“When clients pay attention to noise, we call it dumb. When advisors do it, we call it research.” – Carl Richards

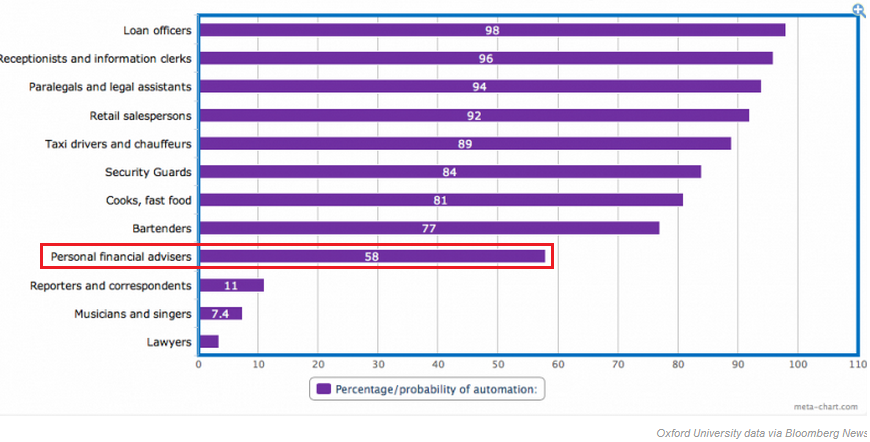

Business Insider ran the following graph with data from a recent Oxford University study on the jobs that are most at risk of being replaced by robots in the future:

I’ve highlighted 8th occupation on the list, which happens to be personal financial advisors. I’m sure this has something to do with the fact that robo-advisors such as Wealthfront, Betterment and Wisebanyan have been getting plenty of attention lately for their automated portfolio solutions.

I have a hard time believing that 60% of the industry will be automated within the next couple of decades, but I do think robo-advisors will put a dent in the traditional advisor model or at the very least make it easier to get portfolio management advice for those with smaller nest eggs.

There are plenty of financial advisors out there with a sole focus on gathering assets to increase their management fees. These are the advisors could and should be in jeopardy of losing business.

It’s not enough to meet once a year with your clients and send a 200 page quarterly market update full of nonsense. You have to actually add value to the advisor-client relationship. I could give you a list of investment guidelines I think are important, but many times it’s the intangibles that really set apart the best advisors.

So here are the non-portfolio management/tax/estate planning ways I think financial advisors can add value to their clients to ward off the machines:

(1) Setting realistic expectations for risks and returns.

Many insurance agents also moonlight as financial advisors (not that there’s anything wrong with that if they know what they’re doing). I had a meeting with my life insurance agent a couple of weeks ago and he was grilling me about my thoughts on the markets for that side of his business. What do you think about high yield? How about European stocks? You think biotech has more room to run?

He said the main worry from his clients is that stocks and bonds are both set up for subpar returns, so he was at a loss for what to tell them. My advice to this guy was to set reasonable expectations up front with his clients. The constant drumbeat of ‘what-ifs’ from clients can be counterproductive for everyone involved if you don’t set clear guidelines from the start.

Educating your clients on the past, present and future risk and return characteristics of their portfolio investments is extremely important. An advisor can’t predict the future, but they can lay out scenarios to prepare clients for different possibilities.

(2) Clear client communication.

Along those same lines, clear and concise communication with clients is also a key attribute of a successful advisor. I’ve seen marketing materials and quarterly reviews from advisors that could pass as phone books. They try to fit every piece of market analysis, graph and macro commentary they can find to prove they’re working hard. Yet 99% of their clients couldn’t care less about most of this stuff and never even bother to look at it.

A simple letter of no more than 2 or 3 pages should suffice: Here’s what the market did. Here’s how your portfolio is positioned. Here are the risks we currently see. Here’s how your portfolio performed along with any relevant benchmarks. Here’s where you stand in relation to your financial and life goals.

There’s no need to show the correlations between soybeans futures and 5 year German bonds just to prove your analytical skills.

(3) Understanding your audience.

A solid understanding of your audience helps with the focus of your communication. My favorite Einstein quote says, “If you can’t explain it to a six-year-old, you don’t understand it yourself.” Buffett says he writes his shareholder letters with his sisters in mind who don’t know a lot about finance.

The simpler your message the better. No need to try to confuse your clients to show how intelligent you are. Make your deeper dive pieces available for those that would like that kind of stuff, but you don’t need to show how the sausage gets made with every correspondence.

Instead many try to go the other way by speaking in complexities to prove their worth and financial acumen. This leads to a huge disconnect between the clients and what you are trying to do for them. Assume that 95% of your audience doesn’t understand a great deal about the financial markets and go from there. It will save you from a lot of confusion.

(4) Here’s what you need to pay attention to. Here’s what you need to avoid.

Wading through the firehose of information and noise is one of the most important jobs of a financial advisor.

The media would have you believe that every single one of these issues is of the utmost importance to your portfolio every second of the day. A solid advisor should be able to tell their clients, “Here’s what you need to focus on. Forget about all of this other non-sense. Let’s pay attention to what’s within your control, mainly your time horizon and what this means for your needs from this portfolio.”

(5) Financial goals are really about your life, not your money.

Financial professionals follow the markets on a daily basis and it can be difficult to separate market dynamics from the fact that improving real people’s lives is the end goal. It’s not all about finding the best investment or market or piece of analysis. It’s about figuring out the best way to help your client achieve their goals with the help of their investments.

Source:

The 12 jobs most at risk of being replaced by robots (Business Insider)

[…] Fend off the Robots […]

[…] Five things human advisors can do that robo-advisors can’t do. (A Wealth of Common Sense) […]

[…] Five things human advisors can do that robo-advisors can’t do. (A Wealth of Common Sense) […]

[…] be a successful investor. If this is the case, the other option would be to hire a trustworthy financial advisor that can handle the heavy lifting for you to free up your time and help you sleep at […]

[…] Financial advisors must be able to share their value-add with current and prospective clients. This will be more important than ever going forward as robo-advisors continue to gain market share and offer automated portfolio construction (see How Financial Advisors Can Fend Off the Robots). […]

[…] How financial advisors can fend off robots by A Wealth of Common Sense […]

[…] Reading: How financial advisors can fend off the robots Things just keep getting better and better for investors Portfolio management & decision […]