Some random thoughts and observations on a wild week in the markets:

1. These are the types of environments where outcomes tend to trump process. It’s much easier to preach process over outcomes when markets are calm or things are going your way. When things go haywire as they did this week, everyone pays more attention to the short-term market outcomes. That doesn’t mean everyone abandons their investment process, but the temptation to make your decisions based on the most current market outcomes becomes much harder to resist.

2. Huge market swings can lead you to believe that you’re right just because the current market direction agrees with you. As stocks were getting slaughtered on Monday and Tuesday a number of commentators and pundits were quick to proclaim that this was finally a sign that the Fed’s policies had caused so much damage in the markets that the whole thing was a house of cards that was finally collapsing in on itself. That lasted until markets rallied on Wednesday and Thursday when everyone on the other side used the rally to suggest that everything was perfectly fine.

It always feels great when the market seemingly agrees with your stance, but in this case both the bulls and the bears are probably suffering from a heavy dose of confirmation bias. The fate of the world’s financial markets aren’t decided in a couple days’ worth of gains or losses. There’s no sudden death, winner take all here. Markets are so noisy over short time frames that trying to discern any reasonable conclusions based on how they’re acting is nearly impossible.

3. Investors have their finger on the trigger. When markets take a dive everyone quickly looks to assign a catalyst. Slowing growth in China and increased uncertainty were the usual suspects this time around. Markets are always uncertain and the China slowdown isn’t exactly breaking news at this point. There’s no way to know for sure what caused this latest downturn, but my best guess is that investors were simply looking for a reason to sell after a six years of large gains.

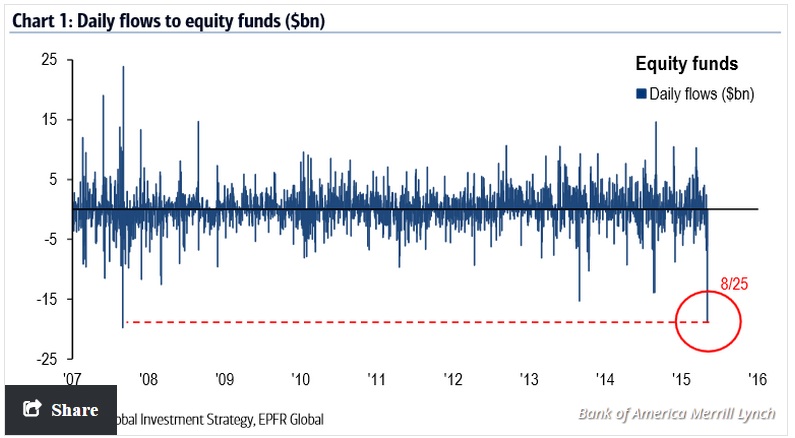

See the enormous equity fund outflows in this chart from Bank of America (via Victor Reklaitis at MarketWatch):

Markets were down leading up to the start of last week. People looked around Monday and Tuesday and noticed panic in the markets for the first time in a while and decided to join in on the fun. It was the largest weekly outflow from stock funds since they started tracking this data back in 2002. I have nothing to back up my hypothesis here other than the fact that humans have a tendency to exhibit the herd mentality during a panic. That doesn’t make for a great narrative, but the narratives rarely tell the entire story.

4. Big market moves make it that much harder to ignore the anchoring bias. When I witness the types of historic two or three day crashes and rallies like the ones we just went through I find it very difficult to avoid the anchoring bias. It becomes difficult to ignore the high and low prices points in the overall market, individual stocks or ETFs. The following thought process is easy to latch onto:

Can you imagine if you would have sold at the highs on Friday before things fell apart on Monday and then bought back in at the lows near the end of the day Tuesday just before the huge rally on Wednesday and Thursday?

I’ve always looked at volatility as an opportunity and not something investors should be afraid of. But I think that second-guessing yourself about what you wish you would have done (or not done) can be a slippery slope. It always looks much easier after the fact.

5. The quick, V-shaped recoveries are going to lead to complacency at some point. Many smart commentators have warned about the potential for a Minsky moment these past few years. The worry is that stability eventually lead to instability as complacency sets in during calm markets and investors begin to become lax on their risk controls.

