You can’t go a single day without seeing at least one news story about the Millennials. I’ve heard it all about my generation at this point — we don’t know how to invest; we aren’t buying homes or cars; we live in our parent’s basement; we have too much student loan debt; we aren’t getting married; we have no idea what our political beliefs are; and we’re lazy.

These are the overgeneralizations I see most often. Everyone’s trying to understand this generation and here’s why, from a recent Forbes cover story:

Millennials, roughly defined as young adults born after 1980, control maybe $2 trillion in liquid assets, Wealthfront says. By the end of the decade that number is expected to surge to $7 trillion. And that will get vastly bigger as Millennials enter their prime earning years and then a massive wealth transfer from their Boomer parents begins.

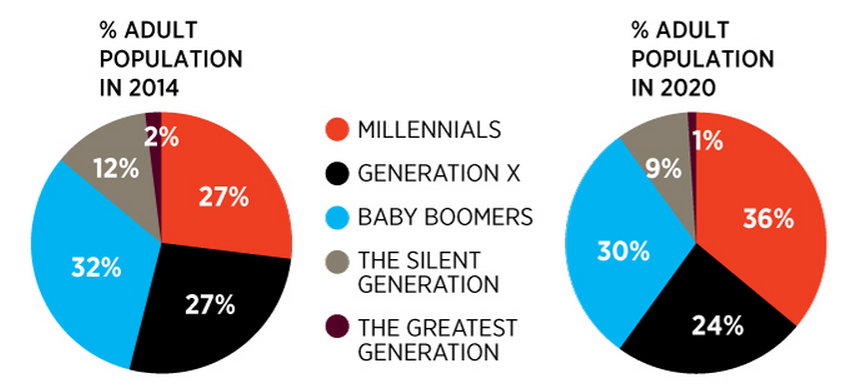

For the visual learners in the group, here’s the data that shows when the Millennials will over-take the Baby Boomers in the coming years as the largest U.S. demographic:

Here’s what Forbes had to say about Millennials and their lifestyle choices:

The Millennials, soon to be the largest adult generation, are finishing college in record numbers but are lagging in marriage, kids and moving into their own homes.

It’s also been pointed out by Zillow that the average age of first-time homebuyers is expected to rise from 31 to 34 in the coming years.

The consensus from many in the older generations has been to assume that Millennials have completely different buying habits than the Baby Boomers so they will never buy homes, get married or save for retirement.

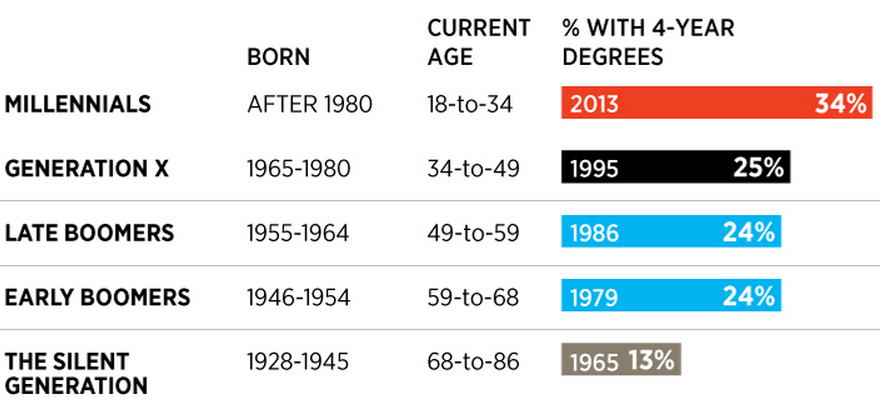

As with most problems, there is a very simple explanation for this phenomenon. It actually makes perfect sense that Millennials are making big life decisions later in life. Here’s another graph that explains it:

Of course my peers will be getting married and buying houses later in life. There are more of us going to college. Millennials aren’t getting married right out of high school, holding down a steady job and raising a family in their mid-20s like their parents and grandparents did.

This is purely anecdotal, but nearly every one of my friends from the Millennial generation put off getting married or buying a house for 5-10 years after college. Many moved to a big city or continued their education and got a graduate degree. They had fun for a few years before settling down. When that time came they all moved to the suburbs or another city with more affordable housing. Many of us are simply growing up a little later in the life cycle.

I have faith this will happen as Millennials continue to mature. It’s not if but when. It’s just going to be 5-10 years later than previous generations.

The people that say the U.S. is in a secular decline have completely missed this fact. As Michael Santoli pointed out this week, the generation that’s the most negative on the American dream is the Baby Boomers:

That’s an all-time high proportion of the population essentially saying the American dream is a long shot, and is up from 60% in 2007 and 63% in 2012 who were downbeat about opportunities for advancement.

Yet a peek at the breakdown of poll respondents, courtesy of Wall Street Journal researchers, shows that the increase in skepticism has been most stark among the older age groups now dominated by Baby Boomers, who are now between 50 and 68 years old.

This perception is largely based on the financial crash that’s still in the back of everyone’s mind. It’s easier to find like-minded people in the pessimism camp these days, but things will get better. Innovation in the coming years and decades is going to take many by surprise and the Millennials are usually the first adopters because we came up during a period of exponential technological growth.

Millennials are going to figure it out and start spending money…eventually. These things take time.

When that happens the economic ramifications could be enormous for those businesses that get ahead of this trend and actually start helping my generation instead of assuming we’re a lost cause.

Sources:

The recession generation: How millennials are changing money management forever (Forbes)

Grumpy old Boomers are a big drag on America’s economic mood (Yahoo Finance)

[…] Don’t Sleep on the Millennials […]

Saddled with expensive student debt, many Gen Y’s move back home for a few years to get back on their feet. That means they’re starting careers later, getting married later, buying homes later, starting to save for retirement later. But we’re also living longer and likely working past 65, so that’s not entirely a bad thing.

A professor at the University I work at did a study that refuted the belief that there was/is a labour shortage due to the baby boomer effect. She concluded that Gen Y was more than capable of filling the gaps. I wonder what that means for the potential retirement crisis with regards to social security/old age security? Does this mean we’ll have enough workers to support and pay into the system after all?

Good point about living longer. Maybe it makes sense to prolong staying out of the real world for longer.

[…] Millennials Will Be Fine […]

[…] that a lot of time and effort went into this book. I think one of the biggest struggles for the soon-to-be biggest demographic in the U.S. is trying to find a balance between ambition and principles. Most Millennials want to […]

[…] so we’ve been told. In an article by Ben Carlson at awealthofcommonsence.com, he explains that we have the same habits as our parents and grandparents. It’s just that we […]

[…] Further Reading: Don’t Sleep on the Millennials […]