Financial success comes from some combination of hard work, discipline, patience and luck.

That last piece is usually the biggest wild card.

If you started investing in the early-1980s, you experienced 20 years’ worth of phenomenal returns from both stocks and bonds.

If you started investing in the early-1960s, you experienced 20 years’ worth of rising rates and inflation which led to muted stock and bond returns.

Let’s say you are the best investor in the world and you can earn double the return of the U.S. stock market over the course of a decade.

If you were invested in the 1970s, that would have been annual returns of around 12%.1

That 12% annual return would look paltry by comparison to the 17% annual return in the 1980s and 18% annual return in the 1990s by simply earning the market’s return.

Good or bad, luck can play a role in the magnitude of your financial success or failure.

The 2010s and 2020s for the housing markets will lead to similar good or bad luck depending on your timing.

If you bought at either pre-2021 prices or pre-2022 mortgage rates you should be in a fantastic financial position, relatively speaking.

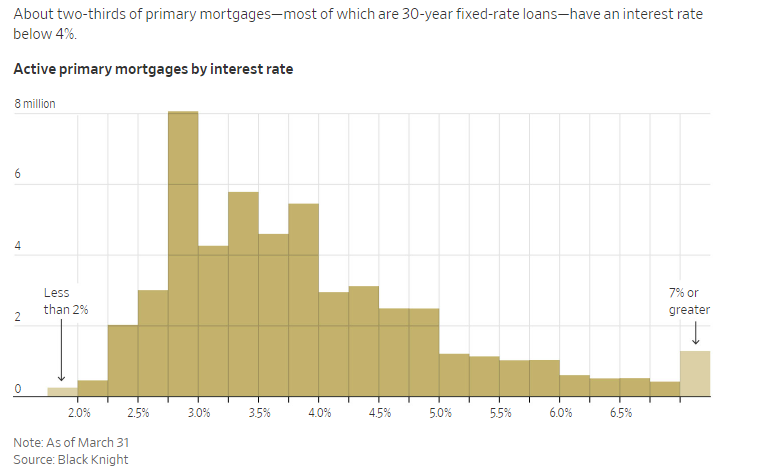

Just look at the distribution of mortgage rates by different levels from the Wall Street Journal:

If you’re on the left side of this distribution you’re in a wonderful position. If you’re on the right side you’re praying for the ability to refinance with those people on the left side or kicking yourself for not buying sooner.

And if you’re lucky enough to combine those low mortgage rates with the rapid price gains we saw in 2020 and 2021, you basically won the housing lottery.

According to CoreLogic, U.S. homeowners had $270,000 more equity on average by the end of 2022 than they did at the start of the pandemic.

One of the more underappreciated aspects of the housing market is the number of people who don’t even have to care about interest rates anymore.

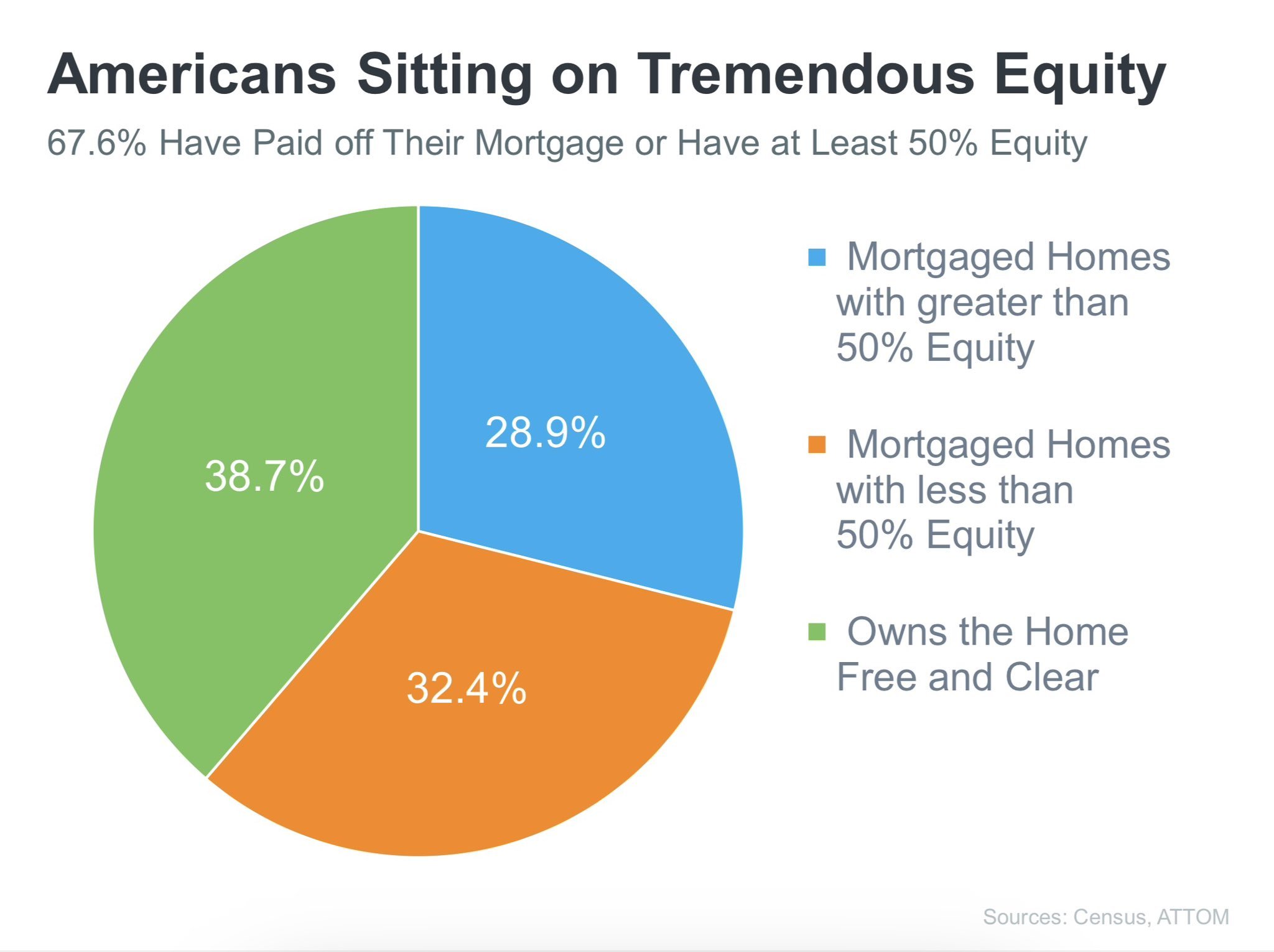

Just look at this chart that breaks down homeowners by the amount of equity they have in their home:

Almost 40% of homeowners have their houses completely paid off!

That’s more than the proportion of people who rent in this country (around a third).

And when you combine that with the fact that nearly 30% of homeowners have at least 50% equity in their homes, we’re talking close to 70% of households who have more equity than debt in their houses.

This is just a staggering number that never gets brought up when it comes to the state of consumer finances. Homeowners are richer and in better financial shape than ever when it comes to the biggest asset for most people.

But it’s not like all of us homeowners are investing savants.

I’ve never bought a house because I assumed it would be a wonderful investment opportunity. Our house purchases have always been for personal reasons, not financial ones.

My guess is that’s the way it’s been for the vast majority of those who find themselves in the enviable position of having a large chunk of equity in their home or a 3% mortgage rate or both.

Unfortunately, there are millions of people who aren’t so lucky.

They didn’t buy a house when prices and rates were lower because of personal or financial reasons. Or the timing simply wasn’t right.

When the Fed began raising interest rates they assumed it would bring some more balance to the housing market. Higher rates should increase the housing supply according to textbook theory.

Instead, it’s only made things worse.

