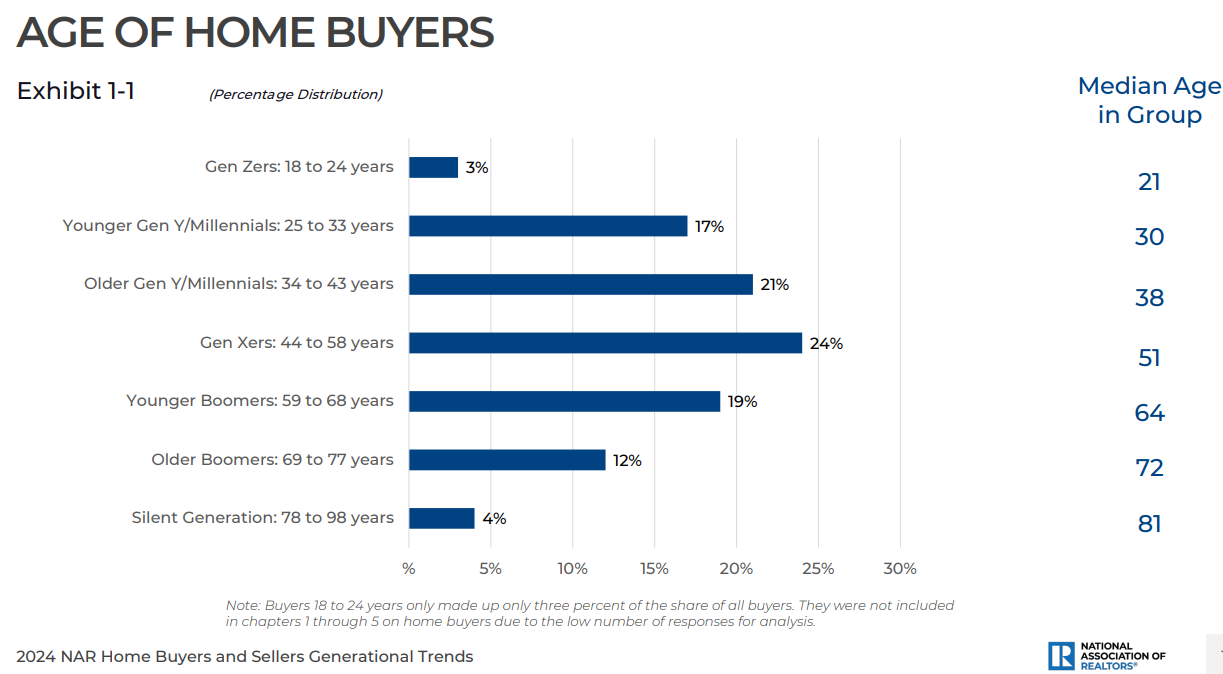

The National Association of Realtors has the answers in their latest Home Buyers and Sellers Generational Trends Report.

Demographics are still in the driver’s seat. Millennials are the biggest cohort of buyers with 38% of the total:

Baby boomers are next in line with 31% of purchases.1

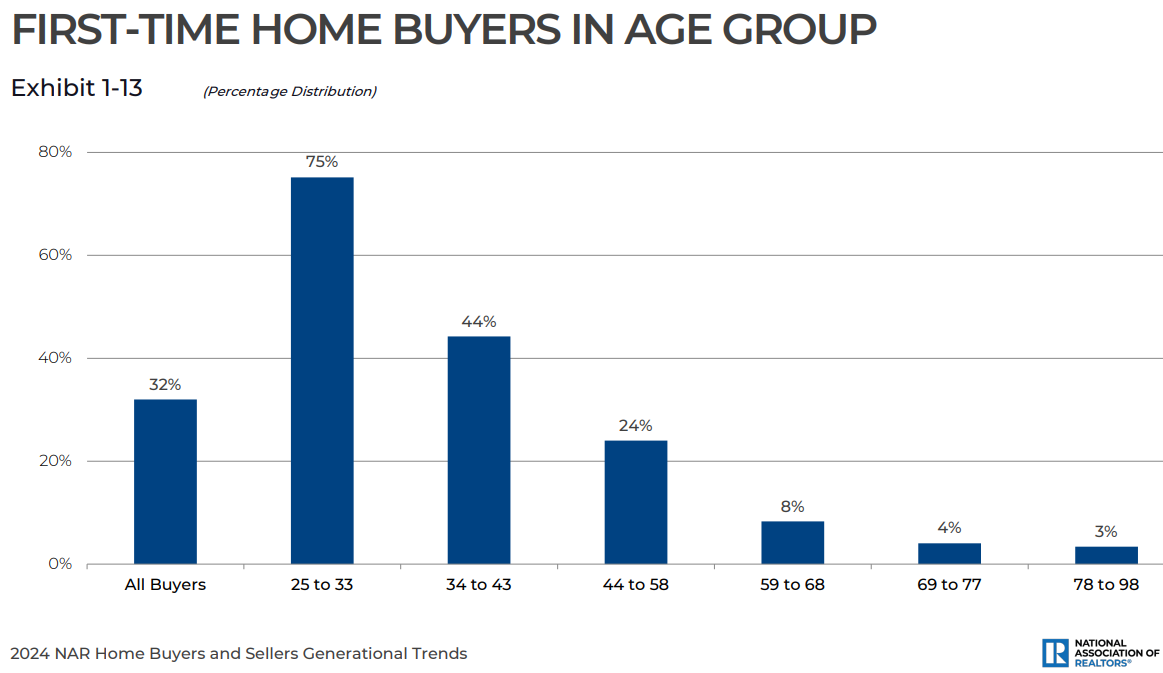

I know it seems like it would be an impossible market for first-time homebuyers but they make up three-quarters of the young millennial cohort:

One-third of all buyers of late have been first-timers. Nearly half of the 34 to 43 age group also purchased their first home.

To be fair, 24% of younger millennials received some form of help from a relative or friend on the down payment.

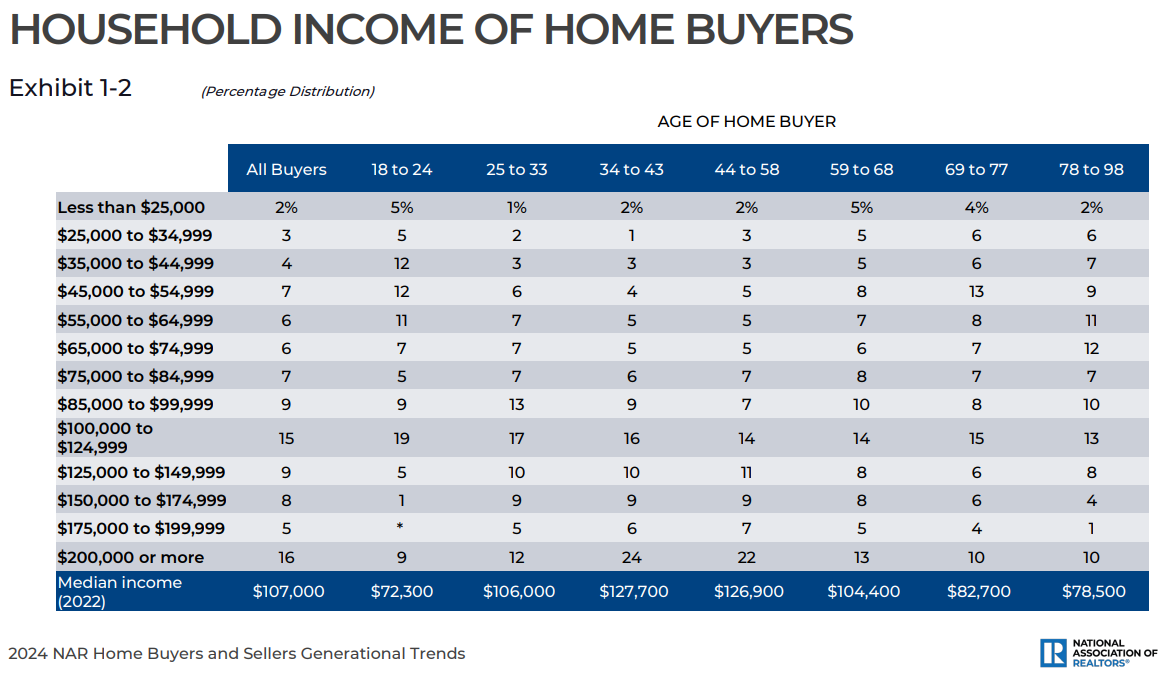

Here’s a breakdown of buyers by income levels:

