“Volatility can be a good thing for investors; be prepared to benefit from it. […] Political uncertainty – like any other form of uncertainty – can be your green light to move into a market.” – Mark Mobius

Emerging Markets have been getting all of the financial headlines lately. Currency issues and political instability have been hammering financial markets of the developing countries.

The Vanguard Emerging Markets ETF (VWO) is down nearly 10% this month after losing around 5% last year. From the high price in 2011, VWO is down nearly 25% with a handful of individual countries performing much worse.

These performance numbers look even worse on a relative basis when compared to buoyant U.S. markets over the past year and change.

Following the financial crisis many thought the U.S. economy would never grow again (I’m only half kidding) and plowed money in emerging market countries because “that’s where the growth is” without considering the actual investment merits.

Predictably, the recent losses have triggered huge withdrawals from emerging market mutual funds and ETFs. According to Business Insider, there have now been 13 straight weeks of outflows from EM funds.

At times like these I like to keep a clear head and view the markets through a historical lens. Each situation will be different but it helps to know how these markets have acted in the past.

Since the inception of the MSCI Emerging Markets Index in 1988 through the end of 2013, EM stocks have returned nearly 1,900% or roughly 12.1% per year. Compare that with the nearly 1,200% gain or 10.4% a year in the S&P 500.

Ten thousand bucks invested in the EM index grew to almost $196,000 while you got around $130,000 in the S&P 500.

Sounds great, but you have to be an extremely aggressive and patient investor to be able to stomach the ups and downs in emerging market stocks.

I’m not a huge fan of volatility (standard deviation) as a risk measure, but I think it helps drive home the point on the difference between developed and emerging stock markets.

The annualized standard deviation of emerging market stocks from 1988 to 2013 was over 35% or nearly double the 18% volatility seen in the S&P 500.

In laymen’s terms, that means investors experienced bigger gains and bigger losses.

For example, in the same 1988 to 2013 timeline, the EM index had six calendar years of performance in excess of 50% including four years of gains over 60%. The S&P 500 returned just under 38% in its best year.

There were also six times that EM stocks finished the year with a loss of more than 10% (including losses of -10.6%, -11.6%, -25.3%, -30.6%, -53.2% & -18.2%). The S&P 500 only finished the year with a double digit loss on three occasions.

Another fact to consider is that these markets are extremely cyclical.

Think of emerging market stocks like small caps. Historically they have outperformed, but they go through long periods of underperformance because the companies are not yet mature and investor appetites are always changing.

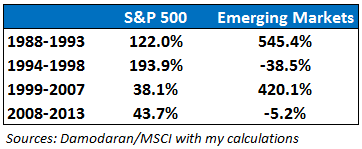

Take a look at this total return breakdown by four different periods:

There are clearly long stretches where one markets takes the lead. Then things get overheated and the baton get passed to the underperforming market.

Do you know what they call it when you have investments in your portfolio that act differently depending changes in economic activity, investor sentiment, trend and valuation?

Why it’s our old friend diversification!

This is how diversified portfolios are supposed to work. Some markets do better, some do worse and then mean reversion kicks in and they switch places.

A simple 75/25 mix of the S&P 500 and the EM Index would have earned you returns of 11.5% during this 26 year period with a standard deviation of less than 20%.

Of course, how much of your portfolio goes into EM stocks depends a great deal on your intestinal fortitude because it will be tested by the wild swings in price.

Emerging markets make up only about 8% of world stock market index funds and almost 15% of total international index funds, but account for around 40% of global GDP.

I would say a reasonable allocation would be in the 5-15% range. It really comes down to personal preference, risk tolerance and time horizon.

If you need to use the money within the next couple of years then emerging markets are far too risky because things could get worse before they get better.

Just don’t pay attention to the talking heads as they try to make sense of what’s happening in complex financial and economic markets that are still finding their way.

Emerging market stocks are cheap when compared to developed stocks in the U.S. and around the globe and they could definitely get cheaper. But investors who think in terms of decades have been rewarded by buying into markets that are beaten down and unloved with low valuations.

I wish I could tell you exactly when to buy into these stocks. In the absence of a crystal ball, my advice would be to dollar cost average or rebalance periodically over a set time frame.

It’s not a perfect plan, but it should serve you better than listening to the “experts” who will tell you to wait until things get better.

You could try to use your macroeconomic Ouija board to guess when things are going to turn around, but no one really knows.

Unfortunately, the coast in never clear when investing in risky assets. If you are a long-term investor you shouldn’t worry about perfect timing, only a consistent process.

I’m probably early here but they say value investing is when everyone agrees with you later.

Further Reading:

Why aren’t investors snapping up cheap, battered emerging markets? (Michael Santoli)

7 reasons to buy emerging market stocks (Brett Arends)

Now here’s the best stuff I’ve been reading this week:

- Why a stock market correction should make you happy (MarketWatch)

- How a simple asset allocation reduces portfolio volatility (Novice Investor)

- 5 ways your brain can sabotage your investing (Investor’s Business Daily)

- Don’t invest or think like a drug addict (Prag Cap)

- Average investors are far more boring than you think (Motley Fool)

- 5 tips for a better retirement savings plan (Passive Income Pursuit)

- How telling the truth makes you original (Above the Market)

- A simple asset allocation beats a complex one, as always (Turnkey Analyst)

- Where are they now? Mutual fund edition (Investor Solutions)

- How to stop being jealous (I Will Teach You to be Rich)

- 25 best sports movie villains. Who’s no. 1? Obviously, it’s Ivan Drago (SI.com)

- How Zappos’ CEO turned downtown Vegas into a start-up Fantasyland (Wired)

- Video: Barry Ritholtz destroys Peter Schiff on the Daily Show (Big Picture)

AWOCS,

Informative piece here. I’ve been looking at the VWO for my retirement accounts. This is helpful. I haven’t done enough research yet, but that table is really eye opening… maybe a little jaw dropping.

-RBD

Hard to believe when it seems like every market is so correlated these days. Those long periods of underperformance make it really difficult for investors to hang on though.

[…] Putting Emerging Market Stock Losses Into Perspective (WealthofCommonSense) […]

[…] goes wrong? (A Dash of Insight) • Putting Emerging Market Stock Losses Into Perspective (A Wealth of Common Sense) see also Dark Side of Capital in Emerging Markets (NY Times) • You’ll Never Grow Rich […]

[…] Putting emerging market losses into perspective. (A Wealth of Common Sense) […]

Hey Ben, this article really magnifies the volatility that investors in emerging markets face. How much of your portfolio have you allocated to EM funds? Personally, I’m tracking it a lot more closely now that it’s been “beaten down and unloved”.

Right, it can definitely be feast or famine investing in EM stocks. Many people jumped in without realizing that they can have large losses in addition to the large gains.

[…] Emerging Market stock losses in perspective (WealthOfCommonSense); see also, The scene is set for bargain-hunting in Emerging Markets, but there are reasons for […]

[…] emerging market to invest in and his top 3 emerging markets. Ben from A Wealth of Common Sense puts losses from emerging markets into perspective. His comparison between the returns of emerging markets to the S&P 500 over the last few […]

[…] Putting Emerging Market Stock Losses Into Perspective […]

Hi Ben. Thanks for the post. You might find this interesting. For each year in the 2003-2013 period, EM was either in the top quartile of asset class performance or in the bottom quartile. Never the middle 50%, so the volatility is truly astounding. Also, 2009 was the last year EM performed above its historical median (2003-2013). My latest blog post digs deeper into these observations. Thanks again, Dave.

That is interesting. I put up an asset allocation quilt a few weeks ago and noticed the highs and lows but didn’t realize EM stocks were never in the middle. Higher highs and lower lows indeed.

I think the nature of the growth in GDP has something to do with it and they get bid up way too high only to get hammered on any hint of weakness. And both ways it goes to far.

EM investments sure can be volatile but before you invest any money there you should be aware of that. Despite what 2013 in the US showed us, markets don’t go straight up. They wax and wane and move in cycles. If you’re going with a broad index approach, then just set an allocation you’re comfortable with and check up on it every now and then to see if you should rebalance. Investing isn’t difficult once you find a way to get yourself out of your own way.

And thanks for the link to my post.

[…] (AWealthOfCommonSense) […]

[…] Putting Emerging Market Stock Losses Into Perspective (A Wealth of Common Sense) […]

[…] Further Reading: The Truth about Stocks and the Economy Putting Emerging Markets Losses in Perspective […]

[…] Further Reading: Putting emerging market stock losses into perspective […]

[…] Putting Emerging Stock Market Losses in Perspective […]

[…] Reading: Putting Emerging Market Losses into Perspective The Best & Worst Part About Investing in Emerging […]

[…] Reading: Putting Emerging Market Stock Losses Into Perspective More of the Same in Emerging Markets How Diversification Smooths Investment […]