This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

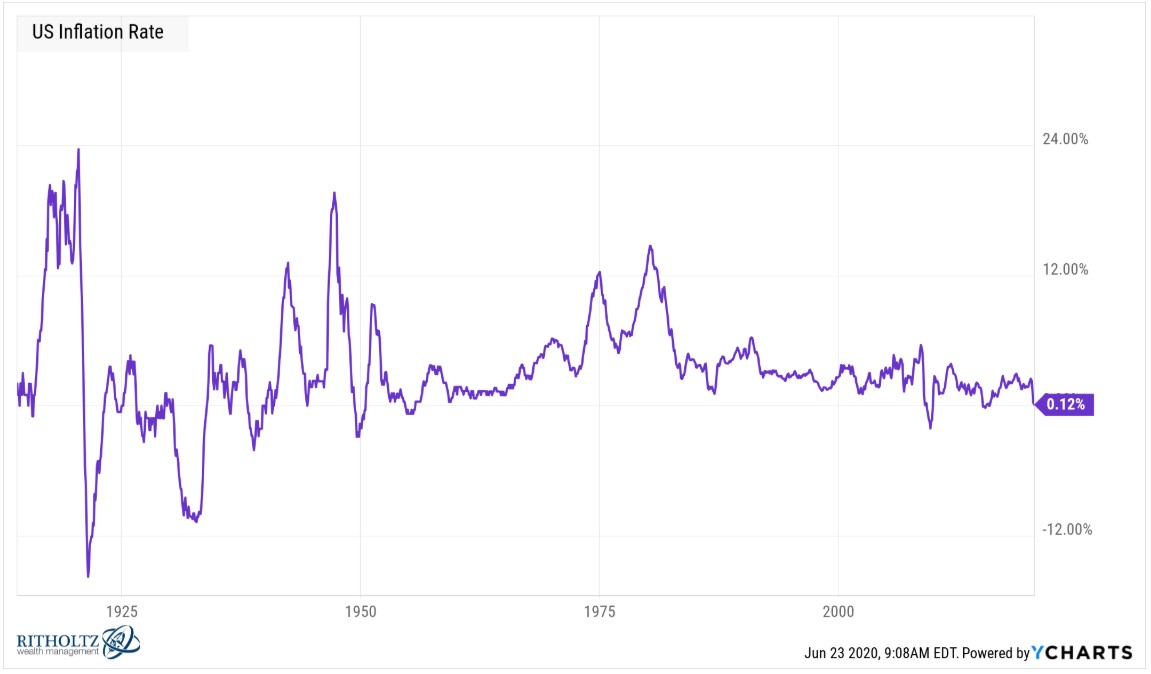

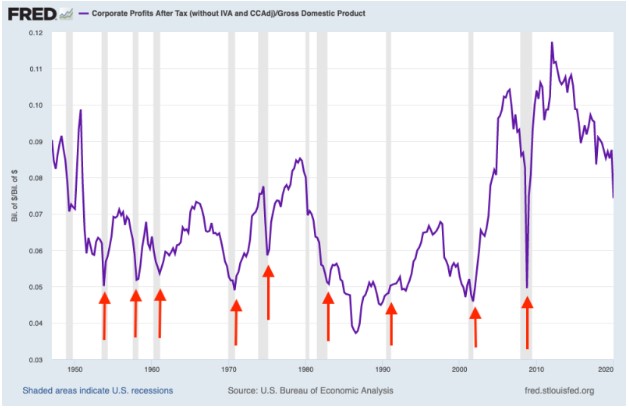

- What if we see a big uptick in inflation that wipes out some of the government debt?

- What would it take to get interest rates back up to 3-4%?

- Why is the Fed buying corporate bonds?

- It’s time to move on from complaining about the Fed

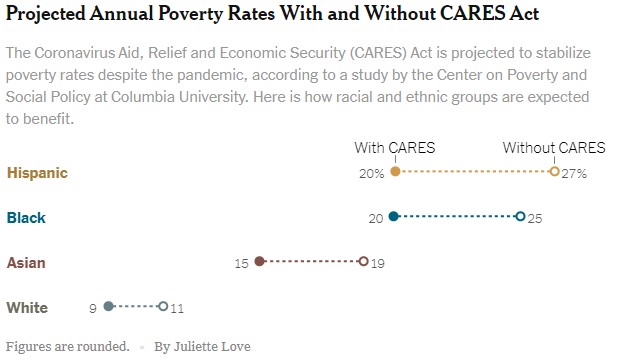

- How is it possible for poverty to decline during a depression?

- Is the Fed telling the government we have more capacity for fiscal stimulus?

- Why can’t we give the lowest wage earners a bigger stipend when things go bad?

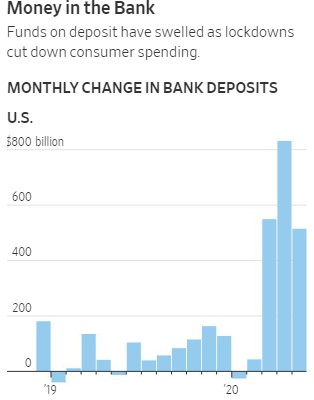

- Could all of the stimulus money lead to a boom?

- What if inflation follows the WWII path?

- Why this is one of the hardest market environments ever for retirees

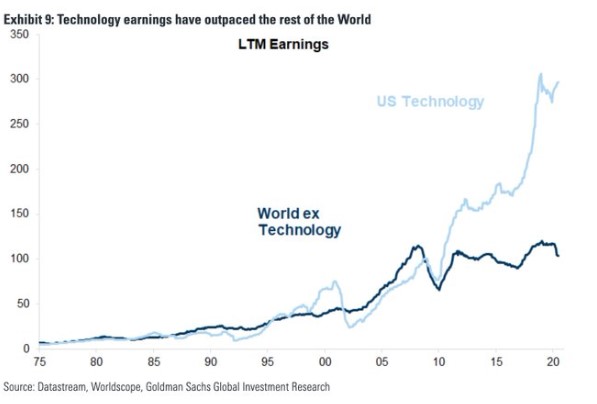

- What if the big tech stocks are all up so much for good reason?

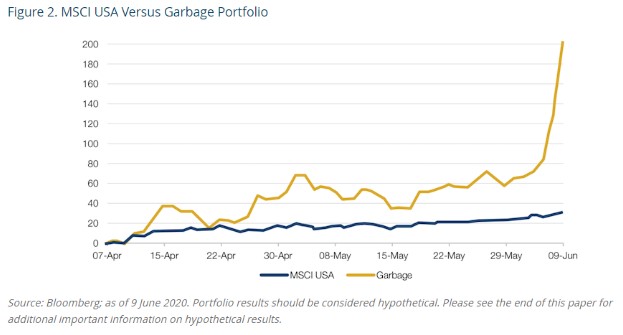

- The garbage portfolio

- New daytraders are not just a U.S. phenomenon

- Why do so many institutions keep investing in hedge funds?

- The hedge fund fee structure is ridiculous

- People are moving to the burbs en masse in New York

- Are colleges going to be forced to open for financial reasons?

Listen here:

Stories mentioned:

- MiB: Jeremy Siegel on the Covid Stock Market

- Fed will amass a corporate bond portfolio using index approach

- Vast federal aid has capped rise in poverty

- Economists want to swap out $600 unemployment benefits with $400 a week

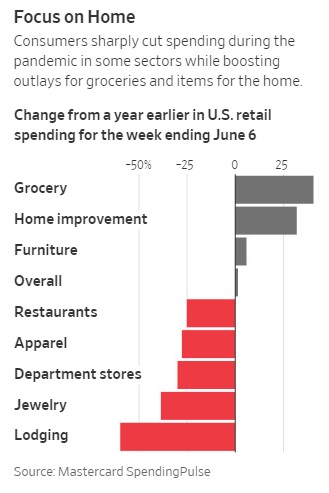

- Boats, pools and home furnishings

- The stock market may be pricey but it’s nothing like genuine bubbles from the past

- Views from the floor

- Investors approaching retirement face painful decision

- India’s lockdown mints more than a million new traders

- The performance of performance fees in hedge funds

- Stock market history says a V-shaped recovery makes total sense

- Suburban New Jersey homes headed for biggest price increase since 2005

- A college reality check

Books mentioned:

Podcasts mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: