A recent Fidelity poll of financial advisors found that their biggest worry right now is rising interest rates over all else. It’s ironic that so many people are worried about rising rates when all rates continue to do is fall. These advisors are not alone as many investors are worried about the future prospects for diversified stock and bond portfolios from today’s levels.

The 60/40 portfolio – the industry’s benchmark portfolio for many – has been a topic of discussion as of late because of these concerns. Tadas over at Abnormal Returns did a nice job summarizing some of the current thinking from many different sources on the 60/40 portfolio.

One of the challenges pointed out by many is the fact that the 60/40 portfolio has been juiced over the past 30+ years by the seemingly never-ending bond bull market. The worry is that bond returns will be muted from here, whether rates rise or not, based on the current low interest rates.

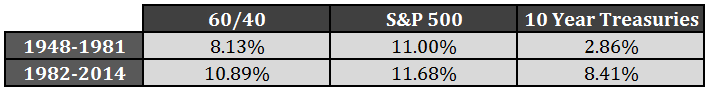

I decided to run some numbers to show the effects on performance from the massive bond bull. I’ve broken up the annual returns for a 60/40 portfolio made up of the S&P 500 and 10-year treasuries by two very different periods. From 1948-1981, interest rates were rising from very low levels. The 10-year yield was 2.4% at the start of 1948 and didn’t stay above 4.0% until 1963, 15 years later. The second period from 1982-2014 is the falling rate environment everyone is now well aware of.

Here are the annual returns:

You can see that the annual returns were nearly 3% higher over the past 33 years than the prior 34 years. The volatility over these two time frames was nearly identical – 10.5% from 1948-1981 and 10.6% from 1982-2014. So the rising rate environment didn’t have much of an effect on portfolio volatility. It’s quite obvious that the 5.5% difference in 10 year treasury returns is the reason for the difference in returns considering the S&P 500 had fairly similar performance over both periods.

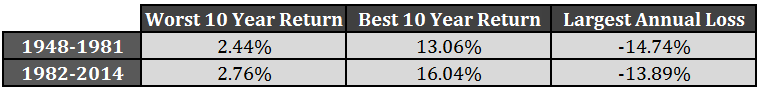

Now take a look at the range in returns for the 60/40 portfolio over 10 year periods along with the largest annual losses:

Again, not much of a difference between the rising and falling rate environments in these returns. What’s interesting to note is that the worst 10 year returns for both periods came right after huge bear markets in stocks – 1974 in the first instance and 2008 in the second one. And this is the reason that bonds are not the biggest risk to a 60/40 portfolio. It’s always going to be stocks that carry the largest risks for investors.

Even with low yields and rising interest rates, bonds still tend to do their job by dampening volatility and minimizing losses for the overall portfolio. The biggest reason for lower 60/40 portfolio returns from here would likely be a combination of lower stock and bond returns. There’s certainly a high probability that future stock market returns will be lower than the annual 11% or so that has been seen since the late-1940s.

Make no mistake, in a 60/40 portfolio, stocks will always be your biggest risk in terms of losses and volatility in the short-run. If you’re looking for that kind of protection, bonds should still do their job more times than not. Long bonds will end up being a very volatile investment at some point once rates or inflation rise from current levels, but intermediate-term bonds should continue to dampen stock market volatility.

Rates rose very slowly in the last cycle, so it’s quite possible we will see a much faster re-pricing of interest rates when they do finally rise considering the speed of markets is now much faster than it was in the past. But once rates rise it will also mean a higher yield for investors as well.

The problem is that most investors think in terms of individual securities, funds or asset classes as opposed to considering how something will impact their overall portfolio. Thinking in terms of different buckets can be helpful from a liability perspective, but you always have to consider risk in terms of the total portfolio first and foremost.

It might sound clever to abandon aspects of a diversified portfolio at times when you’re worried about rising interest rates, stock market valuations or geopolitical events. But diversified portfolios are created to balance out the many risks investors face over time. Lower your expectations for future returns, but don’t assume that you’re doomed forever because of low or rising interest rates.

Further Reading:

The Rick Ferri 60/40 Portfolio

Back-Testing the Tony Robbins All-Weather Portfolio

Looking Beyond Interest Rate Risk in Bonds

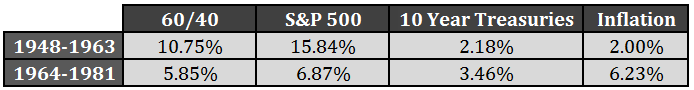

***Update: I was asked by a reader to break out the 1948-1981 period into two periods since interest rates really started to take off after 1963. Here it is along with the inflation rate (the real issue in the 1970s):

I saw a chart recently that showed volatility of the 60/40 portfolio at a 40-year low. No wonder the Robo-Advisors look good right now. At WealthQuant, we’re benchmarking against this portfolio, but it’s been challenging to beat on a risk-adjusted basis over the last couple of years. The good times will end only when they’re over, as the saying goes. Thanks for the consistently good articles.

Yes, in a beta-driven market that’s being led my large cap US stocks and long bonds, it’s a very tough environment to beat that 60/40 portfolio. Here’s something I wrote a few months ago that speaks to your point about the low levels of vol in the 60/40 portfolio:

https://awealthofcommonsense.com/great-volatility-unwind/

Obviously this can’t last forever. It should be interesting to see how investors react once volatility picks up once again (something that may already be happening).

True, it can’t last forever. The good work done over the last couple of years in the field of algorithmic tactical asset allocation strategies may start to pay off during the next economic regime shift. It’s nice to see a move beyond simple risk-parity approaches in recent white papers.

We believe one key moving forward is to bring these investing concepts to Millennials. If volatility picks up in the 60/40 portfolio, they won’t be too pleased when their investments in Robo-Advisors stock/bond templates head south, and many will be looking for alternative strategies.

How about us retirees with conservative portfolios, e.g., 60% bonds, 30% stocks, 10% cash, what kind of expected returns do you see during rising interest rates?

Good question. I actually have some numbers on this, but I can’t get to them until Monday (I willl circle back to you on this). But cash isn’t such a bad thing in a rising rate environment as the yield pick up rather quickly on money market accounts or you can roll some of that over into higher yielding short-term bonds. I’ll get those numbers to you on Monday.

Check this one out for more:

http://www.financial-planning.com/fp_issues/43_3/Bond-Analysis-last-six-decades-can-tell-advisors-about-future-2683414-1.html?zkPrintable=1&nopagination=1

Cash yields are much lower today than they were back then so it’s not exactly the same environment but if/when rates do eventually rise cash will actually be a decent holding.

[…] Rising interest rates and the risk of 60/40 portfolios. (awealthofcommonsense.com) […]

[…] … because 60/40 works, after all – A Wealth of Common Sense […]

[…] The Real Risk to a 60/40 Portfolio by A Wealth of Common Sense […]

“Bond bull market.”

There simply has not been a bond bull market. Everybody has this wrong.

Over the long term the nominal return on a duration-managed bond portfolio (or bond index — the duration on those doesn’t change very much) converges on the starting yield. See: http://www.cfapubs.org/doi/abs/10.2469/faj.v70.n1.5

Real bond returns have been high over the past 30 years or so because nominal starting yields were high and inflation has fallen. NOT because yields have fallen.

Sure, just like the bursting of the bond “bubble” won’t look anything like a crash:

https://awealthofcommonsense.com/bursting-bond-bubble/

But you’re assuming that every investor has been holding the same bond since the early 1980s and not trading in and out of new issues or different duration holdings. Are you really saying that there’s been no price gains from falling rates? You have to look at things from a total return perspective.

Think about is this way. The yield on long-term US treasuries was 4.65% in January of 2005. Yet over that time the annual returns have been north of 8%. That means that returns are getting pulled forward.

[…] … as a result of 60/forty works, in any case – A Wealth of Common Sense […]

[…] Reading: What’s the Worst 10 Year Return From a 50/50 Stock/Bond Portfolio? The Real Risk to a 60/40 Portfolio An Alternative to the 60/40 […]

[…] Further Reading: The Real Risk to a 60/40 Portfolio […]