I’m going through the process of refinancing my mortgage. It’s wild how low rates are at the moment.

When we bought our first home in late-2007/early-2008 our first 30 year fixed rate loan was in the 6.25% to 6.50% range. I’m currently dropping from 4.50% to 3.75%. Eventually there is a law of diminishing returns when you compare monthly price drops, but when you add up those payments over the course of the loan it can be a huge number.

This got me thinking about how maybe the framing of the low-interest rate environment misses a huge point.

Investors are mostly angry at low rates because they can’t earn higher yields in “safer” assets such as treasury bonds or money market funds like they could in the past. I’m sure almost every retiree on the planet would take the 6%-7% treasury yields that were present for a time during the early-1990s and be done with it.

Low rates are painful for investors because they more or less lower expected returns across the board in all asset classes.

Lots of people say lower interest rates only help the wealthy because they’re the ones that hold all the financial assets (and most believe low rates have propped up financial assets).

This is a legitimate gripe in many ways but low rates should also be helping the middle class in the real estate market. There is a silver lining from a personal finance perspective in all of this.

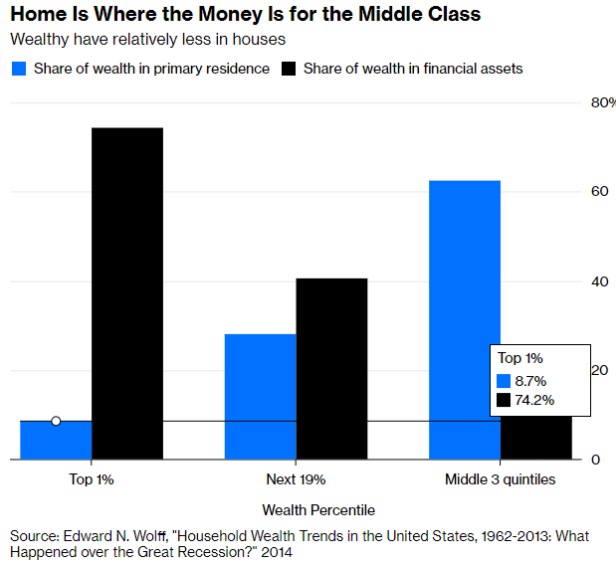

Data from Edward Wolff shows, for better or worse, the middle class has a majority of their net worth tied up in housing:

Lower interest rates mean lower mortgage rates and that’s a good thing for both new and existing homeowners alike.

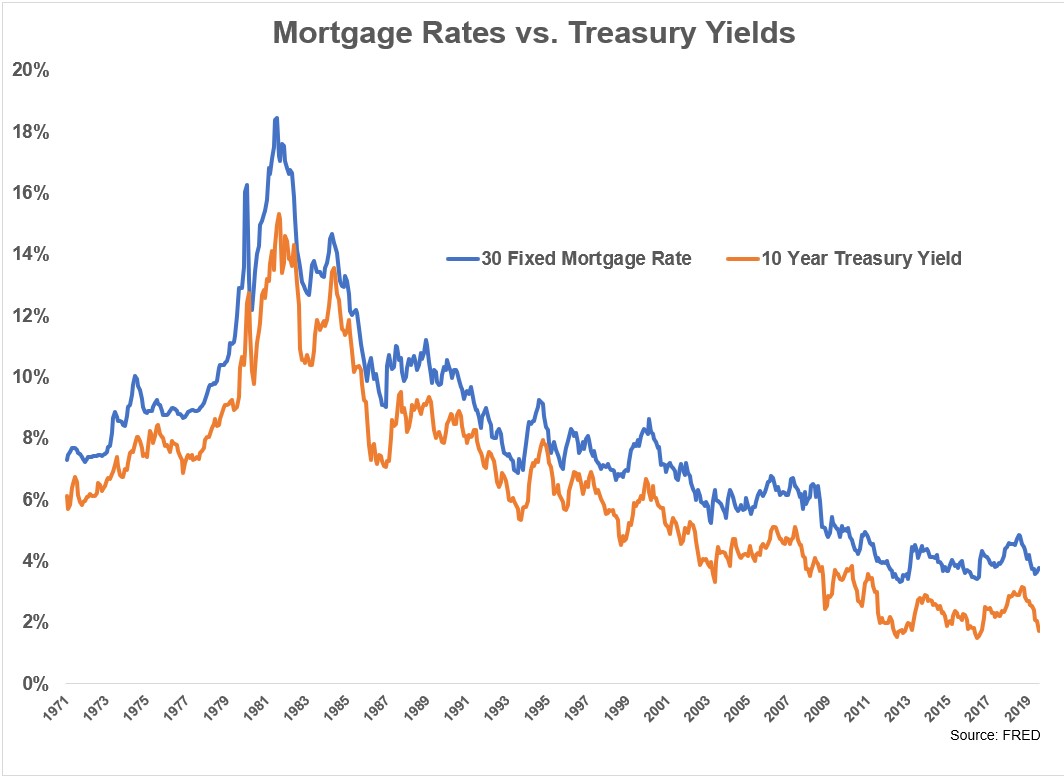

Here are 30 year fixed mortgage rates and 10 year treasury yields going back to 1971:

There is an obvious relationship here.

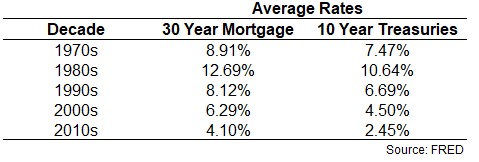

So while people look back at double-digit interest rates on savings accounts, money market funds, and treasuries of the 1980s, you have to remember it also cost a lot more to borrow back then.1 I’m sure we’ve all heard stories from the older generation of 10%-15% mortgages in the 1980s.

Here are the average rates for each by decade:

Higher interest rates translate into higher monthly payments, to state the obvious.

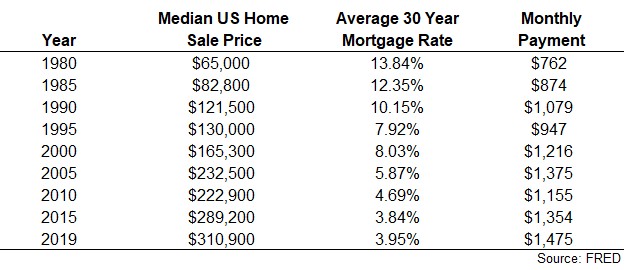

Of course, housing prices are also up in this time so you have to take them into account as well:

Median home prices are up almost 400% since 1980 while monthly payments based on prevailing interest rates are only up 94%. This is even more pronounced this century when you consider median home prices are up more than 33% since 2005 while the monthly payment is up just 7% or $100/month.

You also have to consider the fact that new homes are much bigger than they were in the past so unless we’re comparing older homes to holder homes, these price comparisons may not even be fair. Houses are bigger and nicer across the board than they were in the past.

The U.S. Census put out a report a few years ago on the characteristics of houses going back to the early 1970s which make this abundantly clear:

- In 1973, 49% of homes had no air conditioning. In 2015, just 7% of houses had no AC.

- In 1973, 40% of homes had 1.5 bathrooms or fewer. In 2015, just 4% had fewer than 1.5 bathrooms.

- In 1973, 64% of houses had 3 bedrooms while 23% had 4 bedrooms or more. In 2015, 42% of houses were 3 bedroom while 47% come with 4 bedrooms or more.

- In 1973, the median house had 1,525 square feet of space. In 2015, the median house had 2,467 square feet of space.

- In 1973, the average size of a U.S. household was 3.01 people. In 2015, the average size of a U.S. household was down to 2.54 people.

So you’re likely getting more bang for your buck, especially on newer homes.

If you have the ability to stick it out in your home for the long-term, low interest rates can provide a wonderful value at the moment.

Yes, as investors it would be nice if rates were high, inflation was low and expected returns were always high but that’s not how these things work. High rates of the past may sound appetizing when viewed through the lens of current rates but there are always trade-offs with these things.

While investors of today would kill for 1980s-level interest rates and stock market valuations, people in the 1980s would surely kill for today’s mortgage rates, inflation levels, and housing amenities.

Further Reading:

The Real Estate Market in Charts

1You also have to factor in the fact that inflation was double-digits back then as well, negating the advantage of higher rates on your savings on a real basis.