Today’s Animal Spirits is brought to you by Interactive Brokers.

Check out the Impact Dashboard to create a positive impact on your investments.

We discuss:

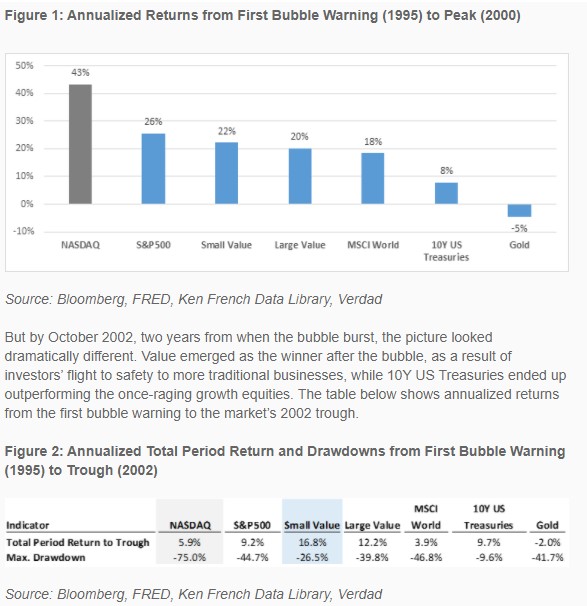

- No one can predict the end of a speculative mania

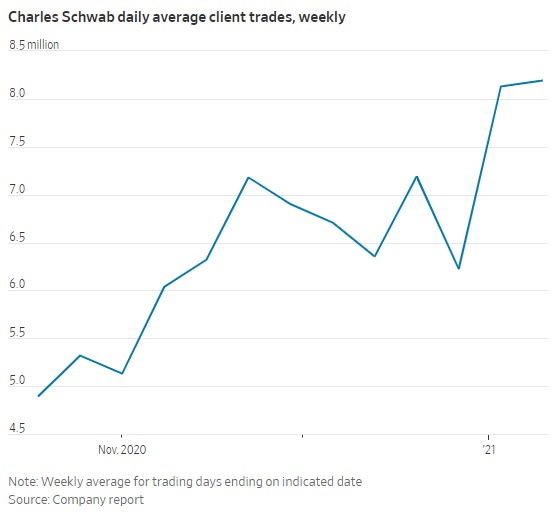

- The youths vs. the olds in the stock market

- For better or worse, this is a young person’s market right now

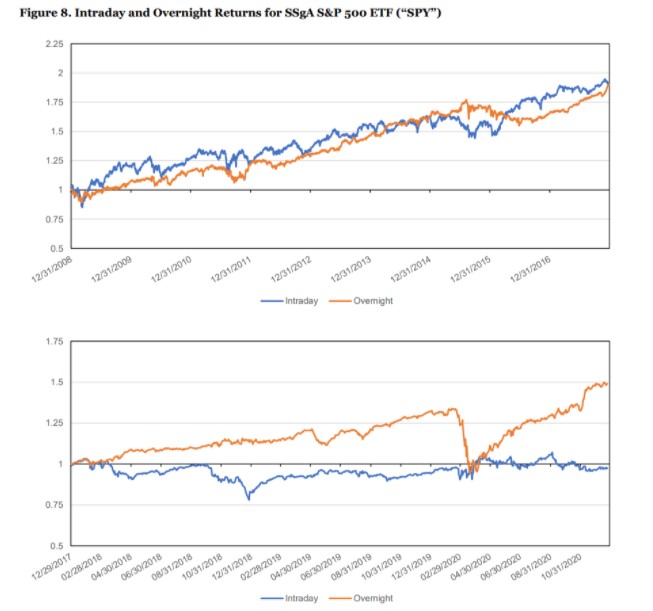

- Why technology may have changed market dynamics forever

- What is going on with Gamestop?

- What were these hedge funds thinking?

- Will the SEC crackdown on WSB?

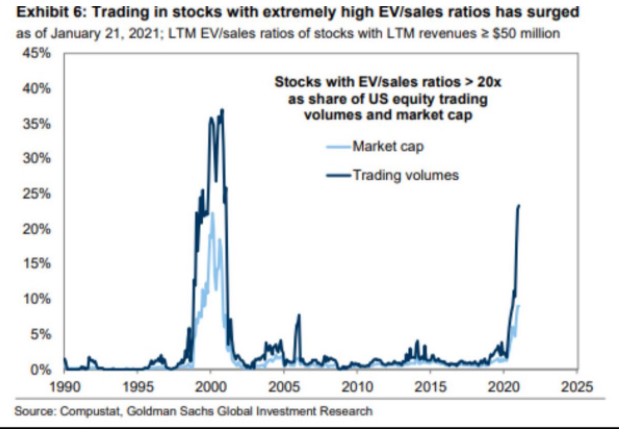

- Why this is something different than 1999

- Are hedge fund short presentations a thing of the past?

