The unemployment rate sits at 4.3%.

Inflation is subdued at just 2.2% over the previous 12 months.

The 10-year treasury bond yield is still well below 3%.

The S&P 500 passed through 2500 recently and has hit 45 (and counting) new all-time highs in 2017 alone.

Stocks haven’t seen a 10% correction in almost 2 years.

It feels as though volatility has been outlawed.

The former host of The Apprentice is the President of the United States.

We haven’t had another economic downturn since the last one ended in mid-2009, making this one of the longest recoveries in history.

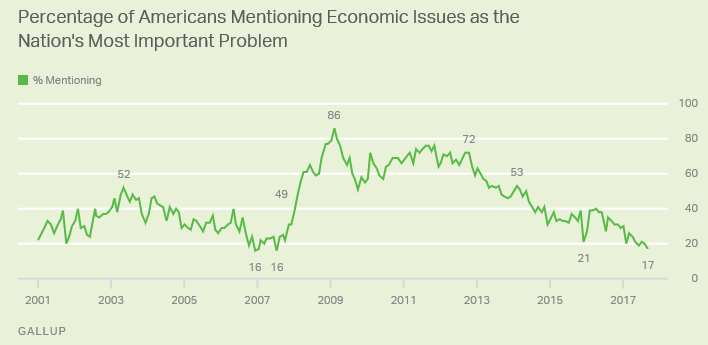

If you would have told me all of these things in 2009 — along with the fact that most people still seem fairly miserable — I would have said you’re out of your freaking mind. This is one of the more bizarre bull markets I can recall. And according to a recent Gallup poll, people don’t think the economy is the most important problem right now:

Contrast today’s 17% reading with the 86% reading in early-2009 at the depths of the crisis. People were freaked out about the economy and for good reason. The entire financial system had almost just completely imploded and the stock market was in a free fall.

In some ways, it would make sense that people should have been more worried about the economy in 2009 than now. Not only are there other things to worry about right now, but back then we were dangerously close to total calamity in the financial system. I suppose this will always be the case as price drives narratives in both the markets and mindshare.

In other ways, this chart is a good reminder that our perception of risk is constantly changing.

Risk perception is something all investors need to understand because it affects us all. Your risk profile is different than your risk perception. Your risk profile is a combination of your appetite for risk, your need to take risk, and your ability to take risk. But your perception of risk changes with time, experience, and circumstance.

The three standard labels investors are typically given in the financial services industry are conservative, moderate, and aggressive. These categories are usually defined by the age of the investor but there are other elements that come into play including your net worth, income, spending needs, etc.

The problem with these labels is that they have certain stigmas associated with them. And as markets change course, the grass is always greener depending on how you’re positioned. Everyone would like to be a conservative investor in 2008 or 2011 while everyone would prefer to be aggressive in 2013 or 2017.

This is why understanding yourself is the most important part of the investment process. If you don’t understand yourself — your reactions, your personality traits, your biases, your limitations — it doesn’t matter which type of investor you’re supposed to be. It matters which type of investor you are.

Some investors are constantly plagued by the fear of missing out on huge gains. Others will be haunted by the fear of being fully invested when markets take a dive. Panic selling or buying is the mistake attached to each of these fears but panicked investment decisions tend to come from a misunderstanding of the current risks rather than a change in risk profile.

There’s no perfect equilibrium between your willingness, ability, and need to take risk but the goal is to balance out your future goals with your desire to sleep soundly at night. You just have to approach the investment process with the understanding that you will never be able to completely hedge out every risk, fear, or market event.

This is why true risk management is about creating behaviorally aware portfolios, not fancy mathematical risk measurement techniques. The biggest risk for investors is never a black swan or even a market-moving geopolitical event. The biggest risk for investors is themselves.

Further Reading:

The Struggle to Define Risk