We discuss:

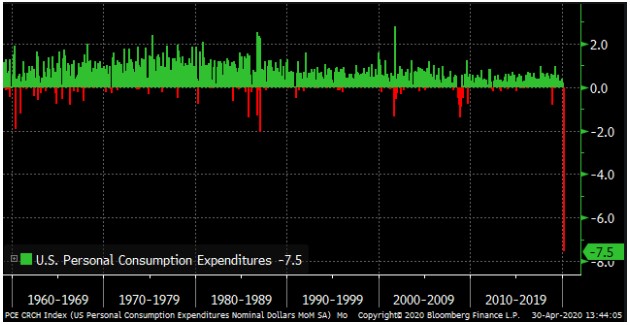

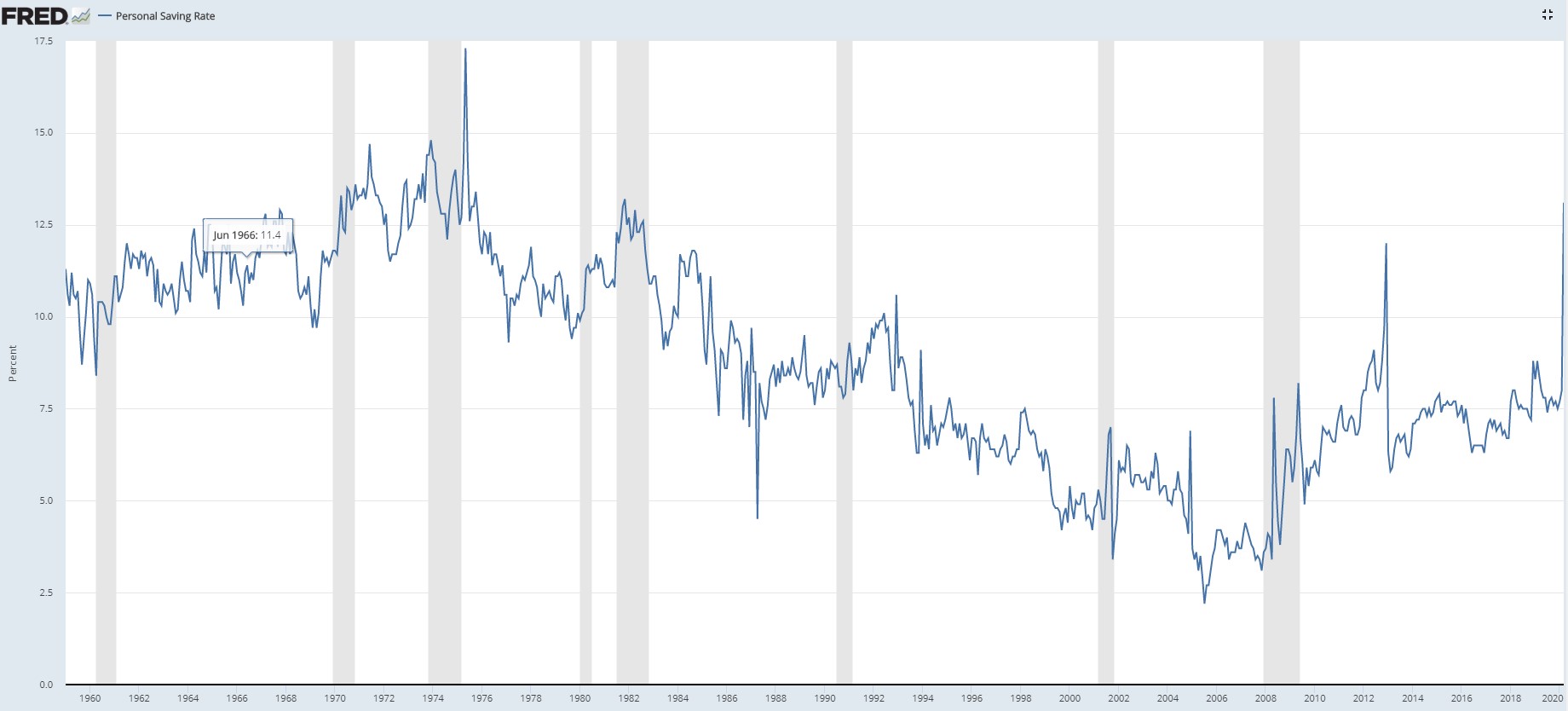

- The latest crazy economic data

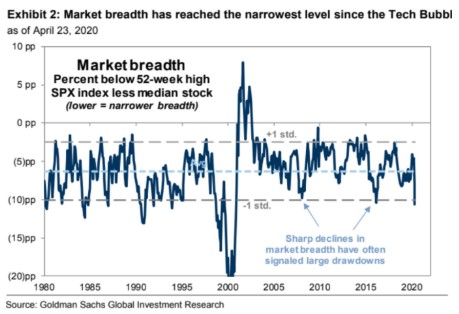

- Is this the hardest market environment to outperform ever?

- Will any investors develop a more open mind about investing after this?

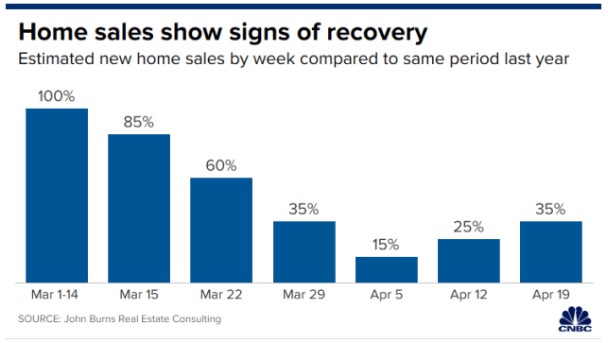

- Will more millennials buy homes because of this crisis?

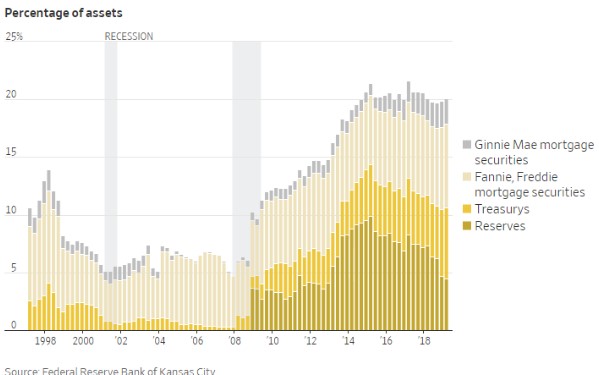

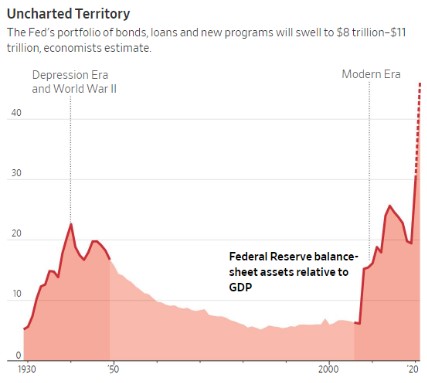

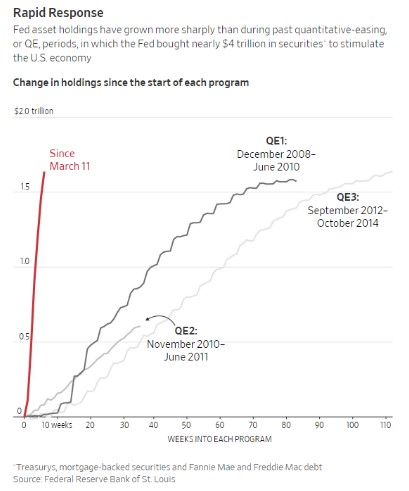

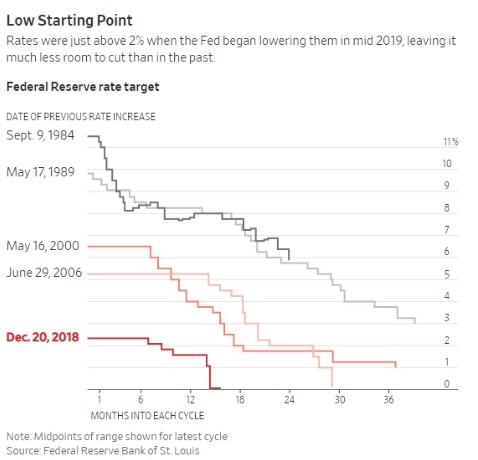

- How worse would things be if the Fed didn’t act so fast?

- What are the unintended consequences of central bank actions?

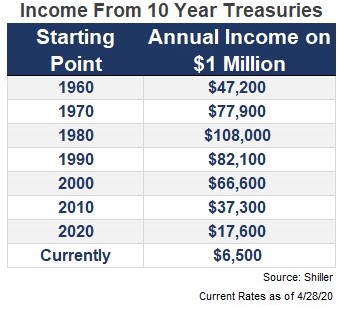

- How much are low rates contributing to the stock market’s performance?

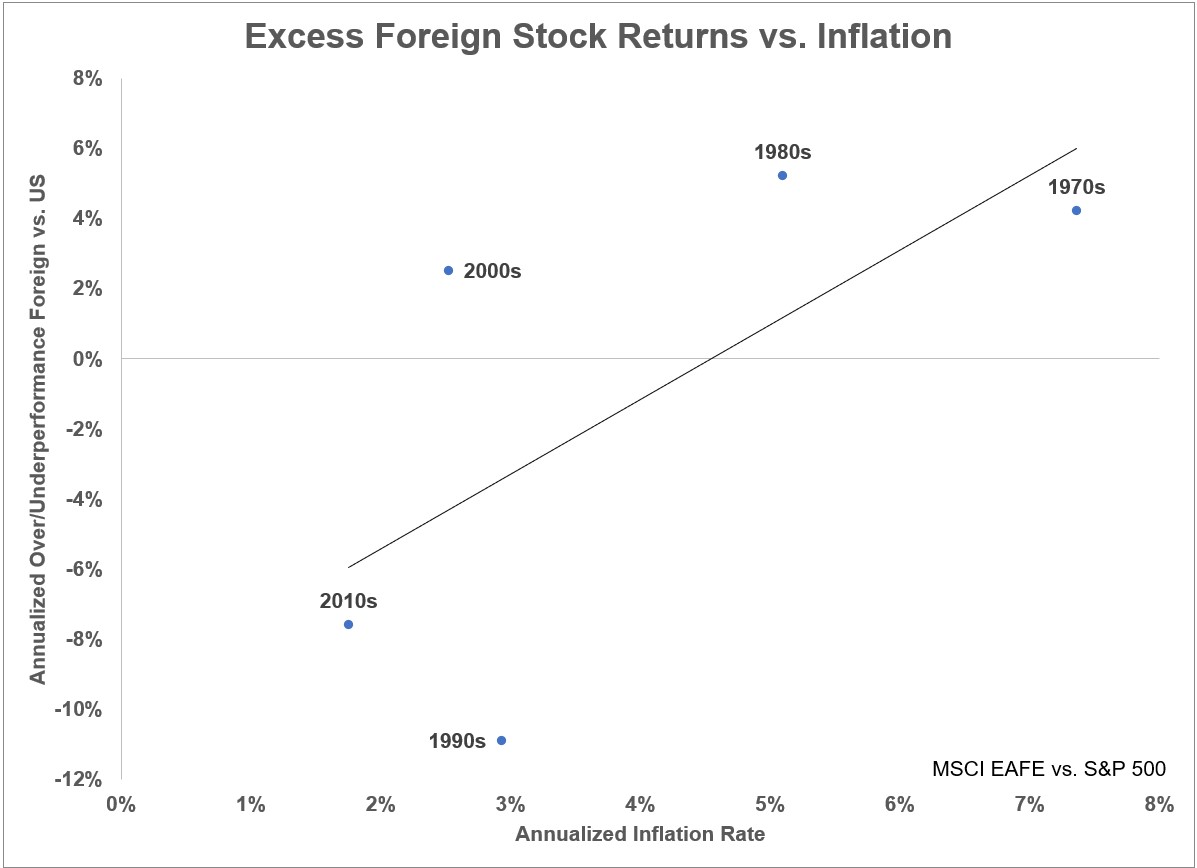

- Why aren’t stocks in Europe and Japan up more if rates are so low there?

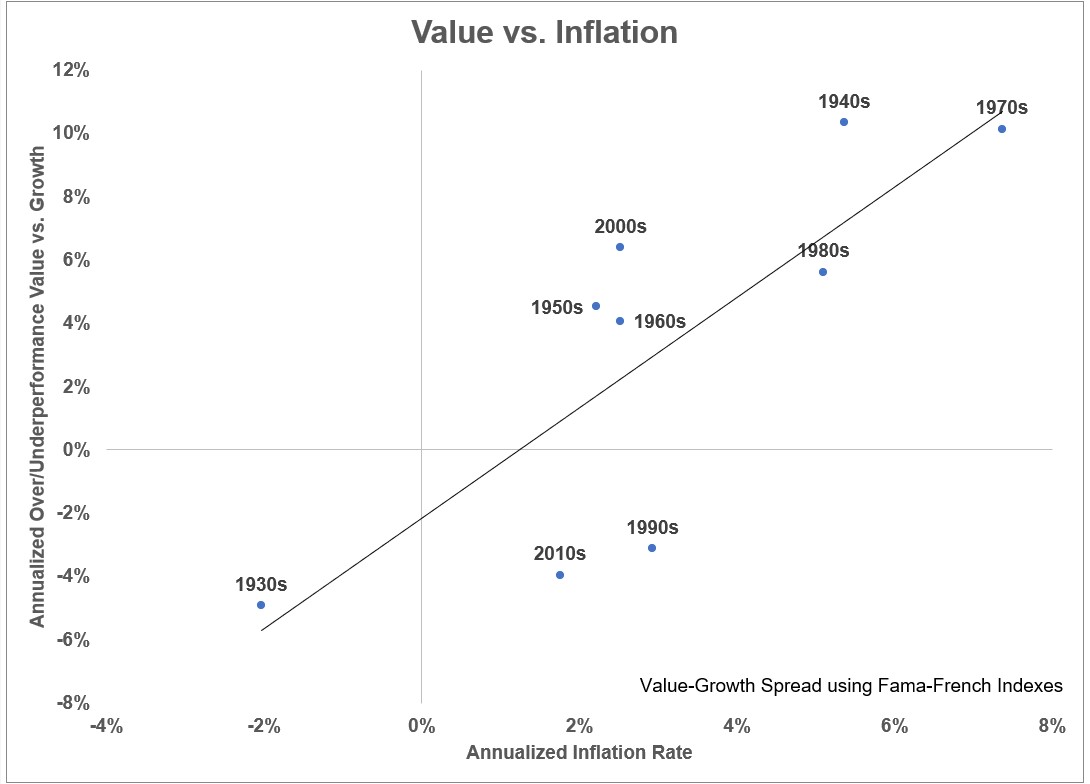

- The relationship between value stocks, growth stocks and inflation

- The resiliency of dividends

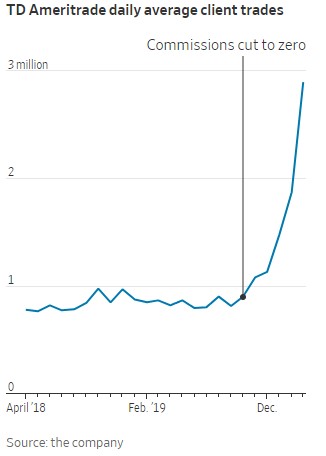

- Market turmoil is drawing in more new investors

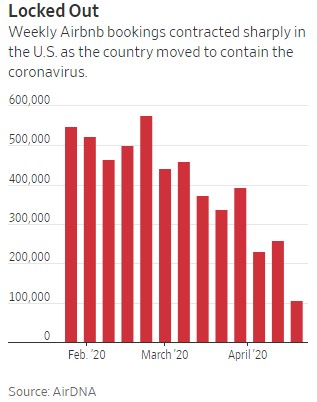

- Is Aribnb in trouble?

- Why The 3 phases of the economy right now

- The supercharged trend in new movies and more

Listen here:

Stories mentioned:

- Homebuilders suddenly see sales jump

- The Federal Reserve is changing what it means to be a central bank

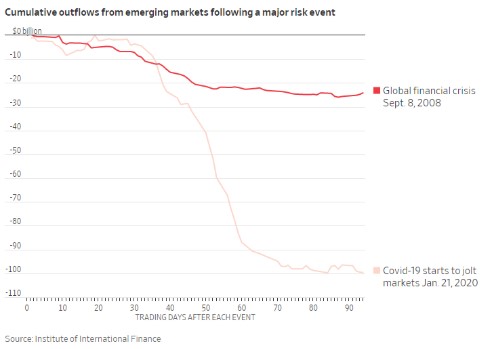

- Investors buy up debt from stronger developing countries

- Occam’s razor on interest rates and the stock market

- Who killed value?

- Why value died

- Companies are suspending dividends at fastest pace in history

- Turmoil, free trades draw newbies into the stock market

- Bill comes due for overextended Airbnb hosts

- How the pandemic will change the face of retail

- How to get 260 million kids back to school after the virus

- Trolls World Tour breaks digital records

Books mentioned:

Charts mentioned:

Video mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: