Finance is a competitive industry so it’s not surprising that performance numbers are the main focal point. Advertisements always discuss a fund family’s best performing funds. The first thing anyone looks at in a pitch book is a fund’s performance track record. Annual return numbers are the currency in which most investment firms stake their livelihood.

There are pros and cons to this performance-first mindset, but I think it’s generally a damaging one for individual investors to focus exclusively on. Thinking of percentage returns at all times can be dangerous if you’re not framing them in terms of the actual dollar amounts at stake.

Performance has to be put into context in terms of where a portfolio resides in its lifecycle. A 50% drawdown is never easy to sit through, but losing half of your portfolio’s value means completely different things to someone with $10,000 in their account who’s just beginning their career versus someone with a million dollars who’s about to retire.

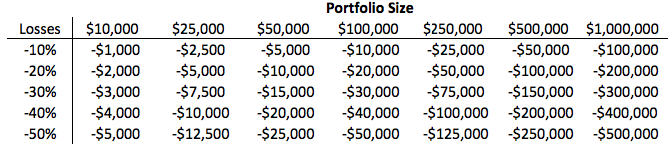

See this simple table that shows the dollar losses at various drawdown levels for different portfolio sizes:

The magnitude of both gains and losses has to be considered when making investment decisions because different emotional reactions can be triggered at various wealth points.

One of the most frequent questions I get from investors is ‘what should my asset allocation look like?’ While this question is impossible to answer without a deeper understanding of someone’s personal risk profile and time horizon, there are a few different exercises that can help investors narrow down where they should generally fall on the risk spectrum.

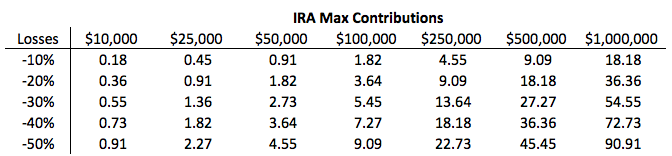

I like to think about losses in terms of a savings replacement rate. For example, assuming the same losses and portfolio sizes from the table above, here are the replacement rates for the maximum IRA contribution (currently $5,500 per year):

So if you were to contribute the maximum in a given year you would be making up for more than your entire loss if there was a 20% drawdown in your portfolio at the $25,000 starting point. Go out to $250,000 and a 20% drawdown requires just over nine years’ worth of max IRA contributions.

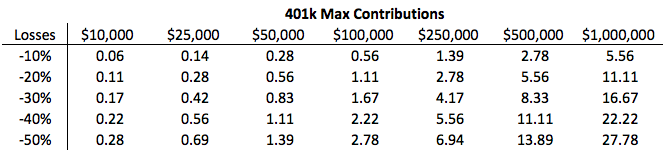

Here is the same idea using the maximum 401k contribution (currently $18,000 per year):

The max contribution makes up for an entire 30% loss at the $50,000 portfolio level. But go out to half a million dollars and it takes a few years to make up for a minor 10% correction. Obviously not everyone is able to save the maximum in their retirement accounts, but it’s something to shoot for.

The point here is not to say that you should automatically be taking loads of risk with small amounts of money or stop taking any risk at all once you grow your wealth. That’s far too generic of a conclusion when there are so many other variables to consider.

The point I am trying to make is that you can use this type of reasoning to put your gains and losses into perspective. How mature your portfolio and career are should be very important inputs in this process. If you’re young you have many, many years ahead of you to earn and save more money. Time is your greatest asset because you can allow your savings to continue to build, but also wait for the markets to come back when they do fall.

Someone who’s closer to retirement age will still likely have a number of years ahead of them, but they now have lower human capital in terms of future savings to make up for market losses.

People tend to underestimate the importance of saving when constructing an investment plan. Saving becomes even more important when markets fall. For anyone who saves and invests on a consistent basis, down markets can be a positive for two reasons:

- You get to buy more shares at lower valuations and higher yields.

- You get to take the sting out of some of those losses by replacing them with new money.

These are fairly simplistic observations, but most people tend to ignore the simple things that matter most when saving for retirement, so it’s worth revisiting from time to time.

(It’s also worth pointing out that the current ~12% drawdown in the S&P 500 is nothing compared to what investors should expect to see over their lifetime in the stock market. The 30-50% losses seen in many foreign markets are losses that every long-term investor needs to become comfortable dealing with in some way.)

Further Reading:

When Saving Trumps Investing

Thanks.Excellent article and excellent way of putting loses into perspective by projecting a portfolio into the future accounting for future inflows from your savings potential

Great Post. Couldn’t agree more – “Time is your greatest asset because you can allow your savings to continue to build, but also wait for the markets to come back when they do fall “.