“The essence of risk management lies in maximizing the areas where we have some control over the outcome while minimizing the areas where we have absolutely no control over the outcome and the linkage between effect and cause is hidden from us.” – Peter Bernstein

When you spend enough time in the finance industry you’re bound to come across a number of arguments you disagree with. And that’s fine because disagreement is what makes markets. If everyone agreed on everything the markets would cease to function.

There’s an investing argument that I’ve heard a number of times over the years that I disagree with. It goes something like this — if you have a 60/40 portfolio made up of stocks and bonds, you really have 90% of your risk in stocks and only 10% of your risk in bonds.

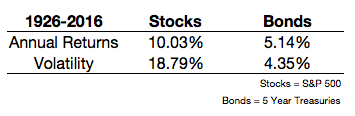

If you look at the statistics I can understand why people make this argument:

The math isn’t quite this simple, but a back-of-the-envelope calculation that takes 60% of stock market volatility and 40% of bond market volatility would work out to right around 90% of the total in stocks and 10% in bonds because stocks are so much more volatile than bonds.

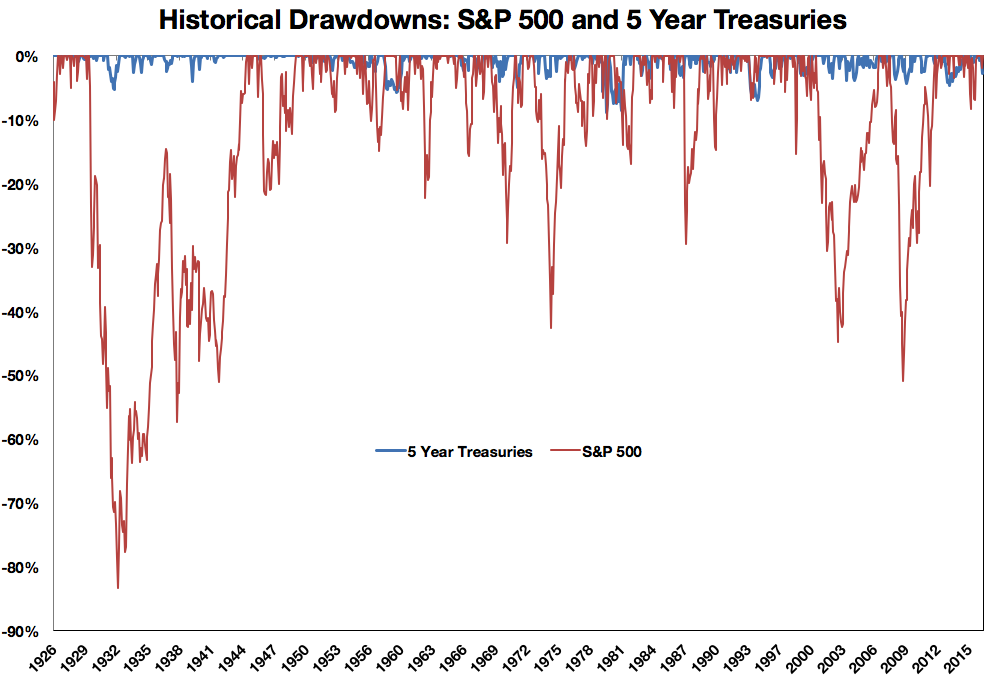

But I think this idea is bogged down in academic definitions of risk and misses the entire point of diversification. Take a look at the historical drawdown profiles for both stocks and bonds going back to the 1920s:

During the Great Depression, stocks fell nearly 90%. The worst drawdown for intermediate-term bonds was less than 9% over this entire period. You can barely see the bond market losses on this graph because they’re so tiny in comparison. So even though stocks tend to dominate risk measurement, bonds can still help with risk management, especially when you need it the most.

If you have 40% of your money in a relatively stable asset during stock market losses you don’t really have 90% of your portfolio exposed to risk. If we were to go by the simple 4% portfolio distribution rule, a 60/40 portfolio would have 10 years’ worth of current expenses that are not exposed to stocks.

There are many definitions of risk and no perfect way to gauge them precisely, but here are some important risk factors to consider along with how stocks and bonds fit into each:

Risk: Inflation. Your biggest risk as an investor is running out of money before you die and being forced to live on dog food for your remaining days. Over the past 90 years or so, stocks, bonds and cash have returned around 6.5%, 1.9% and 0.4% annually above the rate of inflation. Stocks are one of the few investments that have given investors a large premium over the growing standard of living over time. Higher inflation, not interest rates rising, is your biggest risk for bonds.

Risk: Recessions & bear markets. The majority of the stock market drawdowns in my chart from above occurred during recessionary periods in the economy. One of the reasons stocks can give investors such a large premium over inflation is because of these deep losses — that’s the compensation you receive for accepting risk. But investors need something to keep them sane, liquid and in the game during these severe losses. That’s what bonds are for — they act as a counterweight when stocks fall by providing dry powder to rebalance and stability for current spending needs.

Risk: Behavior. Volatility itself is not a good definition of risk because I see volatility as an opportunity. But volatility can be risky if you have the wrong reaction to it. Investing in bonds can act as a hedge against poor decision-making. It’s quite probable bonds will have lower returns going forward than they’ve had in the past, and they may even fall at the same time as stocks in the future, but they still serve a purpose in a well-diversified portfolio as long as they can keep you from making a huge mistake at the wrong time. Stocks can increase behavioral risk, but bonds can help reduce that risk when used correctly.

This is why asset allocation is so important for investors to understand — it’s how you balance out all of your assets, liabilities and risk factors.

I get the idea behind trying to quantify risk, but there’s never going to be a formula or measurement that can calculate all of your investment risks. And volatility is certainly not your true risk because variation in your return stream is not the only thing you should be worried about as an investor.

I don’t have a perfect definition of risk because I don’t think one exists. Your perception of risk will change over time and it will mean different things to different people at different times. Risk is also very personal and depends on the investor in question and their unique circumstances.

Further Reading:

Two Finance Phrases I Could Do Without

*******

A number of readers have asked for more print-friendly posts so if you look at the bottom right-hand side (just a few inches below this text) of every post there is now a little PDF icon that you can click on for a print-friendly version of every post.