On this week’s Animal Spirits with Michael & Ben we discuss:

- The recent market turbulence.

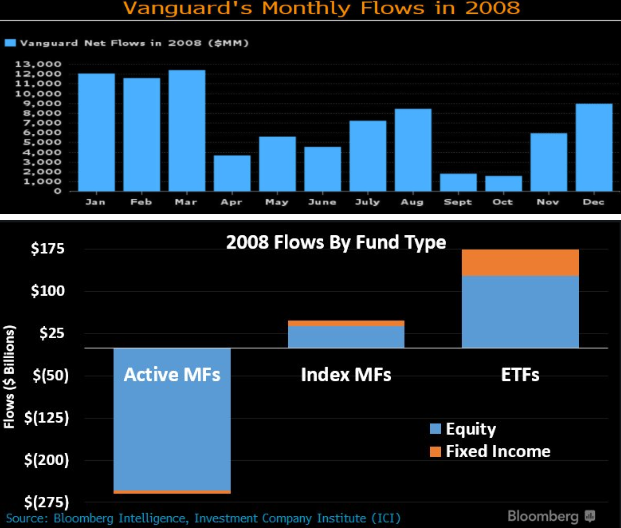

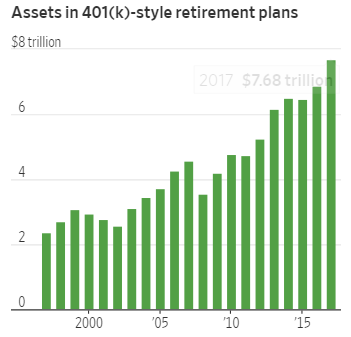

- Maybe 401ks won’t provide a floor under the market.

- The problem with 401k loans.

- The rise and fall of Sears.

- How Buffett predicted Eddie Lampert’s struggles with Sears 10 years ago.

- The similarities between Sears and Amazon.

- The impact of student loans on the economy.

- Survey of the week: What’s holding back first-time homebuyers?

- What if valuations were predicting improved fundamentals?

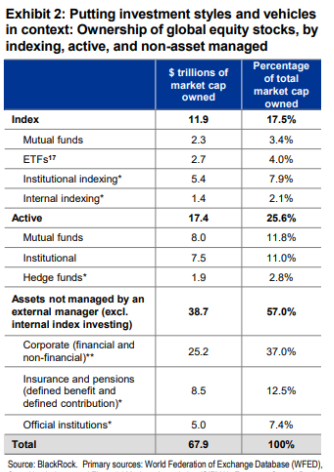

- How many institutional investors index?

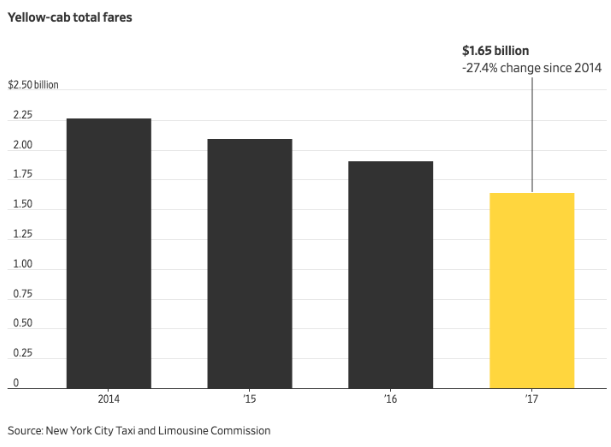

- Value investing in taxis.

- Will Amazon and Wal-Mart be your doctors in the future?

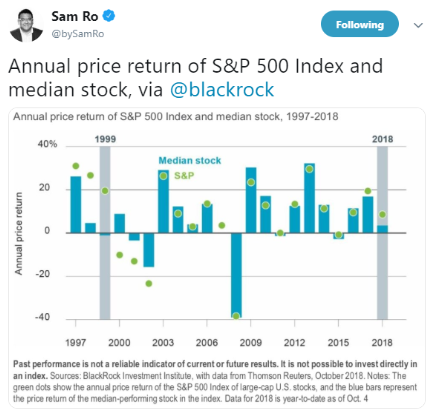

- There’s a difference between individual stocks and the stock market.

- Did Tesla outsell Mercedes Benz?

- Are HSAs underutilized?

- The psychology behind a 100% stock market portfolio and much more.

Listen here:

Stories mentioned:

- The $210 billion risk in your 401k

- Buffett predicted Lampert’s troubles 10 years ago

- The history of Sears predicted nearly everything Amazon is doing

- Student loans rise to $1.58 trillion

- Attitudes on home ownership

- Indexing supports vibrant capital markets

- Amazon and Wal-Mart want to read your vital signs

- Tesla outsells Mercedes Benz

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: