Losing money is never fun but it is a normal part of the investment process.

Stocks go up most of the time but sometimes they go down.

So it goes.

Setting aside the losing money part of the equation, I’ve grown to love the downturns.

Here are 10 things I love about market corrections:

1. The technical analysts. I’ve had subscriptions to the technical analyst newsletters at past jobs. These are typically the ones from investors who came up in the 1990s and have checklists for market bottoms.

Look, we’re not going to see a bottom in this market until all 12 of my proprietary technical indicators are hit. We’ve only hit 9 out of 12 so we’re not there yet.

It cracks me up when investors assume the markets are governed by a set of rules like physics.1

If only investing was this easy.

2. The strategists. Every time stocks fall you’re bound to get a note from a strategist at one of the big Wall Street firms that goes something like this:

We see an additional 5-10% downside in the stock market but we remain constructive on the market over the long-term so we feel this represents a good buying opportunity. We remain cautiously optimistic that a bottoming process is in play and would buy into further weakness.

I still don’t know what it means to be “constructive” on the market. And how come everyone is always cautiously optimistic but no one says they’re recklessly pessimistic (other than Zero Hedge)?

3. The end of the world people. This is the permabears predicting a crash every time stocks start going down:

Every time stocks fall a little, these guys (and it’s always guys), predict it’s the start of a coming apocalypse.

Listen, I know the stock market can and will crash. But every time stocks go down it doesn’t mean the world is coming to an end. Sometimes stocks just need a breather.

4. The random statistics. I love the random stats that start flying around during a sell-off:

Did you know [insert random stat about the stock market] has only occurred in 1929, 1987, 1999 and 2008?

Did you realize [insert even crazier stat] hasn’t occurred since the bottom in 1932?!

The stock market has bottomed on the third Tuesday of the month 9 times?

Today was a 97% reverse RSI thruster reading. This has signaled a bottom on 9 out of the past 10 corrections.

Who am I kidding? I’m totally one of these people.

5. The pictures of exhausted traders on the floor of the stock exchange. Every time:

Do stock traders on the floor of the exchange even do anything anymore? Are these guys actors?

6. The pictures of rollercoasters on every financial media story about the stock market. This one is a lay-up any time stocks are volatile:

I mean come on. A roller coaster looks like a stock chart!

They have no choice but to use these pictures.

7. The human behavior. You don’t need to be a neuroscientist to realize people tend to act differently when they’re losing money than they do when they’re making money.

I don’t know the exact parts of the brain or the chemicals involved but something about seeing your life savings evaporate before your eyes can cause human beings to make emotionally-charged decisions.

Some people freak out and do too much when stocks are falling.

Others freeze up and do nothing.

Some investors are able to make clear-headed decisions during a rout.

It’s fascinating to watch investor reactions during a correction.

8. The content. This is a selfish one but I always find more writing inspiration during falling markets. Rising markets are boring. Everyone thinks they’re a genius.

It’s falling markets that force investors to look themselves in the mirror and question their strategy. This gives people like me more stuff to talk and write about.

Plus more people want to consume financial content when things are going badly.

My readership always skyrockets during a market panic.

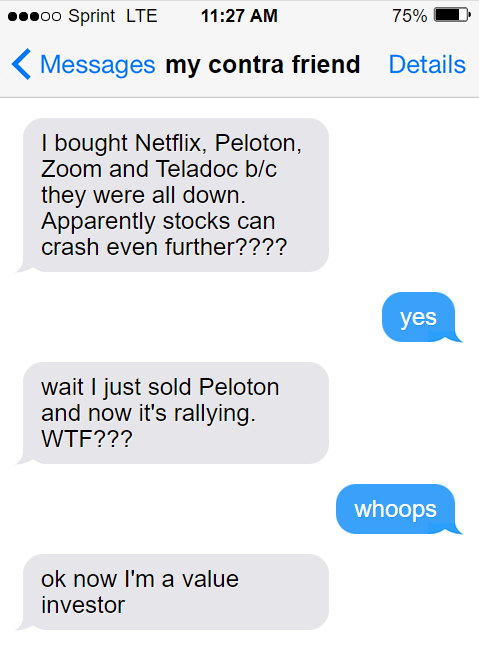

9. Text messages from my friends. I’m the investment friend but I rarely hear anything from my old high school and college buddies about the markets when things are going well.

I get lots of texts from people during corrections that go something like this:

Sentiment is nearly impossible to read these days but I like to think my friends act as a nice contrary indicator.

10. The lower prices. The S&P 500 is only 10% or so off the highs but small caps are down 20%. The Nasdaq 100 is down 15% or so. Throw a dart at a list of individual stocks and you’ll probably find something down 40% or worse.

If you have new savings to put to work you’re buying in at lower prices and higher dividend yields every time stocks fall further. If you hold cash or bonds in your portfolio you can rebalance those more stable assets into stocks.

Corrections aren’t all bad, right?

Michael and I discussed all the things we love about market corrections on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why I Love Writing About the Markets

Now here’s what I’ve been reading lately:

- The rules (Reformed Broker)

- The market is an expensive place to find out who you are (Irrelevant Investor)

- 18 charts that explain the American economy (Full Stack Economics)

- Coping with two conflicting stock market realities (TKer)

- Grind up and crash (Bull & Baird)

- Why you should sit out the mayhem (WSJ)

- What to do when markets feel crashy (Prag Cap)

1I know this isn’t all technicians. Most of them use technical analysis to put moves into context, not predict what’s going to happen next. Still, I love the checklist people.