We discuss:

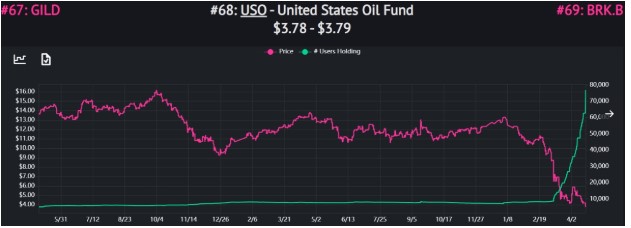

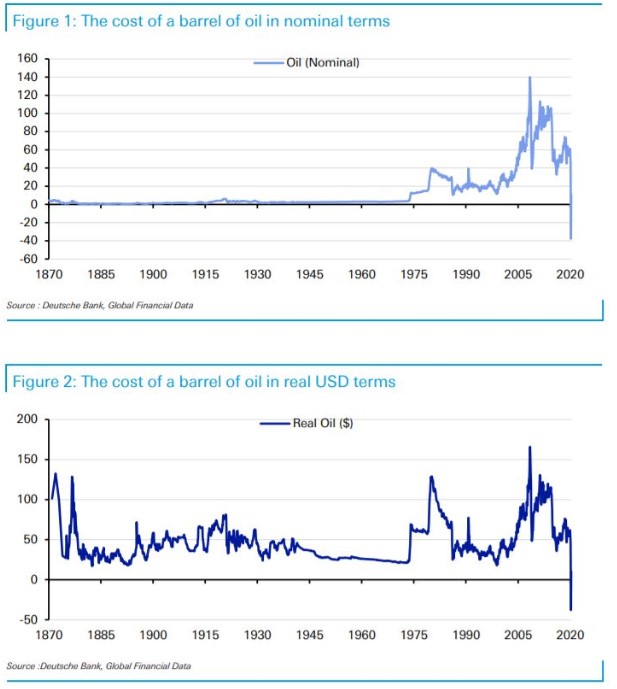

- What is happening in the oil market?

- Why speculating in futures contracts can end up bad

- Is it possible to lose money when you by oil below $0?

- Are “normal” investments the winner during this crisis?

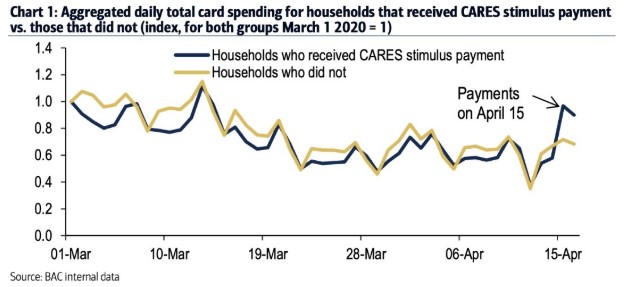

- If you send people money right now they will spend it

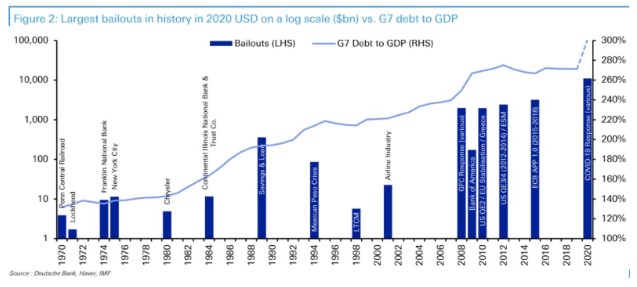

- How much bigger is the fiscal stimulus going to be?

- Did the banks give preferential treatment for PPP loans?

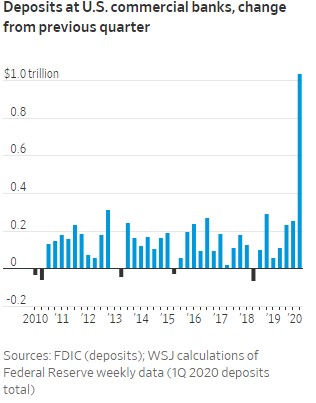

- Winner-takes-all in the banking world

- Is the Fed going to have to bailout mortgage servicers?

- Is private equity out of luck when it comes to fiscal stimulus?

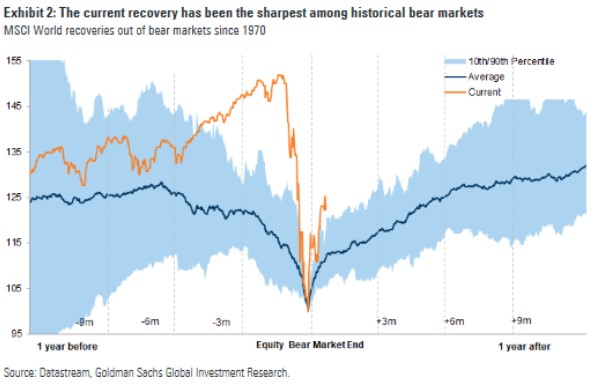

- Why the stock market is confusing at the moment

- How big can the tech stocks get?

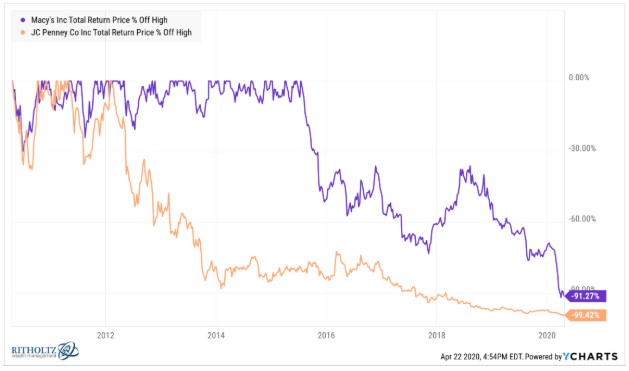

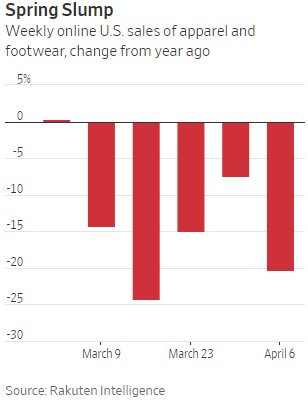

- What happens to malls if department stores die?

- How much retail share is Amazon going to get from this?

- How bad will things get for colleges in the fall?

- Why does the stock market keep rising on bad economic data and more

Listen here:

Stories mentioned:

- How a barrel of oil came to be worth nothing

- Oil crisis spreads to individual investors

- What an oil ETF has to do with plunging prices

- What the negative price for oil is telling us

- Relief payments are working

- Banks gave concierge treatment for SBA loans

- Coronavirus made the biggest banks even bigger

- Mortgage servicers excluded from bailouts

- Private equity squeezed out of another stimulus program

- Netflix has biggest quarter

- The death of the department store

- Black Friday for retailers

- Coronavirus sends American colleges off a cliff

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: