This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

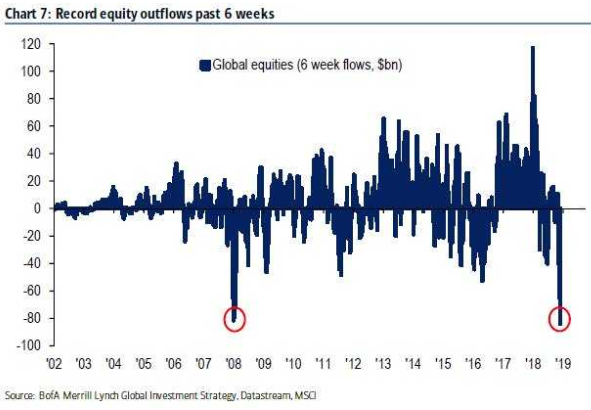

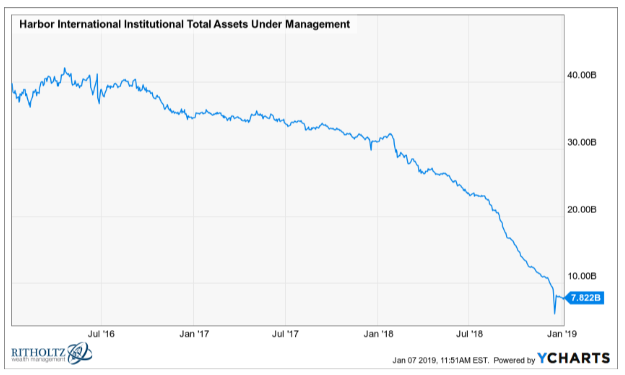

- The record outflows from mutual funds.

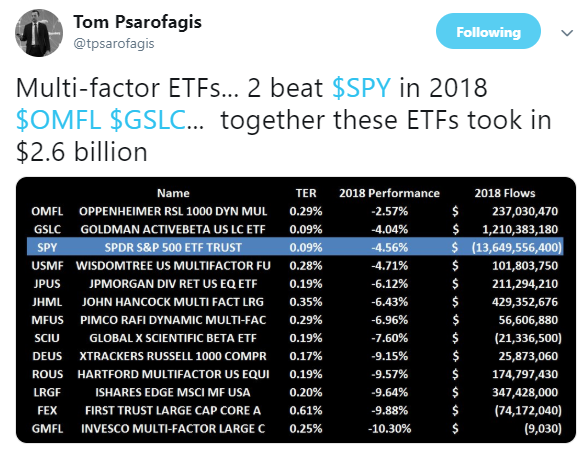

- How outflows are impacting passive and active funds differently.

- Why the S&P 500 is so hard to beat.

- Investing using seasonality.

- Can anyone predict recessions in advance?

- How helpful is economic data in forecasting?

- Did trade wars and tariffs stop a huge bubble from forming?

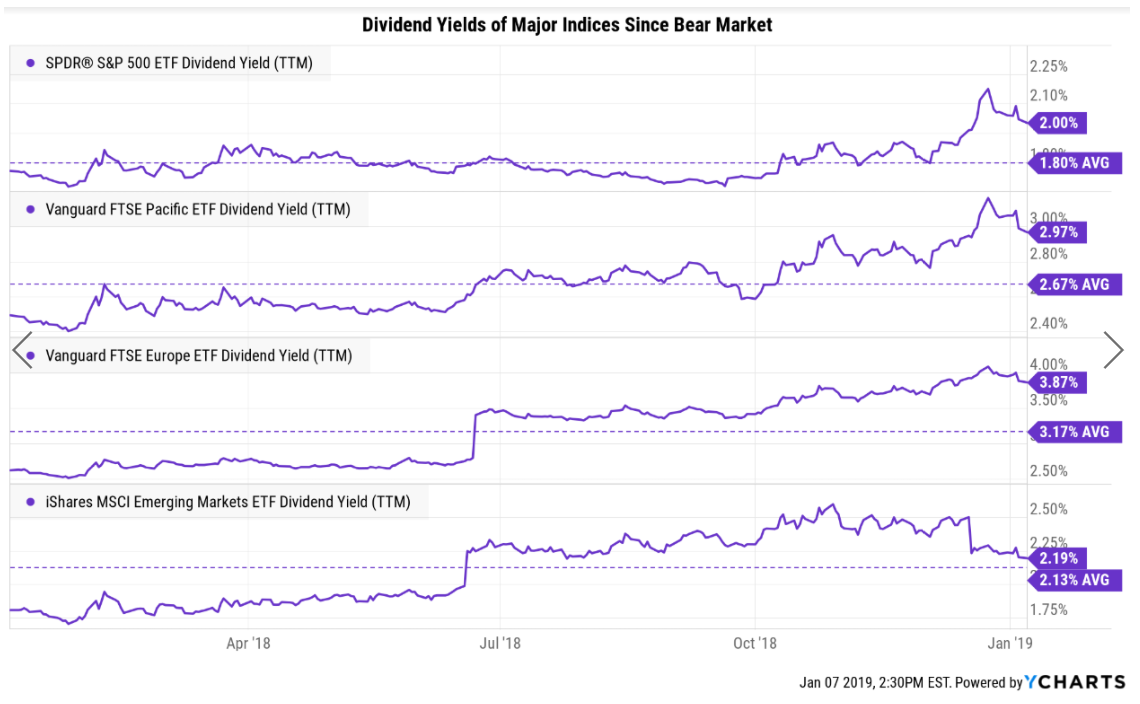

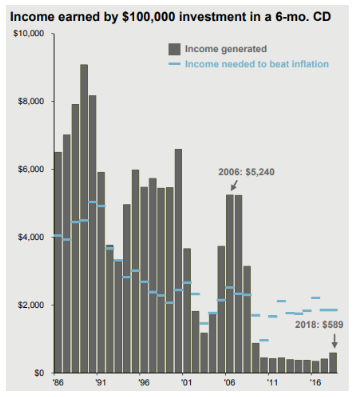

- Dividend yields and CD yields are on the rise.

- The joys of investing in down markets.

- Some good news on the equity risk premium.

- The strange was people pick funds in their 401k.

- Credit card perks and rewards.

- Women in the hedge fund industry.

- Divergent performance between Einhorn and Dalio.

- How many people live paycheck-to-paycheck?

- Millennials are delusional about how rich they’ll end up.

- Should savers ramp up contributions during a downturn?

- Facetime fiascos and much more.

Listen here:

Stories mentioned:

- Active funds hit most by outflows

- Can the unemployment rate signal a recession?

- January macro update

- A reminder that equities are risky in case you forgot

- How people pick 401k funds

- Rewards credit cards gained a huge following

- Women in finance

- Mary Meeker seeks $1.25 billion in first fund

- Einhorn’s Greenlight extends decline

- Bridgewater posts a stellar 2018

- The number of people living paycheck-to-paycheck

- Millennials are delusional about how rich they’re going to be

Books mentioned:

- Impossible to Ignore by Carmen Simon

- The Wealthy Barber by David Chilton

- The Coddling of the American Mind by Jonathan Haidt & Greg Lukianoff

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: