A reader asks:

I have a question for all of the people who have had respectable gains in cryptocurrencies. I got into crypto during the Covid crash and have had some great gains since then. Some of my trades were bitcoin at $8500, Ethereum at $1300, Solana at $70, etc. However, I started with a 10% portfolio allocation to cryptocurrencies which grew to 20% and didn’t change it. Then it went from 20% to 30% and I trimmed it back to 20%. Then it grew back to 30%, then to 40%, now it has grown to 50% of my portfolio. Should I stick to my plan and trim back my allocation or let the winners run and only allocate into stocks/bonds from here on out?

I’m pretty sure this question came in before the current crypto route. Yet even with Bitcoin (-45%), Ethereum (-45%) and Solona (-60%) all in the midst of large drawdowns, this investor is still in the black based on those entry prices.

So maybe this person is changing their tune. But changing your tune based on how high or low prices are is not a sustainable investment strategy.

There is nothing wrong with changing a plan when your circumstances or the facts change.

Investment policies aren’t written in stone.

But if you don’t have a disciplined policy to follow it becomes much easier to make a mistake.

I wrote about the process of rebalancing in my book through the context of weight gain in prison:

Complaining about the food served in county jails is a favorite pastime for inmates. So it was somewhat shocking to a prison guard from a Midwestern country jail when he discovered that inmates sentenced to six months or so of jail time were gaining an average of 20 to 25 pounds over their stay behind bars. Once this was discovered, they searched for answers from a team of researchers. The inmates had access to the exercise yard so that wasn’t the problem. When asked, none of them blamed the food, the accommodations, or the lack of exercise. The reason actually had more to do with the prison clothes, if you can believe it. The orange jumpsuits that serve as the uniform in prison are very baggy. They were so loose on the inmates that it was difficult for them to tell that they were slowly gaining weight because they didn’t have their normal-fitting clothes to give them the signal that they were incrementally gaining weight. There was no safety net to let them know this was happening. Once they tried to fit back into their normal clothes following their jail time, they finally realized how much weight they had gained. Without clothes that fit to give them some sort of measurement and benchmark to keep their weight in check, the inmates were adding pounds that went unnoticed.

Rebalancing helps keep your portfolio from getting overweight (get it?).

Let’s look at a simple example. Let’s say you created a 60/40 portfolio of U.S. stocks and bonds 10 years ago. Had you left that portfolio alone it would now be closer to 85% stocks and 15% bonds.

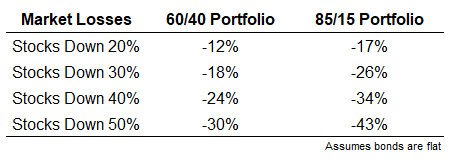

Now let’s look at the potential losses for these allocations during different levels of stock market downturns:

This may not feel like a huge difference but let’s say you’re a retiree with a $1 million portfolio. In a 40% market crash scenario, that’s an additional loss of $100,000. That’s real money.

Of course, the other side of this equation is your gains are going to be much bigger during a bull market when you simply let your winners ride. That’s how you got to an 85% stock allocation in the first place.

So I guess you have to ask yourself the following:

- Is this a portfolio or a plan?

- Why did I create an asset allocation in the first place?

A portfolio is just a bunch of investments thrown together with no rhyme or reason. It’s the Golden Corral buffet where you take a little of this, a little of that, oh that looks good and you end up with a mish-mash of holdings.

A plan involves creating a portfolio that balances your risk profile and time horizon. It involves probabilities, assumptions and scenario analysis. An investment plan is an ongoing process that occasionally involves course corrections.

The beauty of creating guidelines within the construct of a plan is that you don’t need to ask yourself what to do every time one of your holdings goes up a lot or down a lot.

If your plan says you sell crypto every time it hits an upper bound of 20% (or 30% or 40% or whatever) then you sell. If your plan says you buy crypto every time it crashes and hits a lower bound of 15% (or 10% or 5% or whatever) then you buy.

Does this mean your asset allocation will allow you to perfectly nail market cycles?

Of course not!

But that’s not the reason for an intelligently designed asset allocation.

The late-David Swensen from Yale’s investment office once wrote the following:

Far too many investors spend enormous amounts of time and energy constructing policy portfolios, only to allow the allocations they established to drift with the whims of the market. Without a disciplined approach to maintaining policy targets, fiduciaries fail to achieve the desired characteristics for the institution’s portfolio.

What’s the point of creating an asset allocation if you’re not going to follow it?

Listen, all investing is a form of regret minimization. When the risky allocation of your portfolio is flying high, you’re going to regret not owning more of it. And when the risky allocation of your portfolio is getting killed, you’re going to regret now owning more cash and bonds.

You could always hold a concentrated position and never sell or rebalance around it.

You just have to be willing to live with the potential for a wider range of outcomes around that concentrated position. It’s great when that wide range includes more upside but can be painful when it’s more downside.

Successful investing requires an understanding that there are always going to be trade-offs for every decision you make.

We talked about this question on this week’s Portfolio Rescue:

I also had Kris Venne on to discuss some financial planning topics on how to cut back on risk when you own too many stocks and how to treat a pension when it comes to building a portfolio.