Although they have a poor long-term return profile, commodities go through violent boom and bust periods, which opens them up to other strategies to follow those trends. In this piece for Bloomberg I looked at some of those strategies as well as other options for investing in commodities for those looking for this type of exposure.

*******

I recently wrote about how commodities are good for traders, but bad for investors as a useful long-term buy-and-hold financial asset. A broad basket of commodities has given investors lower returns than cash equivalents with higher volatility than stocks.

That higher volatility means there will be cyclical swings where commodities see huge gains as well as huge losses. The question many investors should ask themselves is this: Is there a better way to invest in commodities since the long-term risk-reward profile is so poor?

Commodities are a hedge against much higher inflation, so the past 30 years or so of disinflation haven’t been conducive to strong performance, but there are ways to access commodities in their portfolios without investing directly in futures.

Own an index fund. The simplest way to gain exposure to commodities is to own a broadly diversified index fund. The SPDR S&P 500 ETF currently has around 6 percent of its holdings in energy stocks and another 3 percent in basic materials. Foreign stocks have an even higher commodities tilt. The iShares MSCI EAFE ETF has 5 percent in energy names and 8 percent in basic materials while the Vanguard FTSE Emerging Markets ETF has 7 percent and 9 percent, respectively.

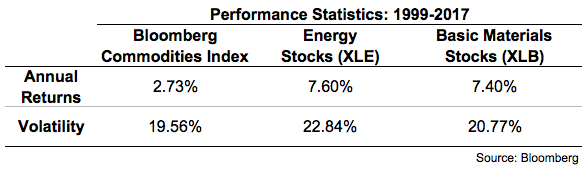

Invest in sector ETFs. You could also invest directly in these sectors. While this is a much more concentrated bet, ETFs now make it easier than ever to make a bet at the sector or industry level. Here are the returns since 1999 for the SPDR Energy ETF and the SPDR Basic Materials ETF compared to the Bloomberg Commodities Index:

Both funds have performed much better than commodities with similar volatility characteristics. The only problem with investing in sector funds is that they still have a fairly high correlation to the overall stock market. The correlations for XLE and XLB to the S&P 500 were 0.62 and 0.88 over this time frame. Many investors put their money into commodities in hopes of finding an uncorrelated portfolio diversifier, which sector funds may not provide.

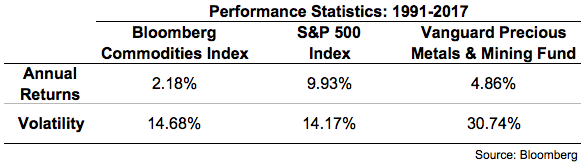

Invest in companies that mine commodities. Instead of owning the commodities themselves you could simply own equity in the companies that extract them and put them to use. The Vanguard Metals & Mining Fund does just that. Here are the stats in comparison to the S&P 500 and Bloomberg Commodities Index:

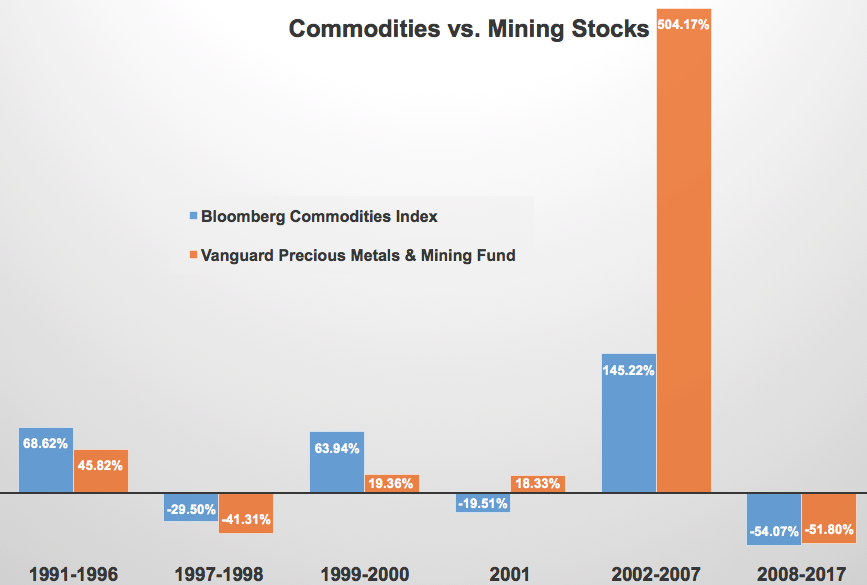

This fund had just a 0.05 correlation to the S&P 500 in this time, meaning there is virtually no relationship between the return streams (1). It also had better returns than commodities, but it did so with much higher volatility. It also comes with bone-crushing losses that can be similar to the underlying commodities:

There have been periods when physical commodities decouple from the equities of the mining companies but both are still quite cyclical. When looking at the types of losses and volatility involved in precious metals and mining stocks it makes for a difficult portfolio holding, even if it ends up providing valuable diversification benefits. Very few investors have the emotional stamina to hold through this type of volatility or rebalance into the pain when necessary.

Stick to trend-following rules. Because of the cyclical nature of commodities they can work much better through the use of trend-following rules. Trend-following as an investment strategy seeks to follow the old maxim that you should allow your winners to run but cut your losers short. The goal of trend-following is to reduce volatility and the potential for large drawdowns.

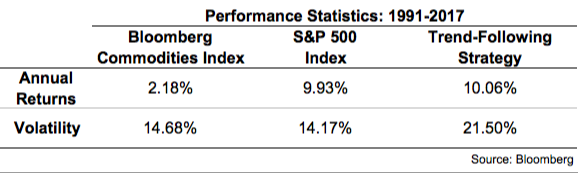

The following table compares commodities, stocks and a simple commodities trend-following strategy since 1991:

Our trend-following strategy in this example follows a simple 10-month moving average rule. Using the same Vanguard Precious Metals & Mining Fund, this strategy shows what would have happened if you would have held that fund when it was above its trailing 10-month moving average price (2) and sold it to buy bonds (3) whenever it dipped below the 10-month moving average.

Not only does a trend-following strategy cut the volatility by roughly one-third in this fund, but it also reduces the maximum drawdown in the fund from minus 76 percent to minus 33 percent by going to bonds as losses and volatility began to pile up.

This example doesn’t include taxes or transaction cost but it does show how investors can use the cyclical nature of these securities to their advantage. The basic idea is to ride the momentum up when they are rising and try to get out of the way when they are falling, with the understanding that you can’t nail the timing perfectly in either direction.

As you can see from the statistics, none of these strategies will be for the faint of heart. But investors do have options beyond investing directly in long-only commodity indexes if they would like to invest in this space.

*******

(1) The Bloomberg Commodities Index had a correlation of 0.30 to the S&P 500 in this time

(2) This rule works as follows: At the first of every month, calculate the trailing average price over the previous 10 months. If the current price is above the 10-month average, stay invested in VGPMX. If the current price is below the 10-month average, invest in bonds instead.

(3) The bond fund used here is the Vanguard Total Bond Market Index Fund.

Originally published on Bloomberg View in 2017. Reprinted with permission. The opinions expressed are those of the author.