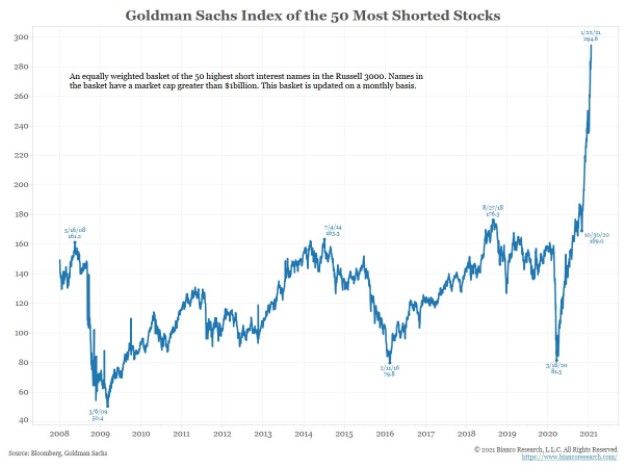

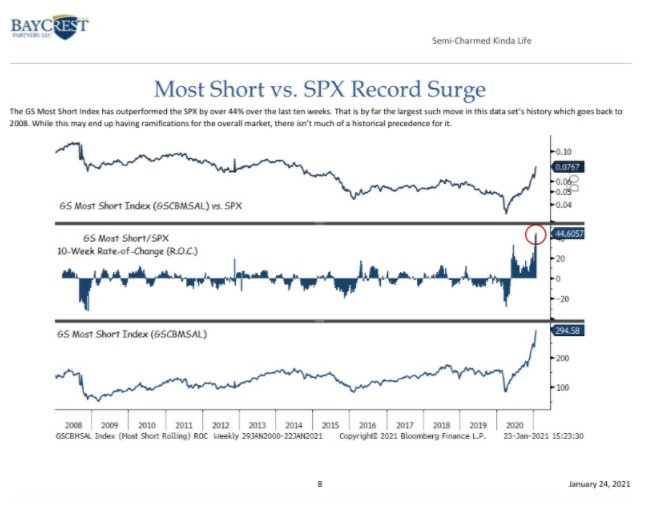

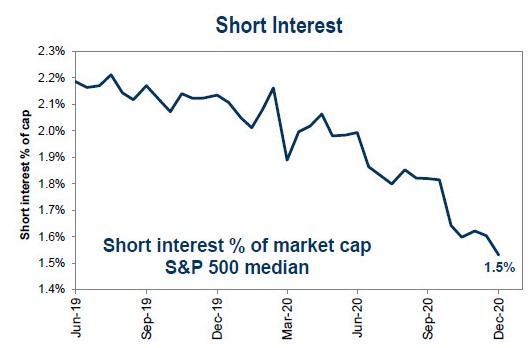

- It’s hard out there for a short seller right now

- Did The Big Short mark a top in hedge funds?

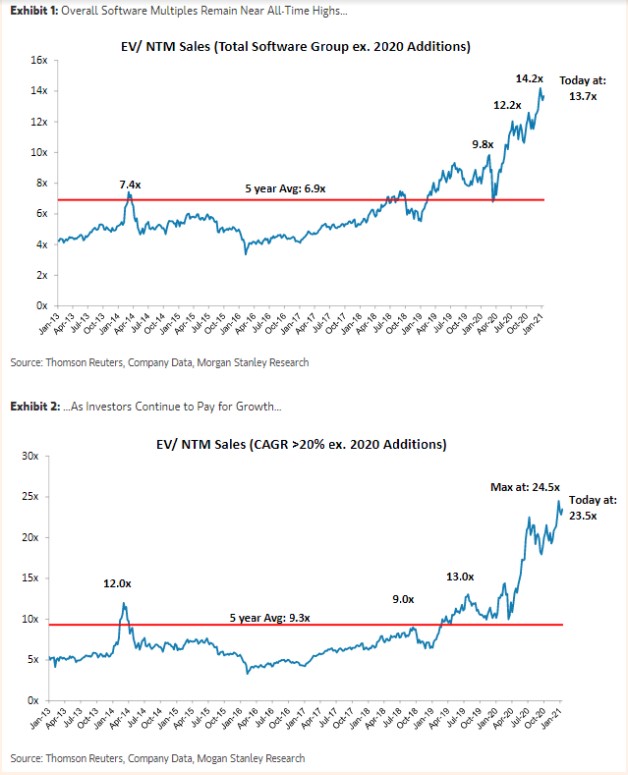

- Why are tech stock valuations rising so fast?

- Buying bitcoin with your tuition money?

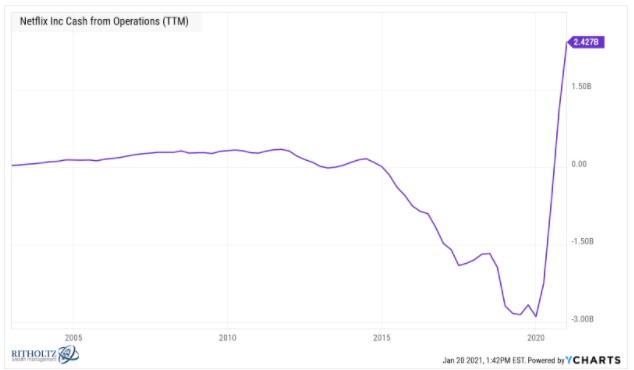

- How Netflix won the streaming wars

- Where to save for a down payment and more

Listen here:

Stories mentioned:

- Investing in a bubble

- Baupost’s Klarman compares investors to frogs in boiling water

- The important lesson a quant manager learned in 2020

- Q4 2020 commentary

- Every Warren Buffett needs a Charlie Munger

- Small investor surge shows no sign of slowing

- Gamestop soars nearly 70%

- How Wall Street Bets pushed Gamestop to the moon

- How technology ate the stock market

- Netflix will no longer borrow money

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: