“The more you think you know, the more closed-minded you’ll be.” – Ray Dalio

Every week there seems to be at least one piece of news, economic data or important meeting that market participants think will determine the fate of the markets.

This week the Fed met to decide what to do about their bond buying program that has kept interest rates low for some time now. Most market handicappers assumed that the Fed would make the decision to slow or taper their bond purchases by about $10-15 billion a month (out of the $85 or so billion that they currently buy).

The thinking was that the Fed would buy fewer bonds, which would decrease the demand for bonds in the market place, thus leading a rise in interest rates as there would now be one less buyer in the market (and a huge buyer at that).

Most of the short-term traders sold their bonds and even bet against bonds assuming a further rise in rates which would hurt bond prices. Tons of investors jumped on this trade and were making bets based on their interest rate forecasts.

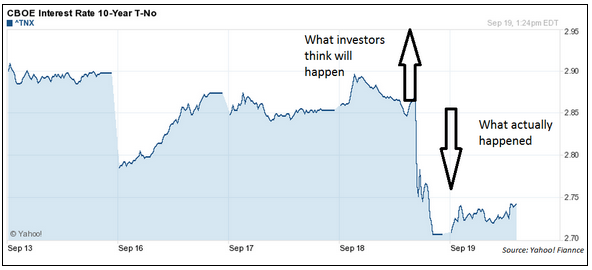

So what happened? Of course the Fed did the exact opposite of what everyone predicted and decided to keep their bond purchases at the same level. Here’s what happened to the 10 year treasury rate about 30 seconds after the fed announcement:

Rates immediately dropped as investors rushed in to buy bonds and cover their short bets. The interest rate dropped from about 2.87% to 2.71% in a heartbeat. That’s about a 6% drop in rates, which is pretty huge in the land of slow moving interest rates.

So what’s the lesson here? Well, it’s not to try to predict the moves of the Fed. Good luck with that. The lesson is that predicting complex financial markets in the short-term is nearly impossible. You could do it a couple of times and get lucky, but over time Mr. Market will take your money if you try to do this on a consistent basis.

This is especially true of interest rates with all of the complex moving parts that determine their fate.

Are rates at or near historic lows? Yes.

Do I think they will rise eventually? That’s almost a certainty.

Do I know when that will happen? Not a clue.

That’s the point. You don’t have any idea when this will happen so trying to predict rate movements over the short or even intermediate term is a game you can’t win and shouldn’t even try to play.

You can use risk management techniques like keeping your bond investments in shorter duration maturities to lower your chances of big losses if rates do rise. And you can take advantage of the low rates by refinancing or consolidating high interest rate debt to make good use of the low rates while they are here.

Those are ways you can improve your likelihood of financial success without trying to day trade interest rates in a game of chicken with the Federal Reserve.

It would be great if you knew what was going to happen with rates to try to protect your portfolio and also make some money. In the absence of a crystal ball, common sense and good judgment will have to do.

Source:

Yahoo! Finance

[widgets_on_pages]