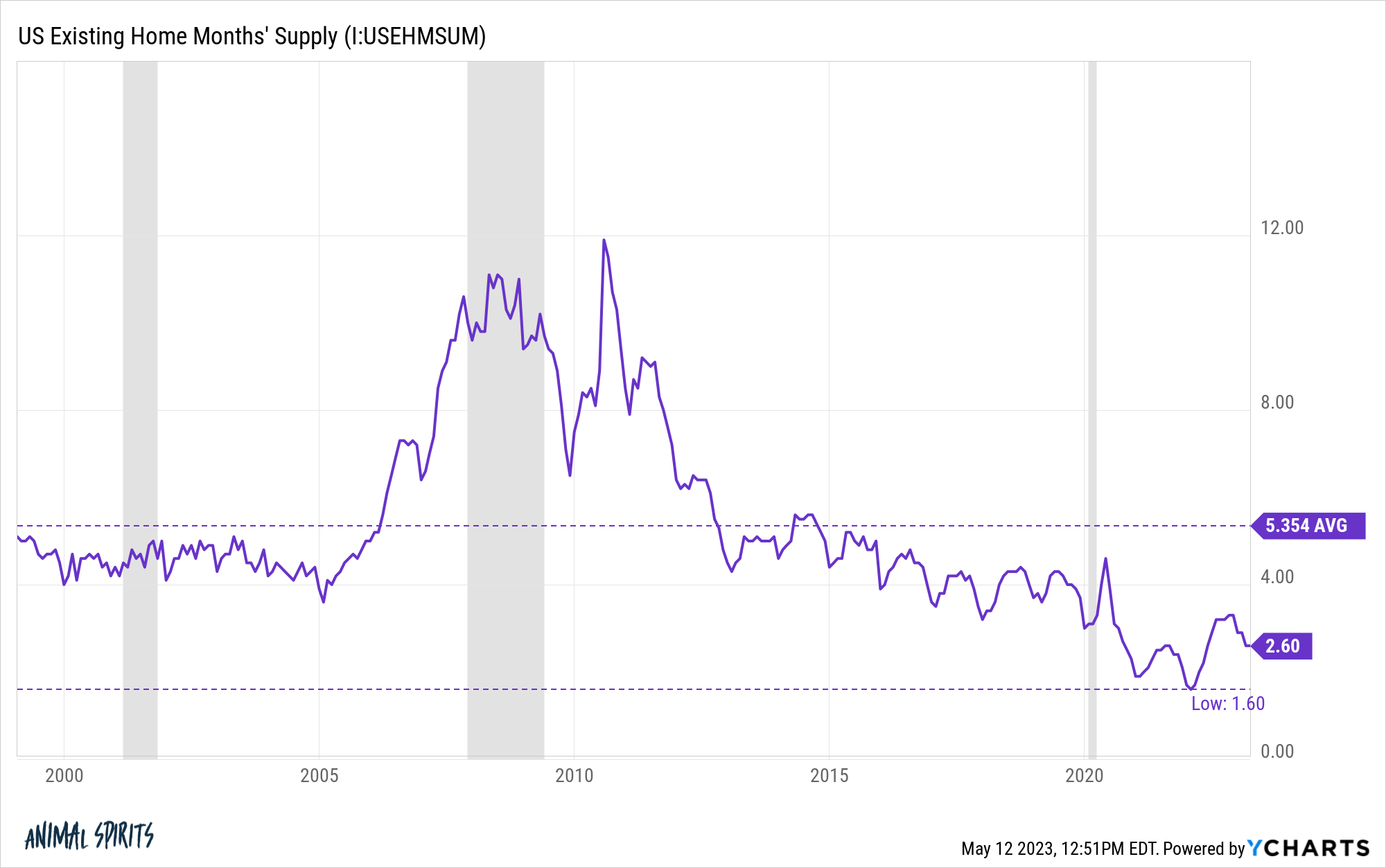

In a normal housing market there should be somewhere between 4 and 6 months of housing supply for sale.

Right now that number is 2.6 months after hitting a low of 1.6 months early in 2022:

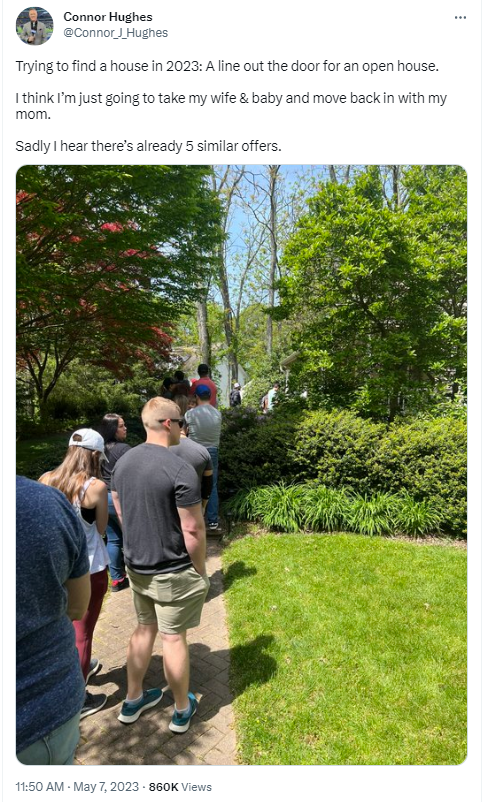

Even with mortgage rates in the 6-7% range, we’re once again seeing lines out the door for open houses:

This has to be so deflating as a potential homebuyer.

Housing is local so this obviously isn’t happening everywhere but I’m not sure anyone would have expected this with mortgage rates and prices so much higher than they were just a few short years ago.

The bad news is prices and rates are up while supply is down.

The good news is life goes on.

People get married. They have kids. They get divorced. They die (not necessarily in that order but sometimes).

The market will thaw eventually. It could just take some time.

It would sting to go from a 3% mortgage to a 6% mortgage but those with a truckload of home equity can make the math work if they use that equity as a large downpayment on a new place.

If you’re in the market, you basically have 3 options:

(1) Hope prices or rates come down.

(2) Keep renting.

(3) Move somewhere more affordable.

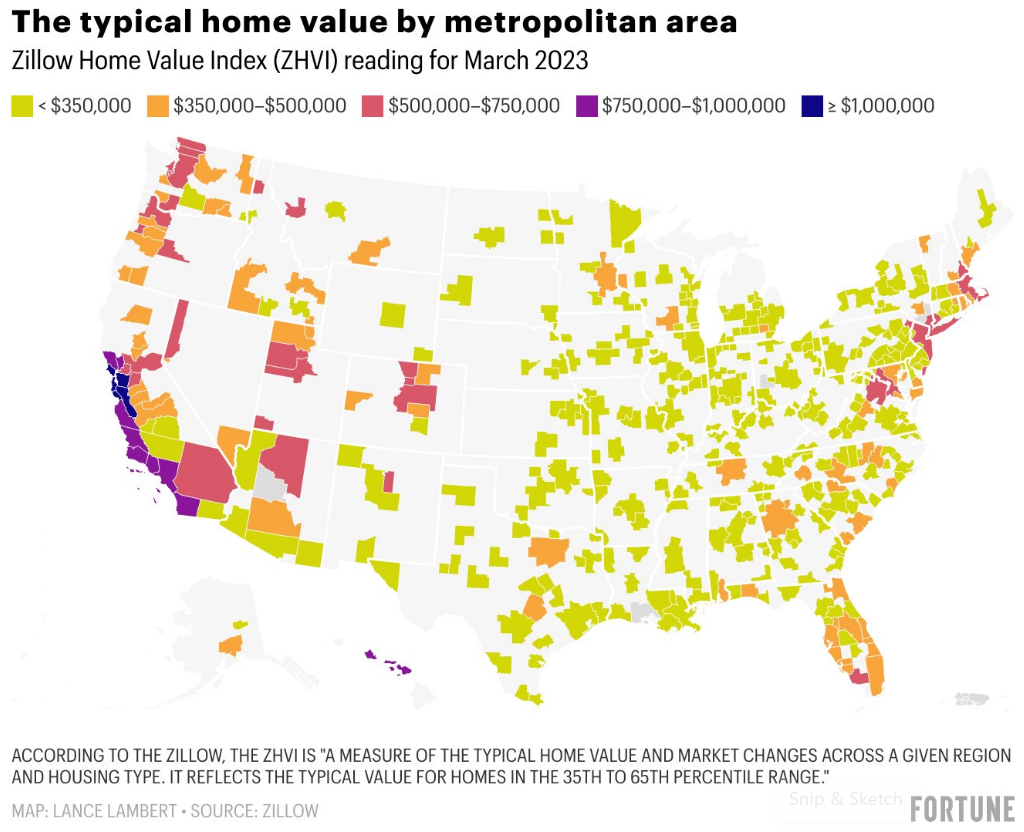

Lance Lambert made this cool chart that shows median home values across the country:

If you move from a blue/purple/red area to an orange/green area your money will go further.

I know it’s not ideal to move to a new city or state for most people what with friends, family, work and familiarity.

But remote work has made it easier for a lot of people to work from more afforable locations.

Short of a housing crash (don’t hold your breath), that might be the only way to find cheaper forms of housing for a while.

Michael and I spoke about the housing market lottery and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Problem With Being House Rich

Now here’s what I’ve been reading lately:

- Maybe money can buy happiness (Dollars & Data)

- Investing in time (A Teachable Moment)

- Glass half empty investors (Big Picture)

- What it means to achieve financial freedom (Humble Dollar)

- The last great decade (The Nation)

- Future Proof unveils first wave of speakers and musical acts (Business Wire)

1Nominal returns in the 1970s were a stone’s throw from 6% per year.