On this week’s Animal Spirits with Michael and Ben we discuss:

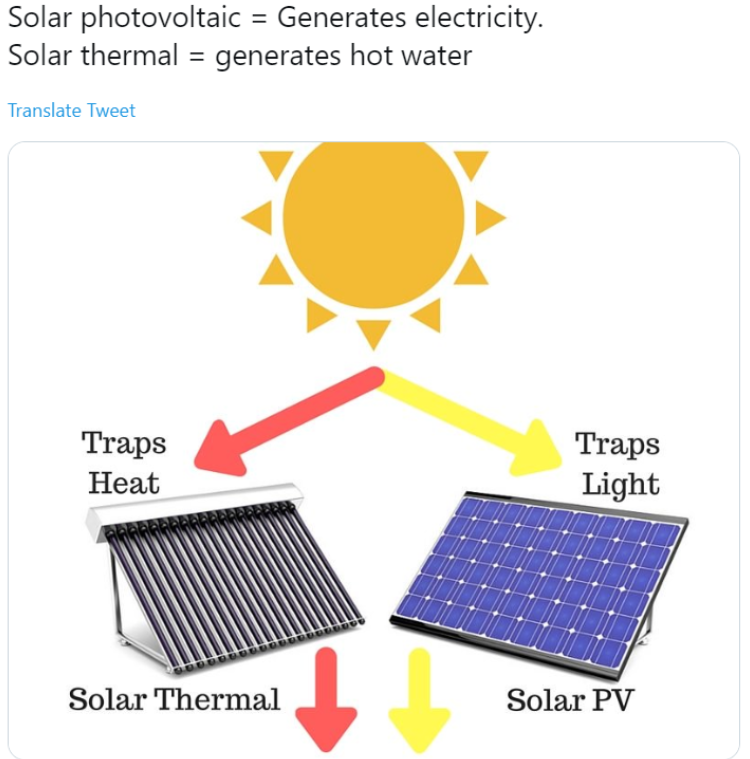

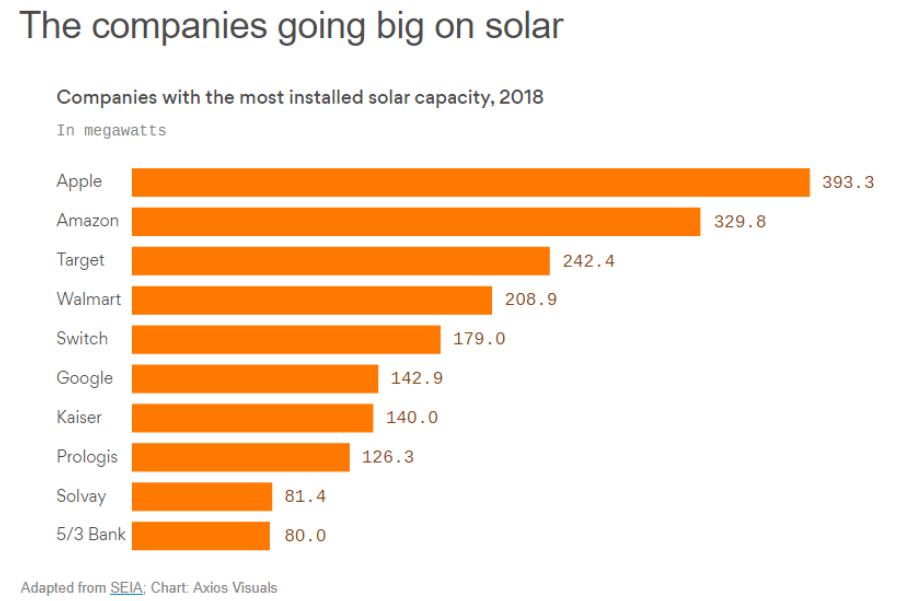

- Solar shaming

- Power laws in the stock market

- The insane number of stocks that end up losers

- The stealth king of the passive bubble

- Why a “rush for the exits” is a poor investment thesis

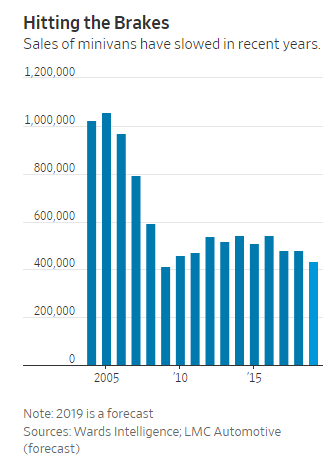

- Why are fewer people driving minivans?

- What would happen if the USD lost reserve currency status?

- Valuations in the electric scooter business

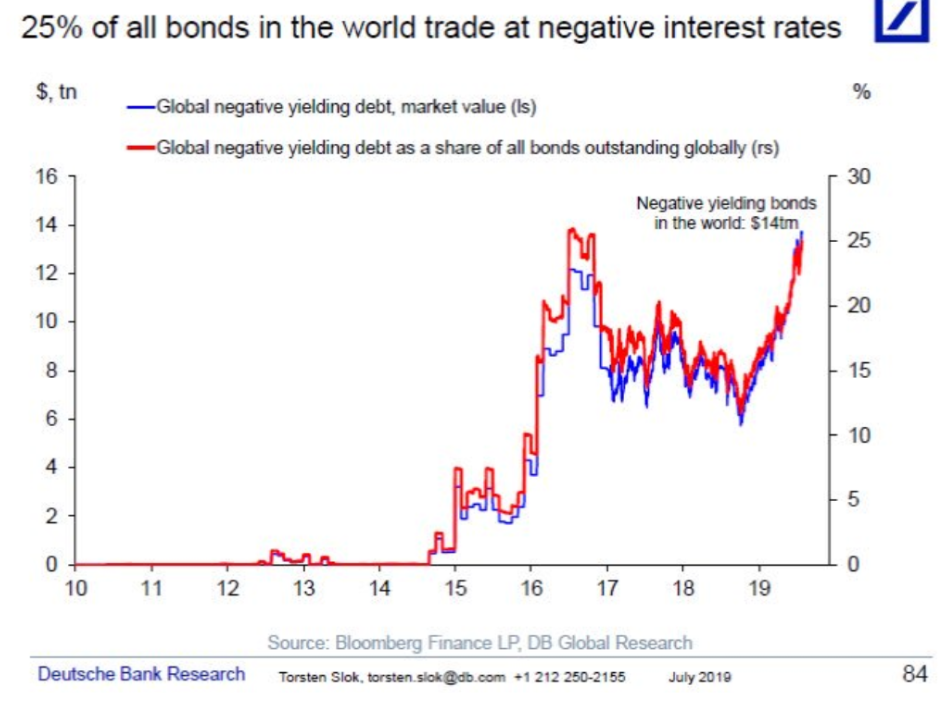

- Negative interest rates vs. investor psychology

- Will there ever be negative interest rates in the US?

- Why you should never borrow money from a friend

- Can fintech take over the banking sector?

- Twitter power users

- What is the CAPE ratio for Marvel movies?

- How momentum works

- Why Star Wars didn’t age well and much more

Listen here:

Stories mentioned:

- Winner-take all phenomenon rules the stock market

- Do global stocks outperform US treasury bills?

- Passive investing boom could be causing a bubble

- Investor portfolios look alike

- Annual survey of assets

- Minivan sales fade

- JP Morgan says dump US dollar as its century of global dominance coming to an end

- Bird is said to raise new funding at $2.5 billion valuation

- The companies going big on solar

- Is it a bad idea to borrow $1k from my friend

- Robinhood raises $323 million

- Betterment Everyday

Books mentioned:

Charts mentioned:

Sebastian Maniscalco bits mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook and Instagram

Subscribe here: