Things are getting pretty speculative out there in the markets.

How speculative are they Ben???

I’m glad you asked. Speculative enough that we’re now in the midst of a “blank check” boom.

Special Purpose Acquisition Vehicles or SPACs are all the rage right now.

Bill Ackman got $4 billion for one. Moneyball extraordinaire Billy Beane of the Oakland Athletics filed for a $500 million pro-sports-based SPAC. Even Jim Ross, the father of the first ETF is getting into the game.

A SPAC is an investment vehicle where investors hand over money to an individual or group who promise to take that money and find a private company to purchase and take public. So investors are handing over cash with no idea what they’ll be investing in, no due diligence whatsoever, and wing and a prayer.

My initial response to these things is:

Typically the well-known investors, like Ackman, who sponsor these funds get to buy into the company at a reduced rate along with an incentive fee above a certain hurdle rate.

The benefit to the company that gets acquired is they get to skip the onerous initial public offering process. It’s difficult to take your company’s show on the road to drum up capital these days in light of the pandemic so this is a way to speed up the investment process and get your equity funding on a fast track.

The investors who fund the SPAC are essentially buying into an IPO without knowing what that company will be or what price they will pay.1 It seems like the company and fundraisers get more out of this deal than anyone, but this does give retail investors access to big-name investors.

According to SPAC Data, there have already been 28 SPAC-funded IPOs this year with a total of almost $9 billion in value.

Nikola and DraftKings are two of the more well-known companies that have gone through this process in recent years.

I can’t pretend to perform in-depth investment analysis on these opportunities because the investments themselves don’t exist just yet. It’s a guessing game based on track records but this is basically the way private equity and venture capital funds work as well in the initial stages.

These SPACs may end up doing just fine but the better they do the more SPACs will show up to fulfill the speculative demand that’s percolating in the markets right now.

It’s always hard to find the exact reason for speculation to run its course but most of the time it comes from the financial industry supplying so many investment options that eventually there isn’t enough demand to soak it up.

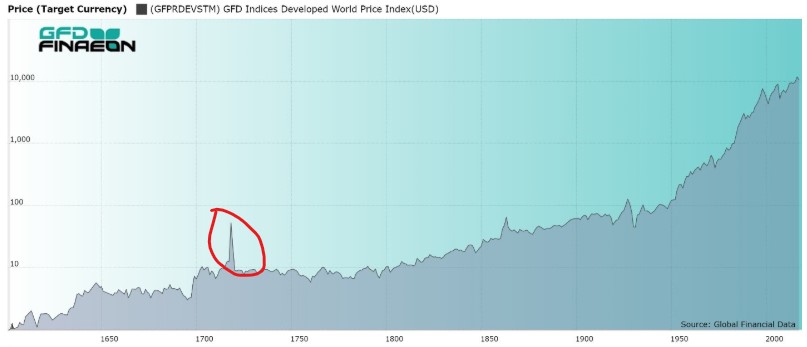

SPACs are nothing new. The original SPACs go back to one of the biggest bubble periods in market history. Global Financial Data has reconstructed stock market prices all the way back to the 1600s:

The enormous spike I circled here occurred in the 1720s when the equity markets were just taking shape. This is when we had near-simultaneous South Sea and Mississippi Company bubbles in one of the most euphoric manias in history.

The South Sea and Mississippi companies were both early adopters of the blank check approach (although the business model was known ahead of time). People in Europe handed over money for these companies to go explore the United States and bring back gold and any other resources they could procure. There were no profits or revenues when they were funded, just hope and a willingness to gamble.

Long story short, they never actually did much exploring but the idea that they could drove such excitement in the public that a bubble was blown to epic proportions.

To take advantage of this speculative craze, other investment opportunities with no actual business plans sprouted up like weeds. There were 190 “businesses” launched in 1720 alone. Just 4 survived and most made it only a week or two at best.

A pamphlet at the time called The Battle of the Bubbles listed out all of the implausible companies being created. Here are some of my favorite business/investment pitches from this list:

- A hydrostatical air-pump which would draw all manner of wind and vapors out of the brain

- 500k pounds for an insurance company to protect against venereal disease (and another called Speedy Cure if the insurance arm failed)

- A business idea that was created for “carrying on an undertaking of great advantage; but nobody to know what it is.”

- Improving the art of making soap.

- Improving malt liquor (OK this was a good idea).

The scam artist who set out to carry an undertaking of great advantage asked for a half million pounds. He sold one thousand shares to the people beating down his door to hand over their cash, took their money and left the country, never to be heard from again.

Some of these business ideas were being formed with the intention of actually helping people but most were simply get-rich-quick schemes. How could normal citizens tell the difference?

It’s not easy because when that demand exists someone will always be there to provide the supply.

The current interaction of day trading and such isn’t anywhere close to what occurred in the 1700s but the amount of gambling we’re seeing in the markets is concerning.

I don’t know when we’ll get there (some people think it’s already here) but when people begin handing over their money without discerning between legitimate investments and speculative schemes, that’s when things get out of control.

And that game typically comes to an end when Wall Street ensures the supply of speculative vehicles exceeds the speculative demand by the investing public.

Michael and I discussed how wild it is that we’ve gone from a depression to a craze in a few short months on this week’s podcast:

Further Reading:

The Man Who Tried to Sell the Eiffel Tower (Twice)

Now here’s what I’ve been reading lately:

- Retirement planning for the gig economy (Belle Curve)

- You don’t need alpha (Dollars and Data)

- The financialization of everything (John Street Capital)

- Why success won’t make you happy (Atlantic)

- The post-pandemic world begins 4 years from today (I’m Late to This)

- Financial planning isn’t about predicting the future (Humble Dollar)

- Our educational colonialism (American Compass)

1Apparently you can get your money back before a deal closes if you don’t like the target company.

2Shameless plug — I covered both of these bubbles in Don’t Fall For It along with the charlatans that helped them along.