Surprisingly, 44% of buyers make less than six figures in income (which is essentially the household median).

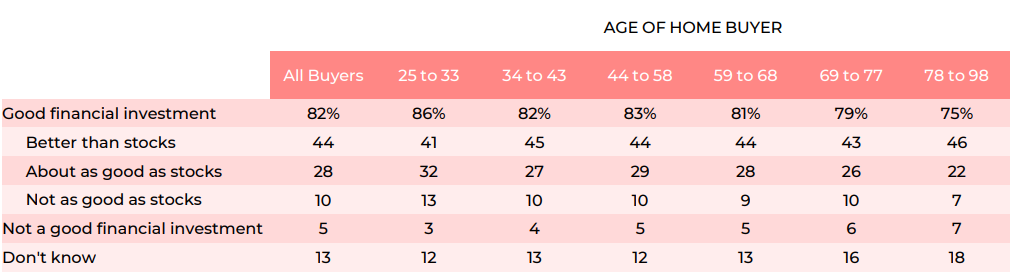

Most homebuyers still view housing as a good financial investment:

Nearly three-quarters of buyers think housing is as good or better than stocks in the long run. My guess is stock returns will be a much higher hurdle rate from current housing price levels, but who knows?

More than 70% of the houses purchased were built before 2004, and more than half were built prior to 1988. If mortgage rates ever come down, there will be a massive boom in HELOCs and cash-out refis, fueled by all of that pent-up home equity sitting in houses right now.

I’m bullish on renovations for the remainder of this decade.

It’s also worth pointing out that there are probably more housing transactions going on right now than most people would assume, given the pricing and financial dynamics.

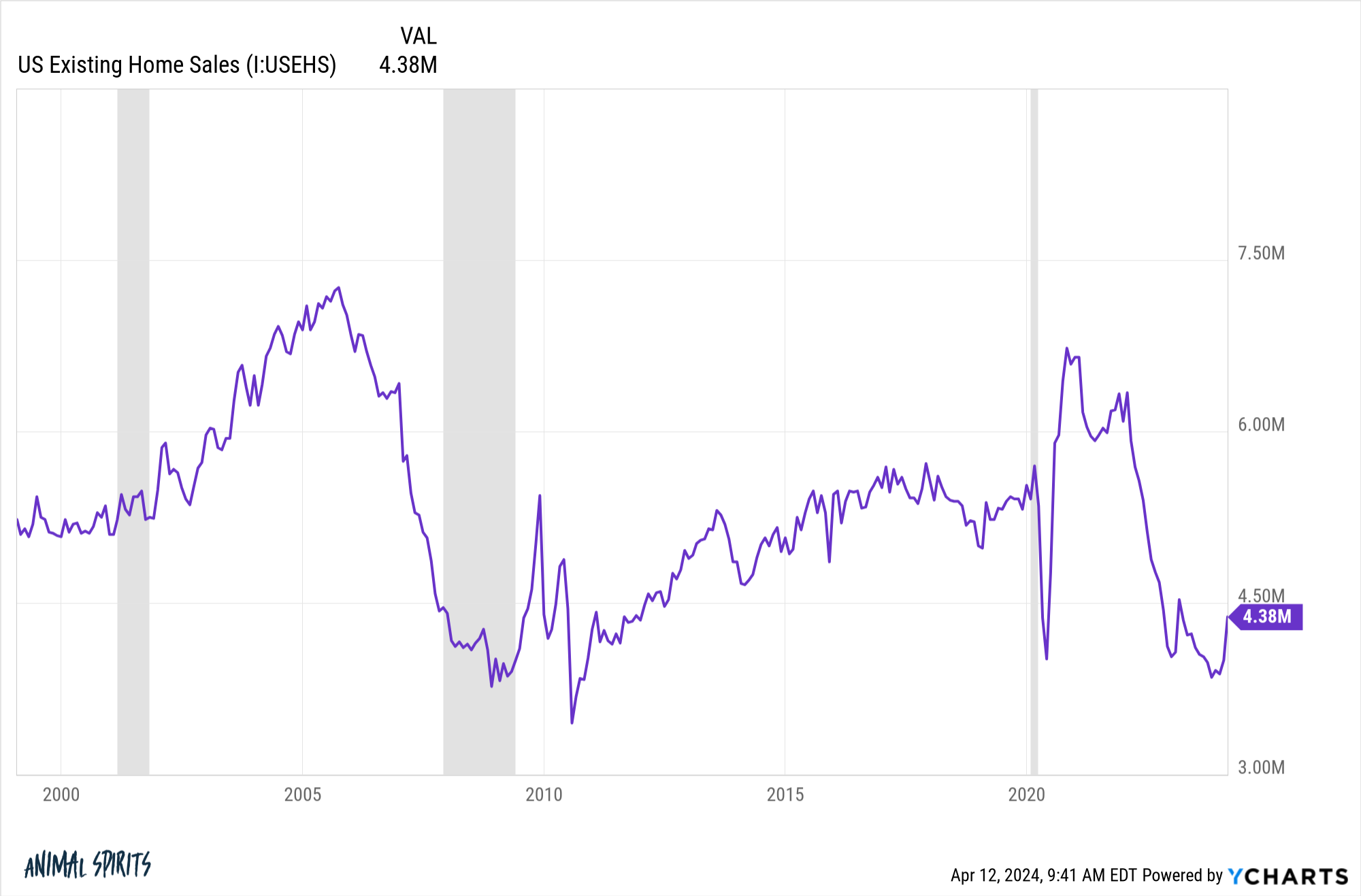

Here’s a look at existing home sales:

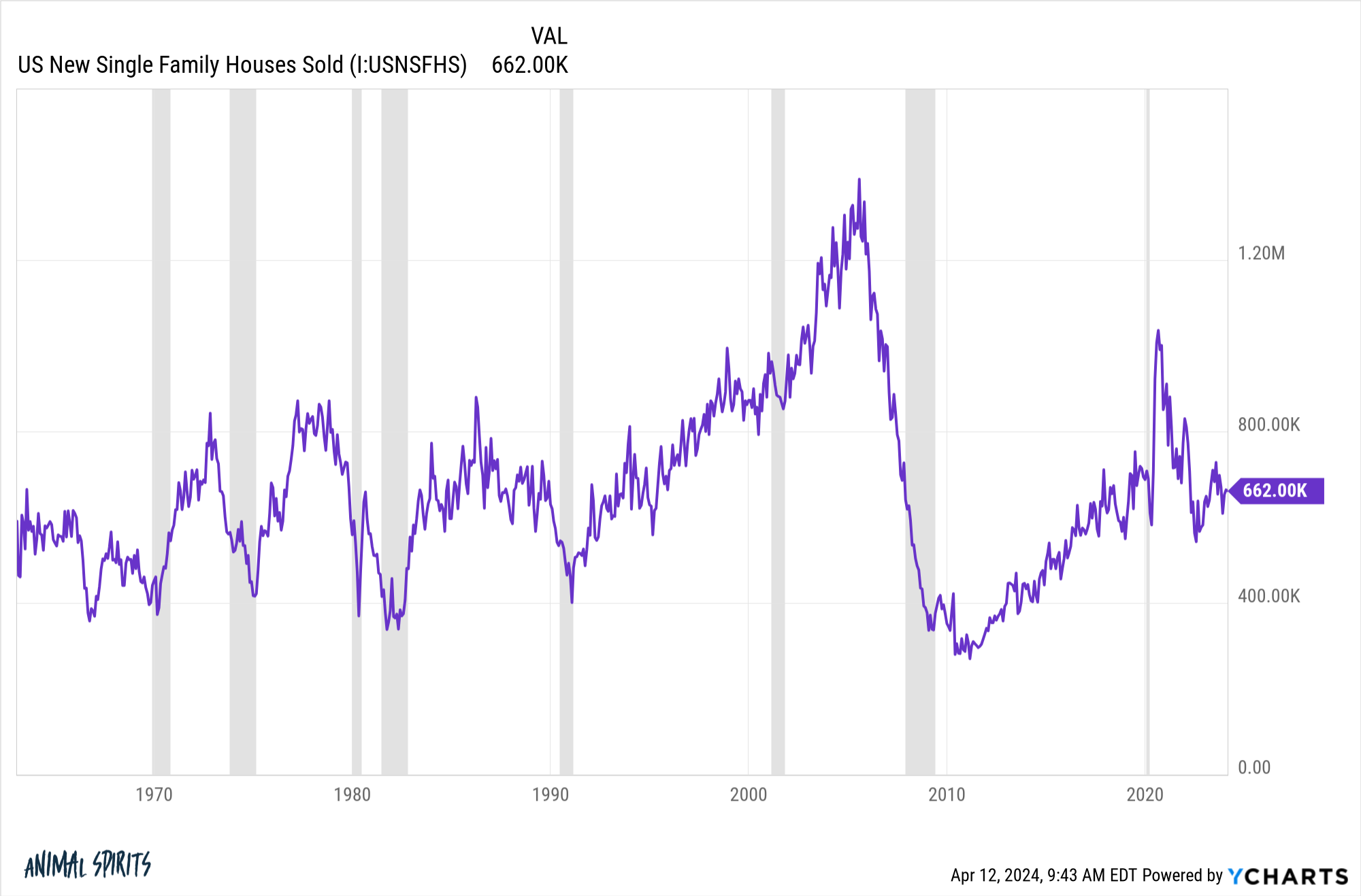

And new home sales:

This data tells us there have been a little more than 5 million houses sold in the past 12 months. That’s down from around 6 million at the end of 2019. So there has been a decrease in housing activity but people are still moving.

I know that might not compute to a lot of people who have finance on the brain, but it does make sense when you consider why people move or buy a house in the first place.

There are five Ds of real estate — divorce, downsizing, diapers, diamonds, and death — which drive people to buy and sell. Add in new jobs and that covers most of the reasons. Eventually people have to move because life intervenes.

People change jobs. They move to a new city. They get married. They start a family. They get divorced. Someone dies. Life goes on and people make it work, high mortgage rates and all.

The good news is if you can afford the payment now with mortgage rates so high you can grow into it. Your wages will (hopefully) rise. You can refinance whenever we do finally have a recession or the Fed cuts rates.

The bad news is lots of people simply cannot afford to buy a home in this market. They don’t make enough money. They don’t have rich parents who can help out with a down payment. Or they live in an area that’s far too expensive for buyers.

Unfortunately, the expensive housing market is likely going to make wealth inequality even worse than it already is.

But it’s also true that buying isn’t for everyone. For most people right now, especially those in big cities, renting is far more cost-effective.

Just make sure you buy some stocks since you’re not building any home equity.

Michael and I talked about who’s buying all of the houses, the boomer vs. millennial tug-of-war in the housing market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Generational Luck in the Housing Market

Now here’s what I’ve been reading lately:

- The risk spectrum (Ramp Capital)

- What I learned from Daniel Kahneman (The Intelligent Investor)

- The most important thing that determines how successful you are in life cannot be quantified. (The Irrelevant Investor)

- How F Scott Fitzgerald spent his money in 1924 (Allocating Capital)

- Maggie Rogers’s journey from viral fame (The New Yorker)

- Every episode of Curb Your Enthusiasm ranked (The Ringer)

Books:

1This is a flip-flop from the last report when baby boomers were the biggest buyers.