On this week’s Animal Spirits with Michael & Ben we discuss:

- What’s the one thing we’re certain of about the stock market going forward?

- Why volatility begets more volatility in the markets.

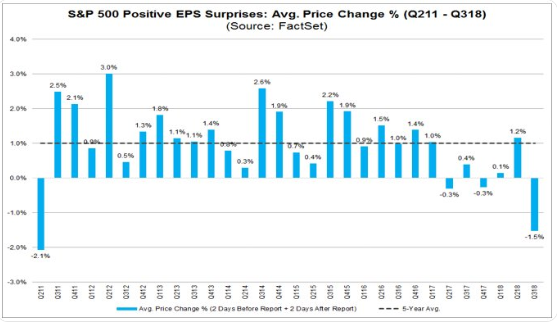

- How expectations factors into the stock market and the economy.

- Why the stock market is nothing like a casino.

- Labor shortages, wages, and a sub-4% unemployment rate.

- How does the stock market affect the economy and vice versa?

- What should you do if you’ve been sitting in cash for a number of years?

- What you can learn from the robo-advisors.

- When is it OK to panic in the stock market?

- Why are investors fleeing bond funds?

- What % of people think they will win the lottery?

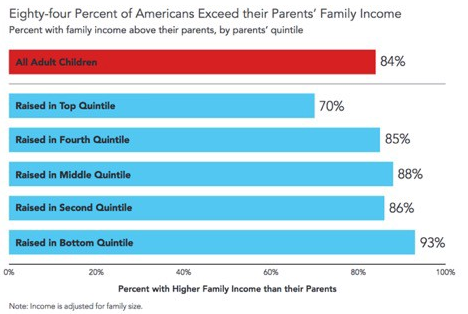

- Are all the economic gains really going to the rich?

- Is Uber really worth $120 billion?

- Is it possible for the stock market to be down over a 20-year period?

- Never buy an investment product because of a free meal and much more.

Listen here:

Stories mentioned:

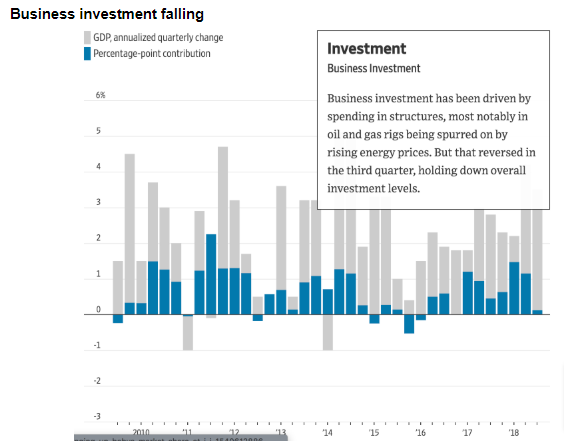

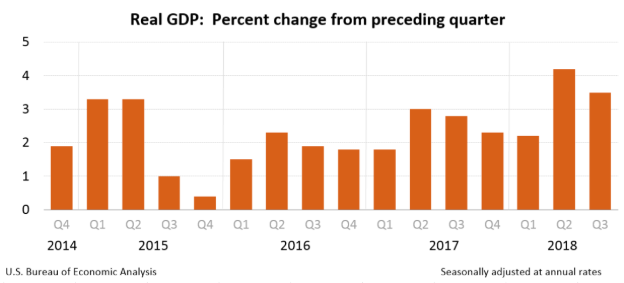

- U.S. economy grew at 3.5% rate for the quarter

- When stocks fell 10%…

- The psychology of sitting in cash

- The retirement algorithm

- It’s okay to panic a little

- Investors are fleeing bond funds

- What investors can learn from gamblers

- Do the rich capture all gains from economic growth?

- Uber-Inequality

- Steak dinner and annuities

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: