This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service

We discuss:

- When will people feel comfortable going back to Disney?

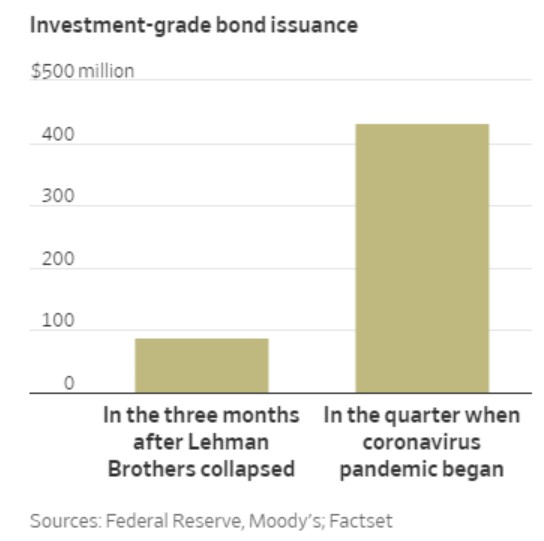

- Companies are borrowing like crazy

- Why the anger from Main Street is justified

- Why stories stick with us more than data

- Why wealth inequality will only get worse from here

- Getting used to the Fed being involved in the markets

- Will private equity firms take advantage of companies in trouble?

- Why investing is so counterintuitive

- Buying insurances after a flood

- Should you have a more flexible approach to retirement distributions?

- What will the job market look like for young people?

Listen here:

Stories mentioned:

- Bob Iger thought he was leaving Disney

- Apple and google partner on covid-19 contact tracing technology

- A legacy of debt

- Private equity is too big to fail

- US shouldn’t bail out hedge funds, billionaires during corona crisis

- Employee costs of corporate bankruptcy

- It’s not about debt or stock buybacks or whatever. It’s about the virus

- Fed takes additional actions

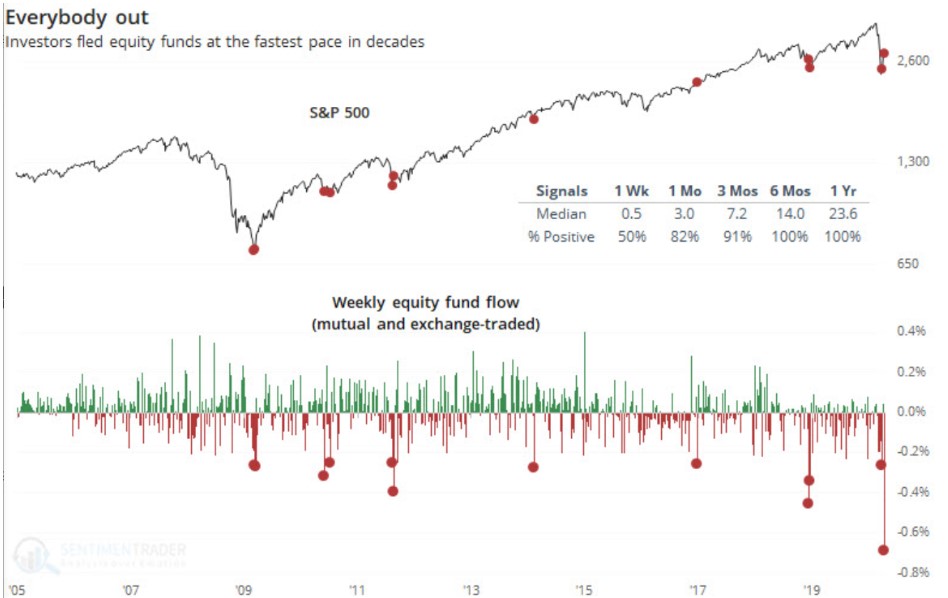

- Investors flock to bear funds at a record pace

- Misconceptions about individual bonds vs. bond funds

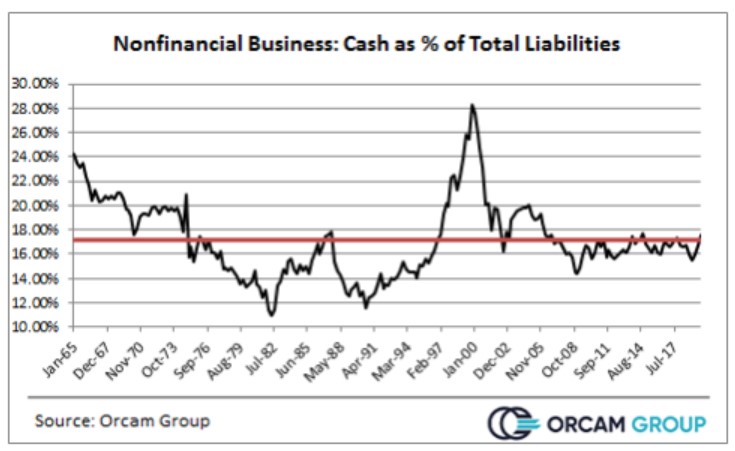

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: