On this week’s Animal Spirits with Michael and Ben…

We discuss:

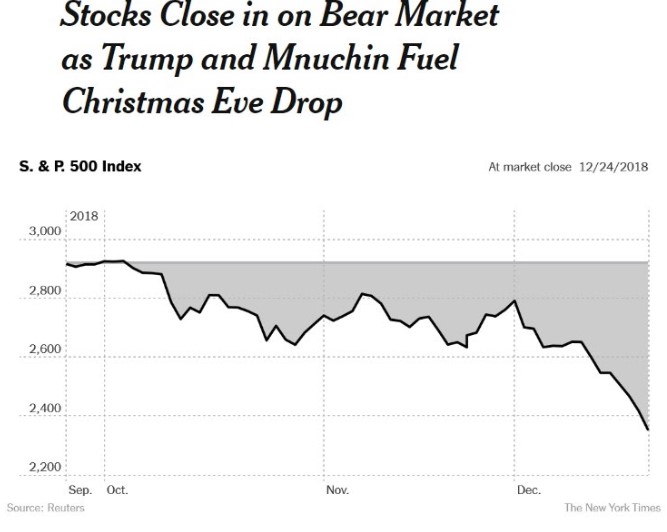

- Remember the bear market that happened a year ago

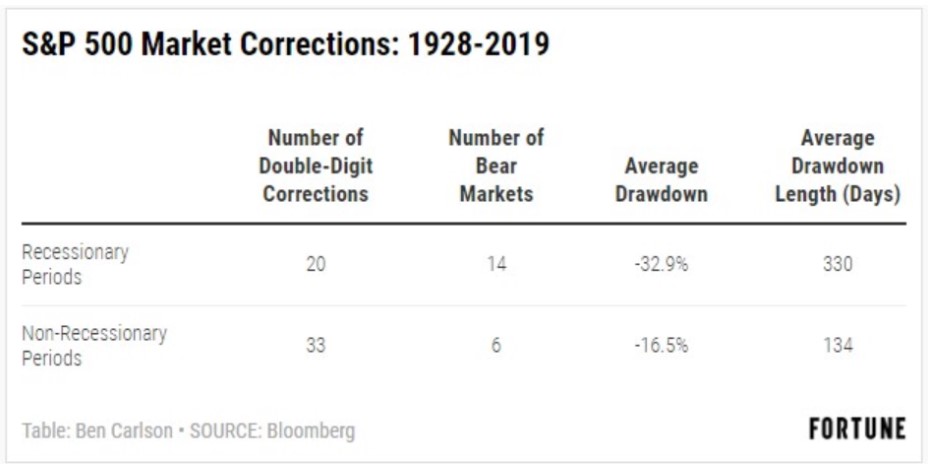

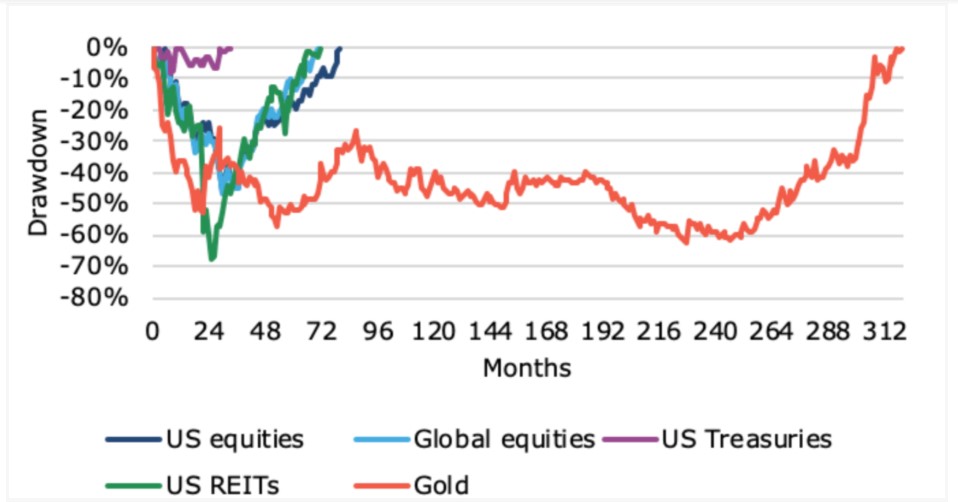

- The difference between recessionary and non-recessionary bear markets

- Contrarian indicators are almost useless anymore

- Why it’s never easy to buy when stocks are getting crushed

- Why it’s impossible to emulate Peter Lynch

- Was Peter Lynch overrated?

- Is illiquidity a form of risk management?

- How will robo-annuities work?

- What can Disney possibly do as an encore next year?

- Tesla’s unbelievable stock run

- Why is NBA viewership down?

- What would you teach a group of college students about finance?

- What will the year 2030 look like?

- What if there are no sellers when you want to sell?

- What books do we read to our kids?

- My favorite movie of the year candidate and much more

Listen here:

Stories mentioned:

- Stocks close in on bear market as Trump and Mnuchin fuel Christmas Eve drop

- Things that were said during the bear market

- Master stock picker Peter Lynch

- Peter Lynch’s track record re-visited

- The illiquidity discount?

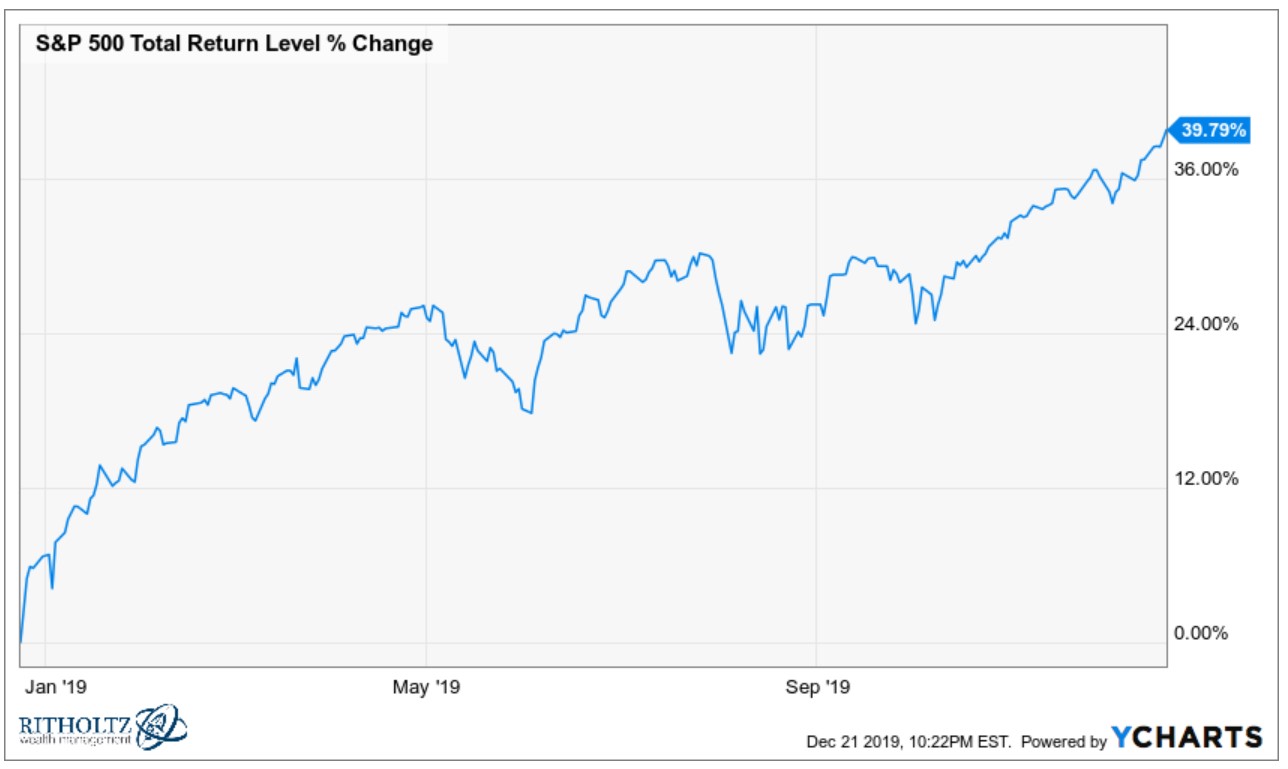

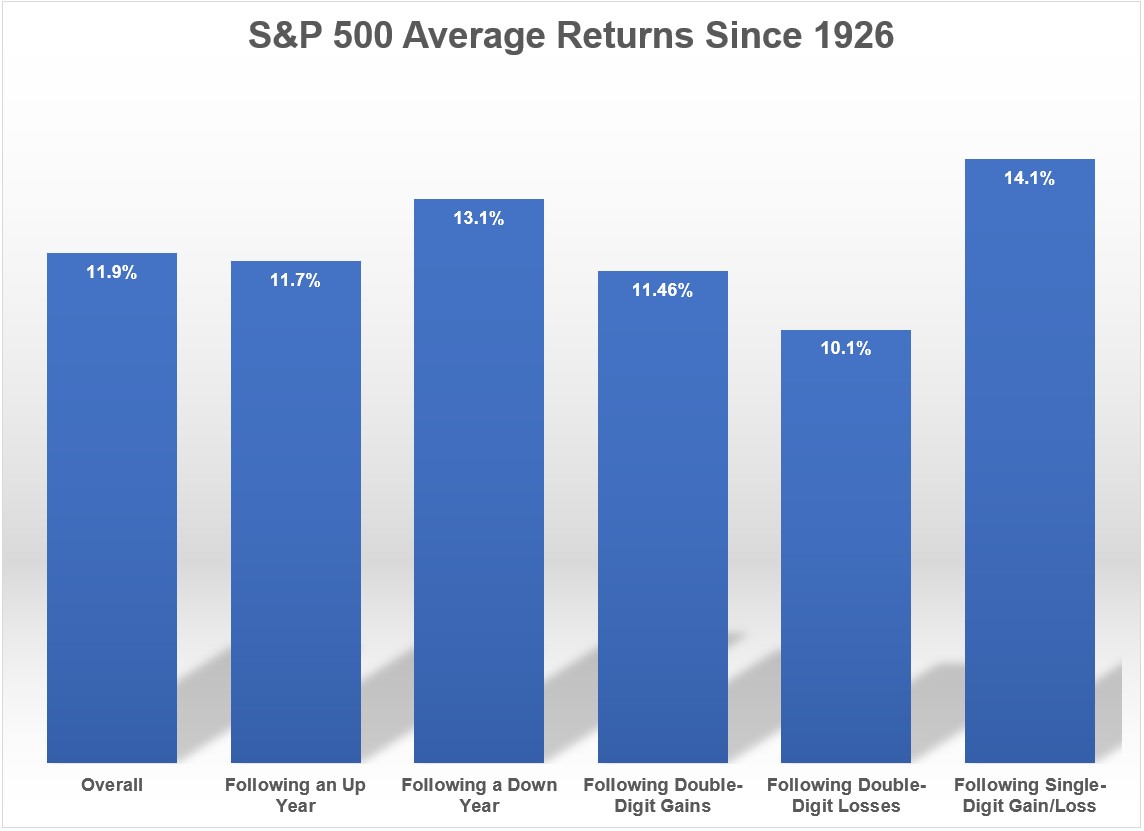

- What big stock market returns in 2019 mean for 2020

- Schwab set to launch robo annuity

- Tesla short-sellers have lost almost $8 billion in stock run up

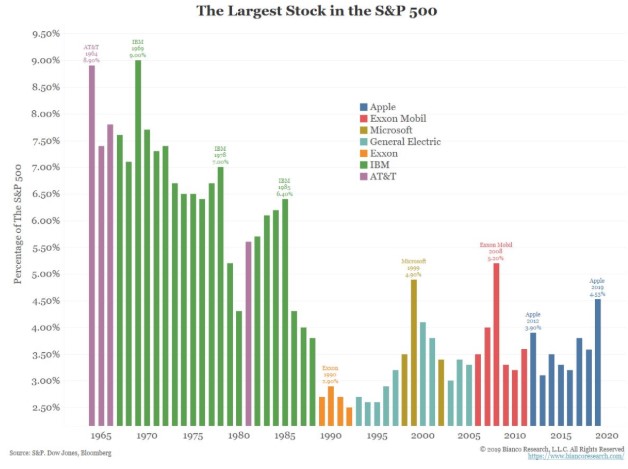

- We’ve just had the best decade in history

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: