Facebook was one of the worst-performing stocks in the S&P 500 in 2022, falling 64% on the year.

Who knew pouring billions into the metaverse during a time of Fed tightening and 9% inflation would be a bad idea?

Well last year’s loser has turned into their year’s darling.

Facebook shares are up more than 55% in the first month and change of 2023, including a one-day jump of more than 20% this week after they reported earnings.

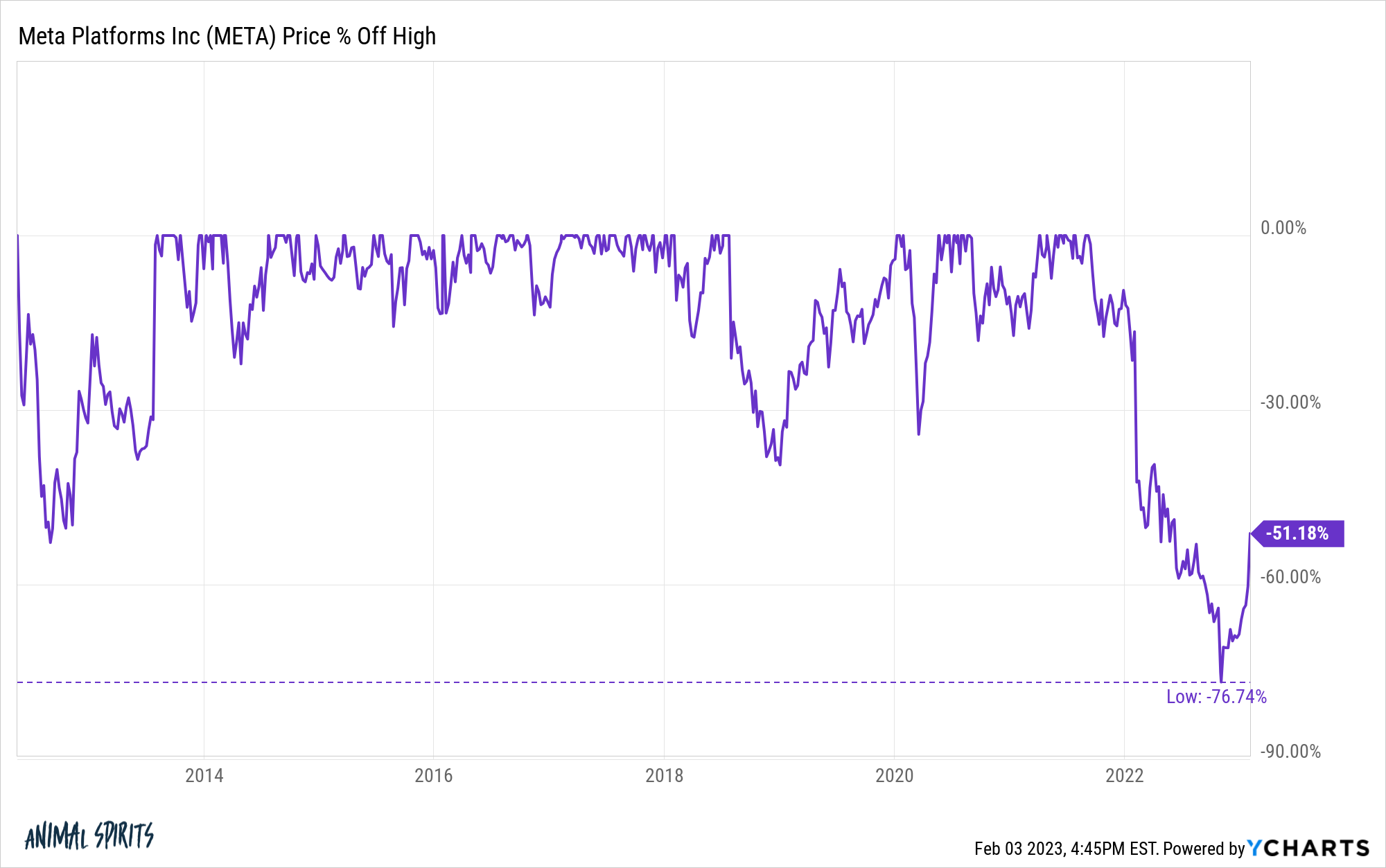

The peak-to-trough drawdown was the worst in Mark Zuckerberg’s helm, bottoming out at more than 76%:

The stock price is still down more than 50% from the highs but it’s now up more than 100% from the lows.

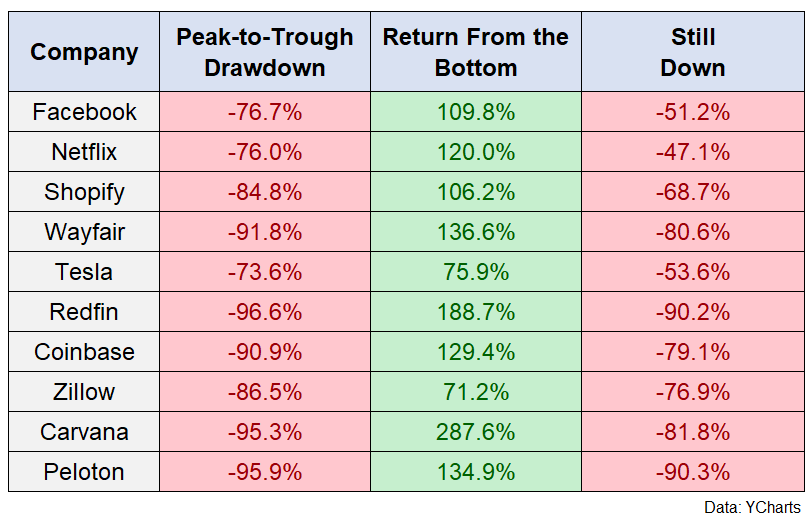

Facebook is far from the only company that got shellacked, bounced back in a big way but remains well below all-time highs:

The hard part about these ginormous moves is distinguishing between the dead cat bounces and the true values can play head games with you.

There’s an old saying on Wall Street:

What do you call a stock down 90%? A stock that was down 80% and then got cut in half.

Another play on this saying might go something like this:

What do you call a stock that’s down 70%? A stock that was down 90% and then rose 200%.

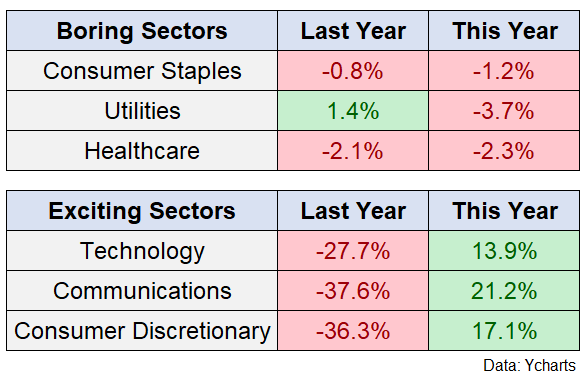

The returns aren’t quite so extreme but a similar situation has occurred in the various S&P 500 sectors.

Last year the defensive sectors outperformed while the more exciting sectors got killed.1 This year the boring sectors are lagging while the exciting stuff is going nuts:

Last year the Dow finished with a loss of just 7% while the S&P 500 was down more than 18% and the Nasdaq 100 crashed more than 32%.

This year the Dow is up a little more than 2% while the S&P 500 has gained nearly 8% and the Nasdaq 100 has rocketed 15% higher.

The turning points don’t always occur this neatly but whipsaws like this can lead to portfolio mistakes if you’re not careful.

John Templeton once said, “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

You could say investment mistakes are born on regret, grow on the fear of missing out, mature on market timing, and thrive on capitulation.

Big moves from tops or bottoms always look obvious with the benefit of hindsight.

I knew I should have bought that stock that just went up a million percent.

I knew I should have sold out of that asset class that just got crushed.

I swear I was going to buy or sell or short or go massively long on that thing that just did the thing that I knew was going to do.

When market moves seem obvious it’s worth asking yourself:

Was I really going to nail the bottom (or top( on that trade or is it more likely I would have bought before it fell even more (or sold before it continued charging higher)?

Did I really want to own that or am I just kicking myself because something is up a lot and I wish I would have purchased it before it rose?

Are big market moves (in either direction) causing me to make avoidable mistakes in my portfolio?

I’m as guilty of these thoughts as anyone. I just think it’s not useful to waste your time thinking about all of the trades or investments you wish you would have made.

There is always a bull or bear market somewhere. Thinking you can nail every single one of them is a mistake.

No one can pick tops and bottoms on a consistent basis.

The good news is you don’t need to time the market consistently to succeed as an investor.

Further Reading:

2022 Was One of the Worst Years Ever For Financial Markets

1Facebook and Google make up more than 40% of the communications sector.