Understanding the markets boils down to a combination of studying the past, analyzing the present and preparing for the future. The future part is always the tricky one because we have no idea what will happen when it comes to any of the most important variables.

But we can set expectations based on the general behavior of markets, asset classes and investors. Here’s a look at three things you can bank on as we move forward in a new decade.

*******

Looking back at what happened during the last decade can help provide context and lessons for what happened in the past. But most investors prefer to quickly move past those lessons to gauge what it means for the future.

Predicting what will happen next in the markets over any time frame is a challenge. So setting the right expectations is more important than trying to accurately guess what comes next. You’re better off preparing than predicting when it comes to the markets. With that in mind, here are a few things investors can prepare for in the coming decade.

The stock market will fluctuate

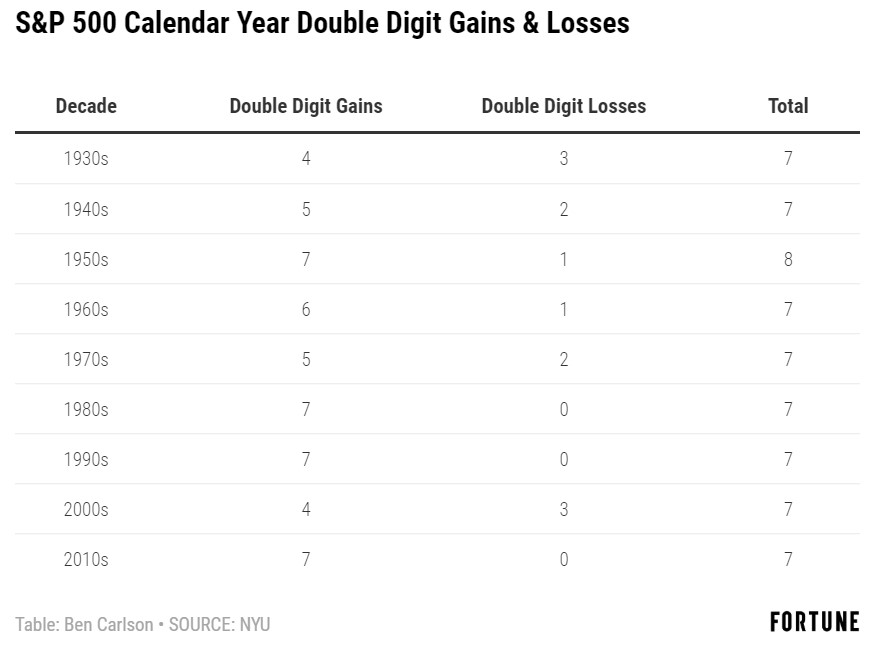

Depending on your starting point, the stock market has a long-term average return of somewhere around 9%. But the typical year in the stock market is rarely ever close to those long-term averages.

And these double-digit returns can be much higher (or lower) than most would assume. In fact, since 1928, the S&P 500 has either been up or down by 20% or more 2 out of every 5 years. That works out to 32 years of 20% or higher gains versus 6 losses of 20% or worse.

The normal state of affairs for the stock market is abnormal returns from year to year. We just don’t know if those returns will be abnormally high or abnormally low.

Bond returns will likely be lower than past decades

The stock market is difficult to predict because it’s not only a game of fundamentals but also guessing how investors will feel at certain points in the cycle. It’s difficult to predict how people will feel next week, let alone 10 years from now.

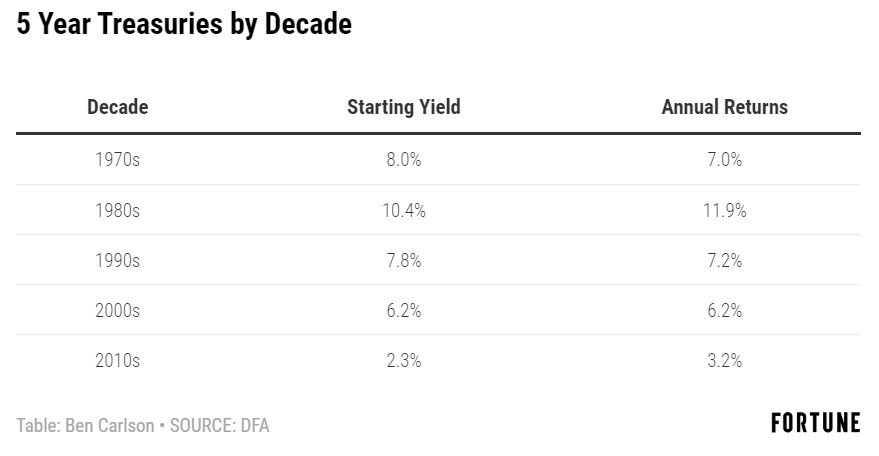

But the bond market is more grounded in fundamentals than stocks. This is especially true in high-quality bonds like U.S. treasuries where you don’t have to worry about credit risk (the U.S. government can always print more money). While there can and will be fluctuations in the meantime because of changes in interest rates, the best predictor of long-term returns for the overall bond market will always be the starting yield. The following table shows the starting yield for 5 year treasuries going into the past 5 decades along with the subsequent annual returns for each 10 year period:

Returns can always be higher or lower than the initial rates because these markets are fluent. But you can see the starting yield was a fairly accurate predictor of the future returns for bonds every decade since the 1970s. This is what makes the current situation so difficult for fixed income investors. Investors of today would kill for yields seen in the 1970s, 1980s, 1990s or 2000s. Even the start of this decade, low by historical standards, were much higher than current levels.

The current yield on 5 year treasuries is 1.6%. The 10 year is yielding 1.8% while the 30 year bond is a minuscule 2.3%. You could go further out on the risk curve to increase your yield in sectors such as corporate bonds, mortgage-backed securities or other asset-backed bonds. But even high yield bonds are yielding just 5% at the moment. That sounds juicy on a relative basis but that’s a number which is lower than intermediate-term treasuries yielded for the majority of the past 50 years (and high yield debt is much riskier in terms of drawdowns, volatility, and credit risk than U.S. government bonds).

Investors need to learn to live with volatility

When you add up low interest rates in the bond market to the inherently volatile nature of the stock market, investors who expect to earn a return over and above the rate of inflation are going to be forced to accept volatility in their portfolio. Volatility alone does not guarantee you profits in any investment but investors are going to need to be more thoughtful about how they allocate their assets going forward. There are no easy places to stash your cash and live off the interest in today’s investment landscape.

This piece was originally published at Fortune. Re-posted here with permission.