There were a lot of surprising details that came to light from the Silicon Valley Bank fiasco.

It was surprising how quickly a bank run took hold for such a large institution.

It was surprising how quickly the bank’s customers fled one of their most trusted partners.

It was surprising how seemingly little oversight this now systemically important bank had.

It was surprising the Fed was kind of asleep at the wheel in terms of understanding how their interest rate hikes would impact the financial sector.

And it was surprising how many individuals and businesses were so bad at cash management.

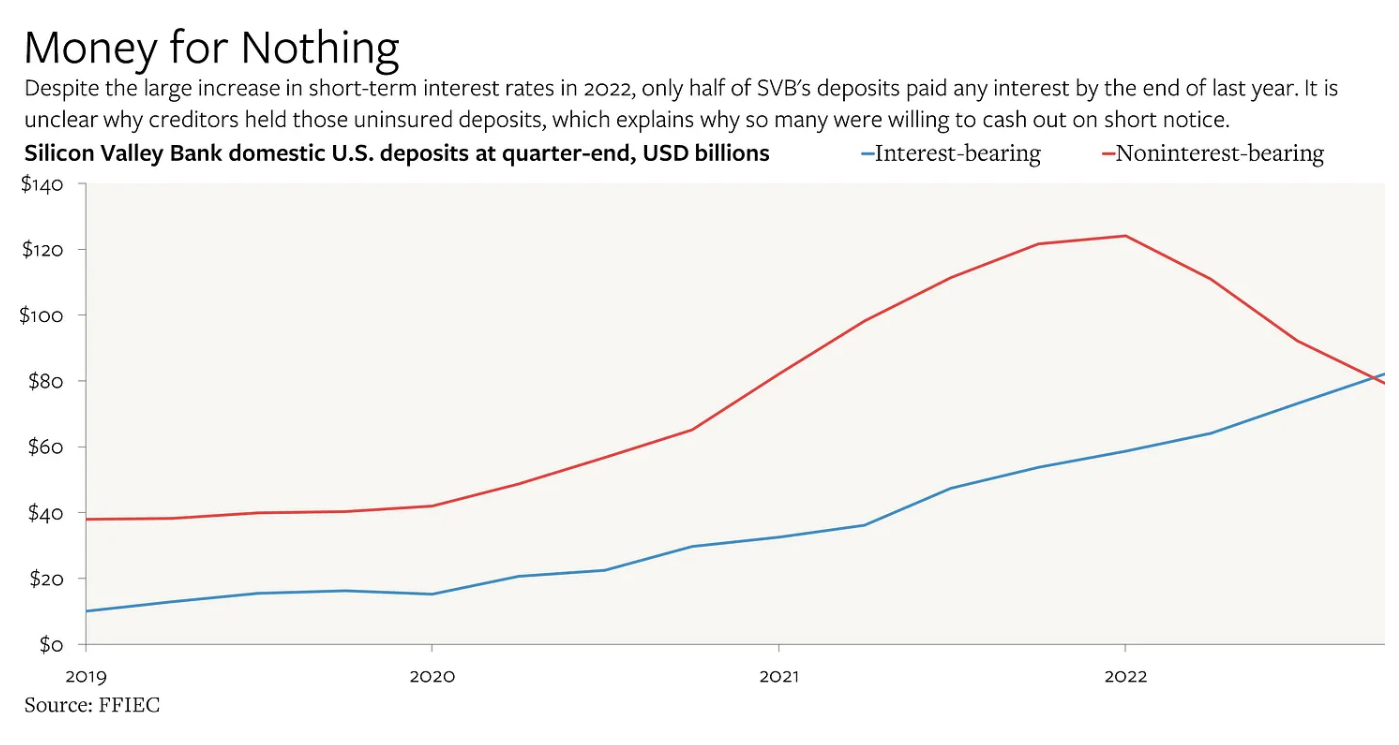

Matthew Klein put together this chart that shows interest-bearing versus noninterest-bearing deposits at Silicon Valley Bank as of year-end 2022:

Klein explains:

As late as the end of last year, only half of SVB’s U.S. deposits ($82 billion) even paid any interest! For some reason, large and ostensibly sophisticated entities were still lending almost $80 billion to SVB at the end of 2022 even though their claims were unsecured and earning nothing.

That is bizarre. Even before I realized how many of those deposits earned zero interest, when the possibility of uninsured business deposits getting wiped out first presented itself last week, my first question was: why would any company have had that kind of unsecured exposure to a bank in the first place? After all, there are plenty of alternatives to bank deposits, especially for entities with money and even a tiny amount of sophistication.

Only half of the $82 billion in deposits earned any interest on their money.

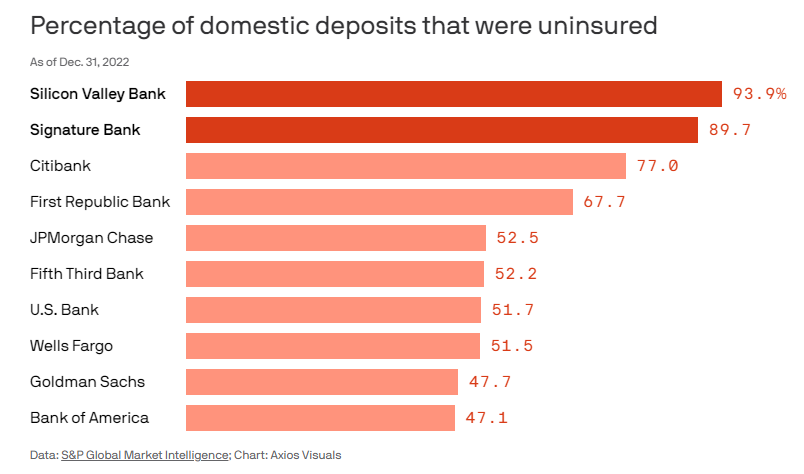

And according to Felix Salmon, nearly 94% of those deposits were uninsured, meaning they were more than $250,000:

That’s a lot of money with no money management behind it.

I agree with Klein that this is bizarre from a cash management perspective.

Why weren’t these tens of billions of dollars earning any interest?

A simple cash sweep account that automatically transfers into a money market account when it goes above a certain threshold would have worked.

Or Treasury Bills? I would even accept a checking account that pays some interest.

SVB was obviously offering some other services. And maybe the business owners who held their money at the bank would tell you they were too busy running the business to worry about cash management. Or the individuals simply didn’t know any better.

I’m not sure these are good excuses, though.

When rates were 0% maybe you could get away with ignoring large cash balances but not anymore.

Managing your cash is part of running a business. It’s also an important piece of any investment or savings plan.

Look, I’m sure SVB’s clients were very intelligent when it comes to running businesses and creating new and exciting technologies.

But this is a good reminder that having more money doesn’t necessarily guarantee that you know how to manage money effectively.

In fact, for many people, having more money is detrimental to the management of their finances.

Why?

Successful people with a lot of money are usually busy and preoccupied with other stuff going on in their life.

There are other people with gobs of money who assume their success in one area of life (like business or start-ups or just being rich) will automatically translate into success in another area of life (like investing or money management).

Unfortunately, it doesn’t work like that.

For some people, success in one walk of life can actually make you even worse at managing your own finances.

I know plenty of wealthy people who are terrible investors because they’re overconfident or assume their level of wealth guarantees them access to secret ways to make money that are only available to the rich or famous (hint: there are no secrets).

Boring things like cash management aren’t going to make you rich.

But it’s the small things you do around the edges that can compound over time to keep you rich.

Things like putting a comprehensive financial plan in place, diversification, asset allocation, rebalancing, tax planning, estate planning, insurance planning, keeping fees to a minimum and having a written investment policy statement in place.

This stuff is not as exciting as creating the next unicorn company in Silicon Valley but they are important if you wish to keep your financial life in order.

Michael and I talked about the SVB debacle from every angle on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Money Lessons From The White Lotus

Now here’s what I’ve been reading lately:

- The brilliant inventor who made two of history’s biggest mistakes (NYT Magazine)

- Whose fault is the SVB fiasco anyway? (Irrelevant Investor)

- 10 ways to deflect market fear merchants (A Teachable Moment)

- It’s normal to be anxious about money (Bull & Baird)

- 3 dimensions of Fed failure (Employ America)

- The good news (Reformed Broker)

- The squeal that set off the Panic of 1907 (Novel Investor)

- 2023 is not 2008 (Big Picture)