While we finally got the long-awaited double digit correction in stocks, at some point they’re not going to snap back quite so fast. After being down around 5.3% on Monday and Tuesday, the S&P 500 actually finished the week up almost 1%. It’s always nice to see such a short window of pain as a stock investor, but it’s not something that we should expect to happen every single time the markets stumble. You can’t always plan on the stock market bailing you out so quickly.

Source:

‘Total Risk Surrender:’ Record $29.5 billion yanked from stock funds (MarketWatch)

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Your point on anchoring (registers with me!) raises what is essentially an existential question, “What is price?” (More importantly, what is the right price to buy?)

IMHO, this conversation eventually ends with Ben Graham and Buffett…and that’s where it gets truly interesting, how expensive things are in modern markets relative to Graham’s criteria back near the deepest throes of the depression.

But waiting for those price levels -which even at the end of his life, he didn’t think anyone was likely to see – requires patience of a sort I (and most people) simply may not possess.

So I guess we’re left with Buffett’s “a great company at a good* price.”

*whatever “good” means…

Yup, it’s never easy. And the patience piece is much harder today because we’re constantly bombarded with the latest prices, products and commentary. People say to ignore the noise but it’s basically impossible. You have to learn to deal with the noise, not ignore it.

Gray, I’m a few chapters into Graham, anything supplemental that mixes well with it?

Ben – Your perspective is always such “Common Sense”….

As Always, thanks!

3. Investors have their finger on the trigger.

Have to disagree with this one for two reasons.

Yes, the panicked outflows were there, but exactly who were the “investors”? Since the vast majority of public market shares are held by institutions and the wealthy, it sure as heck wasn’t Joe Sixpack trying to push through his sell order on his Tuesday lunch break. So most likely the herd consisted of panicked equity fund advisors and managers. I’m sure there is data somewhere to show who did what.

Secondly, there are no “Sell Only” trades. For every share sold in panic, that same share was bought in greed (as the chart shows, bought mostly outside of funds). Again, the buyer most likely wasn’t Joe Sixpack in his cubicle on Monday morning, it was smart financial professionals like Cullen Roche/Orcam (and yourself?). Any data/inflow charts to show just where the outflow went? Cash? Bonds? Gold?

Main St. investors might have itchy trigger fingers, but their spud guns aren’t capable of causing that kind of damage.

What is the split between “Main Street/Joe Sixpack” and Advisors/Managers?

There is a distinction between investor — those who provide capital — and manager/advisor. To be a manager does not automatically make one an investor.

There are ~90 million retail investors in the U.S.; there are ~18,000 funds and ~285,000 financial advisors. Funds of all types and investment firms manage possibly up to 75% of retail capital. That means when there are weeks like last week, there are ~300,000 non-investors whose actions have the most effect in the market and for actual investors. Yeah, it might be semantics, but clarity and precision should be a priority in the financial sector.

Would be interesting to get data on how much personal skin fund managers and financial advisors have in the game.

In his book Money, Tony Robbins wrote that nearly half of all fund managers don’t own any shares in the funds they manager.

Thanks for the figures.

That’s crazy, isn’t it? It’s amazing more of these PMs don’t invest in their own funds.

Yeah, but I never know where to draw the line. Employees are told not to keep all their retirement stock in the company they work for and PMs are somewhat the same. Then again, with no “skin in the game” it’s all upside for them.

I like the idea of eating your own cooking. Plus, most PMs who do tend to perform better:

http://www.morningstar.com/advisor/t/103820500/why-you-should-invest-with-managers-who-eat-their-own-cooking.htm

Thanks for those number. I need to lead a book club of Intelligent Investor on Tuesday. Know offhand how much capital the non-investors have?Also, good sources on why “Mr. Market can be bipolar” (J. Zweig). If institutions dominate the landscape, and employee the smartest people and best tools, how can the retail investor make money?

I’m sure there is some flaw in that logic, but don’t know where.

Maybe @disqus_YKbGADukKU:disqus can weigh in too.

Thanks.

I never said it was Joe Sixpack making the trades here. “Investors” paints a wide brush. Data here:

https://awealthofcommonsense.com/stop-blaming-mom-pop-for-everything-bad-that-happens-in-the-markets/

Thanks for the article! Is the “Daily Flows to equity funds” both mutual funds and ETFs?

That’s a great question. I was wondering that myself. Not sure but I’ll see if I can track down the report to check on their methodology.

Great, keep me posted! Thanks!

[…] https://awealthofcommonsense.com/some-thoughts-on-the-wild-week-that-was/ […]