On this week’s Animal Spirits with Michael & Ben we discuss:

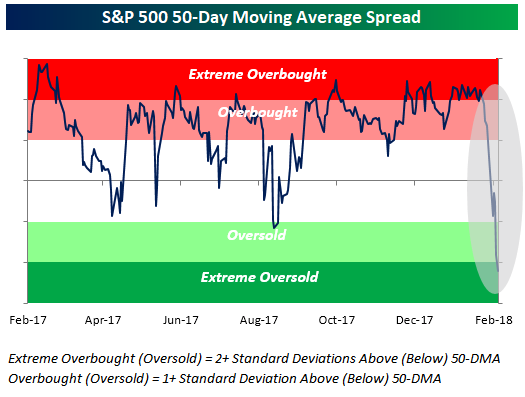

- Our thoughts on the market correction.

- What happens when there’s nowhere to hide and correlations go to one.

- What we personally did, if anything, during last week’s sell-off.

- The countless reasons everyone is giving for the latest downturn.

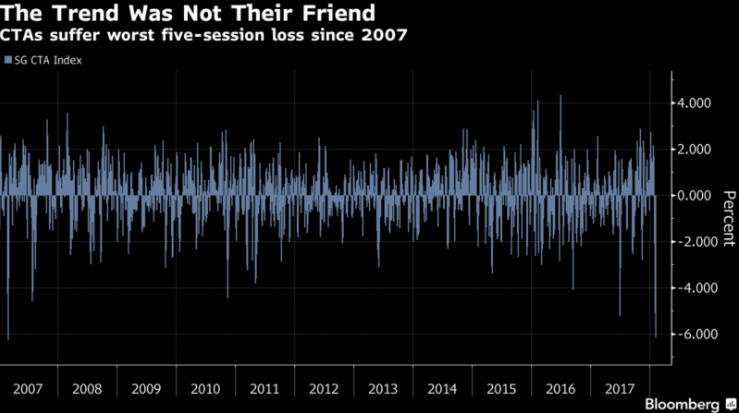

- Why managed futures had such a poor showing in this correction.

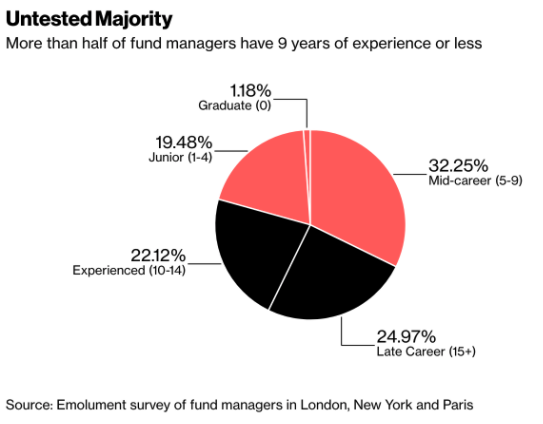

- The untested majority of young fund managers.

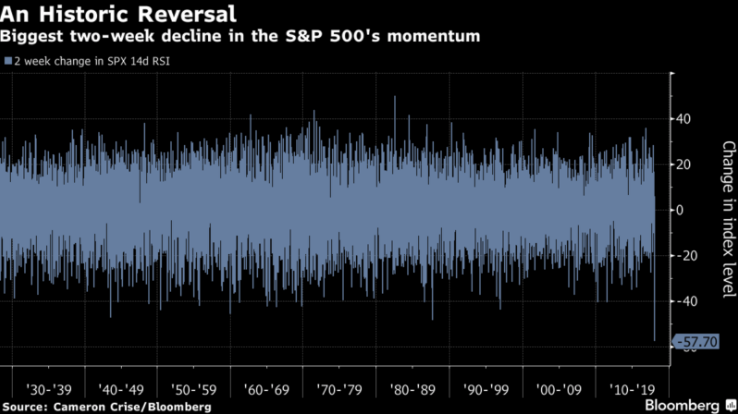

- The momentum crash.

- How “passive” investors fared last week.

- Why millennials should hope these losses continue.

- Where all those hedge fund fees really go and more.

Listen here:

Stories discussed:

- These kinds of stock market losses aren’t that unusual

- An unprecedented decline

- 1946-1967 bar markets revisited

- Markets test millennial traders who have never seen a crash

- The worst momentum swing for U.S. stocks in history

- Business digest: Tuesday, October 20, 1987

- You don’t see this very often

- Record $23 billion flees world’s largest ETF

- A harsh lesson for millennial investors

- Managed futures & dealing with uncorrelated assets

- What big hedge fund fees pay for

Books discussed:

- Deep Work: Rules For Focused Success in a Distracted World

- Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts

Charts discussed:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Subscribe here: