Today’s Talk Your Book is presented by Simplify Asset Management.

We spoke with Simplify CEO and co-founder Paul Kim about their new ETF lineup.

We discuss:

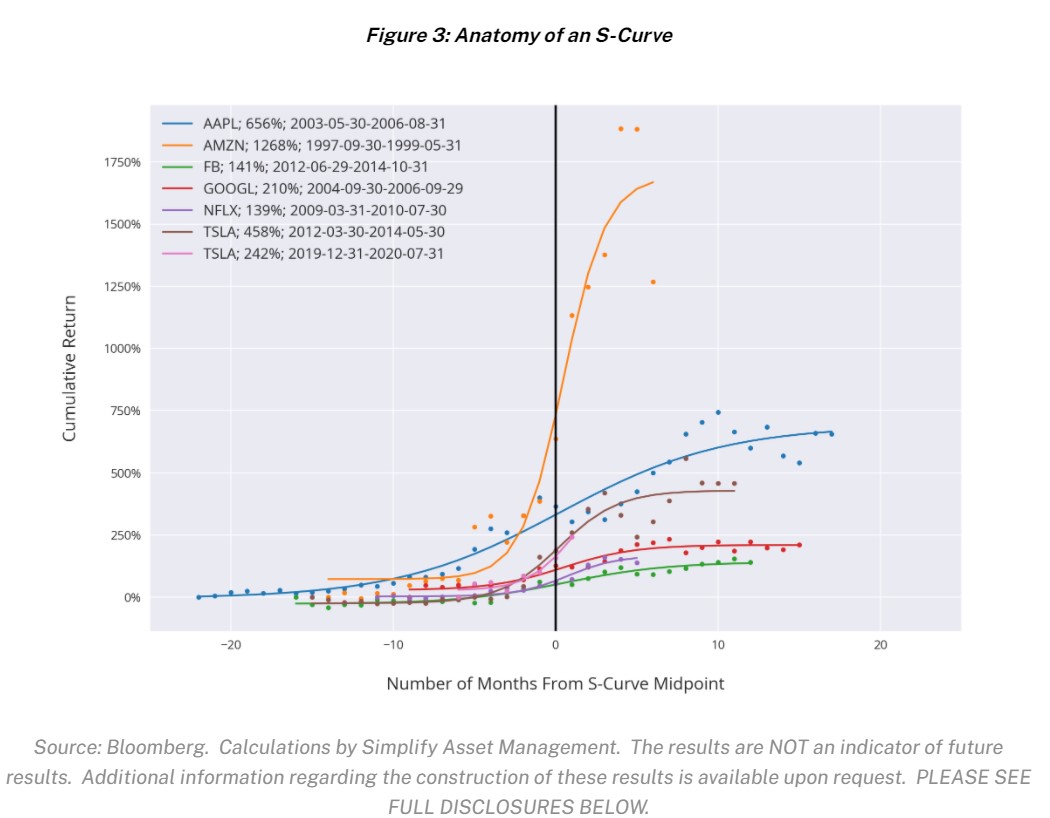

- Protecting the downside and enhancing the upside on disruptive companies

- Is growth the new value?

- The difference between now and the 1990s with growth stocks

- The relationship between growth stocks and interest rates

- What ends the current environment?

- Using options to gain more upside potential and downside protection in concentrated portfolios

- Investing in fintech, cybersecurity, robocars and pop culture

- Why options need to be actively managed

- How options work inside ETFs

- Planning for huge sell-offs in disruptive companies

- Are thematic funds the next star fund managers?

Listen here:

Links:

- Will Tesla dominate autonomous driving?

- Harnessing the power of disruption with concentrated convexity

Podcasts:

Charts:

Videos:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: