I was always a saver growing up.

Whenever I got money for birthdays, holidays, church stuff, my allowance, or summer jobs, I would sock it away. At first that was in a secret compartment in a wallet in the top drawer of my dresser.

In high school, I finally opened up my first bank account. My first job was as a bus boy. I probably saved a thousand dollars that summer. The next summer I delivered furniture and saved a little more.1

After 17 years or so of saving I had a few thousand dollars saved up so my dad and I went over some cash management options at the local bank where my money was just sitting in a checking account.

CD rates were higher than they were paying on a savings account so that made sense. I think it paid something like 5% over 12 months.

I put a few thousand bucks into that CD with the idea that it would mature as I was going away to college. A year later I collected my money along with a little bit of interest.

Is this the most boring first investment story in history? Probably. Too practical for a teenager? Most certainly.2

But I had no knowledge whatsoever of the stock market at that point and my time horizon was so short that a boring old certificate of deposit made the most sense for my risk profile.

This was back in the late-1990s so CD rates were much higher than they’ve been for the majority of this century.

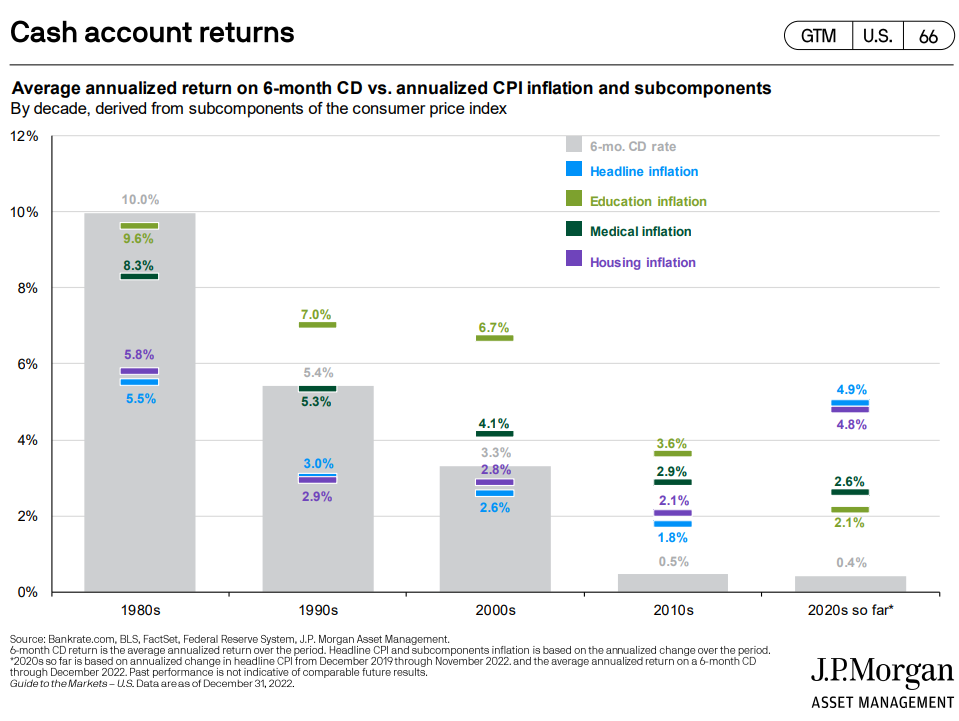

JP Morgan has a chart that compares average 6-month CD rates by decade along with some different measures of inflation:

It’s hard to believe average CD rates in the 1980s were higher than the inflation rate. It was a stairstep down from there with average rates near the ground floor level by the 2010s. Average rates for the 2020s aren’t any better but the rates today have finally reached the respectable levels I was getting when I made my first CD purchase.

Savers have taken notice.

The Wall Street Journal had a piece out recently detailing the huge flow of capital in CDs:

High inflation, rising interest rates, and economic anxiety are making CDs cool again, with yields rising as high as 5.25% recently at some banks. Balances in CDs rocketed from $36.5 billion in April 2022 to $418.4 billion in January, according to the Federal Reserve.

The average yield on a 12 month CD is still just 1.6% but if you know where to look (just search some of the online banks) you can get something in the range of 4% to 5% right now.

The rate depends on the provider and your time horizon.

I pulled up the CD rates for Ally Bank this morning. A 12-month CD was quoted at 4.5% but go out to 18 months and it was 5%. However, 3 and 5 year rates were 4.25%. Go shorter and rates were lower (2% annualized for 3 months).

There are pros and cons to CDs.

On the positive side of things, locking in 5% short-term rates takes some of the interest rate volatility out of the equation if the Fed is forced to cut rates if they help cause more pain in the economy or banking system (or both).

It’s also nice to have an end date in mind if you’re planning on using the money at a certain point in the future.

One of the biggest downsides of CDs is you give up liquidity to lock in those yields. Most banks will let you pull your money early but there is typically a penalty in the form of lost interest.

On the other hand, locking up your money does take some of the temptation away from constantly tinkering with your cash.

I’m not sure how long today’s CD rates will last. Short-term bond yields have come down quite a bit in recent weeks so that could be a precursor to lower rates in the future. Or maybe the bond market is just as confused as everyone else right now.

I don’t know the future path of interest rates from here so I’m not going to pretend I do.

But I would enjoy the yields we have on CDs right now because they might not last very long.

Michael and I talked about the first investments we ever made and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

More Money Doesn’t Make Make You Better at Managing Your Finances

Now here’s what I’ve been reading lately:

- What is a bailout? (The Big Picture)

- Is now a good time to buy a house? (Dollars and Data)

- The making of Tom Wambsgans (The Ringer)

- Riskless at age 104 (Advisor Perspectives)

- The good, the bad and the ugly of being a financial advisor (Belle Curve)

- What’s happening to the American Dream? (The Long Run)

- Being poor vs. feeling poor (More to That)

- True luxury goods don’t have brand names (Morningstar)

1Not a fun job at all but lifting all those heavy sleeper sofas, dressers and sectionals did help keep me in shape.

2My investment style is so boring my second investment was an IRA contribution into a targetdate fund. Sorry not sorry.