“Doc Brown was the brains of the operation, but Marty McFly would have done better on CNBC.” – Jeff Macke

In Clash of the Financial Pundits, Jeff Macke asks CNBC contributor Karen Finerman if most people are better off not watching financial television every day. Here was her response:

You’re maybe better off – not maybe; likely you’re better off not seeing it. How can it matter every day, all the time, everything, every piece of information? Just by definition every single thing can’t be that weighty.

I love her honesty, but many investors fail to understand the difference between information gathering and useful advice for your specific time horizon and personal circumstances.

Using the shows on CNBC, Bloomberg or Fox Business News to make portfolio decisions is like betting on sports using the predictions from ESPN commentators. There are knowledgable people on these shows but they have their own biases and can’t predict the future any better than you can.

And the financial commentators have no idea what your money situation is. If you’re going to watch financial television you have to understand the difference between what’s actionable and what’s just entertainment.

While ignoring the noise in the financial media sounds good in theory, being totally ignorant to what’s going on around you can have its own side effects. Here’s what Clash authors Josh Brown and Jeff Macke had to say on the subject:

A true media diet virtually assures an overreaction to market volatility and expert prognostication once the dieter returns to the flashing lights and headlines. And how well equipped can one be to cope with the stimuli—the blinding rays from a thousand Las Vegas billboards and the deafening roar of bells and whistles— after too much time spent in solitude?

Everyone has their own perspective. It really depends what works for your investment style. Although I do wish there were better options for long-term investors on the financial stations. The majority of the programming consists of short-term data and stock picking.

A study from the U.S. Bureau of Labor Statistics showed that the average American reads about 19 minutes a day, but watches almost 3 hours of television each day (apparently texting and social media don’t count as reading).

While I think everyone can benefit from reading more books, the odds are it will be much easier to reach many more people through a TV show.

I get a steady stream of email questions from readers and none of them are about economic data, quarterly earnings reports, mergers or stock picks. They’re mainly questions about asset allocation, financial advisors, dollar cost averaging versus lump sum investing, the differences between the various asset classes or the correct accounts to utilize.

The programming available today on the financial networks play up to the extremes. You have a few get-out-of-debt shows with Suzie Orman or Dave Ramsey types on one end of the spectrum or Mad Money stock picking with Jim Cramer on the other end.

There’s really no in-between for the investors that have their debt and savings under control but need help with portfolio management issues.

Stock picking is no longer a hobby for the average investor as it was in the 1990s. Passive investments have continued to gain market share within the industry. This group of investors will only increase in the future as automated investment platforms gain more prominence.

Vanguard alone has nearly $3 trillion in assets under management. Doesn’t this seem like an untapped audience for these networks that should at least garner some air time?

With that in mind, here’s my idea for a financial television show that will cater to the longer term investor:

- It would only be on once a week.

- Weekly guests would include the different ETF and mutual fund providers along with portfolio managers to explain their strategies and fund options.

- The audience could call/email/tweet their questions on the portfolio management process.

- There would also be a financial advisor segment to discuss how they run their client portfolios and any issues that seem to come up on a regular basis.

- Guests would get at least 15-20 minutes a piece instead of the 5 minute soundbites they get now so they could explain themselves and their positions in detail (other guests would include authors, bloggers, academic researchers and successful individual investors).

- Obviously, you would need many different voices to share their experiences and thoughts since there isn’t a single way of doing things.

- A focal point would be investor behavior and how human nature messes with our decision-making process. There is talk of the ‘dumb money’ from time to time on financial programs these days, but not much coverage gets paid to the long list of cognitive biases that seem to affect every investor, both professional and novice, in different ways.

In addition here are some of the main talking points that would be addressed on the show:

- Asset allocation

- Risk tolerance

- Diversification

- Retirement strategies

- Matching assets with liabilities

- The various investment philosophies and how they differ

- Financial market history

- Perspective on historical stock and bond market performance

- The benefits of tax sheltered accounts

- Investment book recommendations

- Investment costs, fees and expenses

- Common mistakes to avoid

- Defining your various time horizons

- Compound interest

- New products, services and technological advances within the industry

- Rebalancing your portfolio

- Explaining academic market research in layman’s terms

- A running scorecard of predictions from the most well-known pundits

- How to develop your emotional intelligence

- How to find and/or judge a trustworthy financial advisor

- Career advice

- What you need to pay attention to and what you can ignore

Would a show like this ever get put on the air? Probably not. At the end of the day these networks are businesses and it’s much easier to get eyeballs on the screen through entertainment than long-term investment advice.

I will be awaiting calls from producers at CNBC, Bloomberg and Fox Business.

It’s a good thing I’m patient because it could be a while.

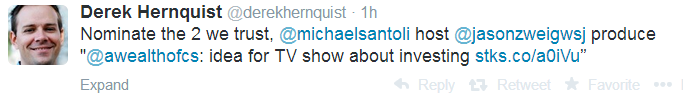

UPDATE: A great idea from Derek Hernquist…

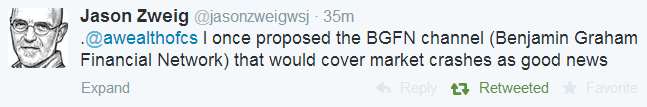

…with a great reply from Jason Zweig…

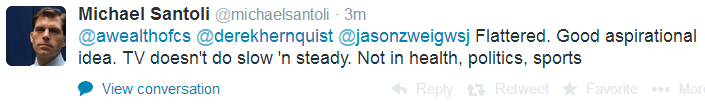

…and finally the reality from Michael Santoli…

That show does exist, starring consuelo mack

I’m a fan of that show and I really like Consuelo Mack, but I think maybe there are a few too many mutual fund managers on that show offering investment ideas. There’s a difference between investment ideas and portfolio management.

The show does exist. It is on National Public Radio. Though it may vary with your listening area. Good thing Al Gore invented the Internet.

http://www.bloomberg.com/news/2014-02-24/buffett-warns-of-liquidity-curse-celebrates-property-bet.html

[…] A New TV Show […]

Australia has a show called YOUR MONEY YOUR CALL. Ticks all the boxes you mentioned over 4 programs per week. Its really quite good.

Interesting. I’ll have to check it out and see if it’s on the web anywhere. So Australia has retirement savings and financial TV figured out. Nice, thanks.

[…] Ben Carlson’s idea for a better financial TV show (doesn’t he think I’ve pitched this already? It would be great – and no one would watch). (WealthOfCommonSense) […]

It was called Wall Street Week on PBS. They tinkered with it after Louis Ruckeyser was gone but it never came back from his loss. It was similar to your idea, which sadly we will not ever see.

I’ve read good things about WS Week. Too bad they couldn’t keep it going. I’ve gotten some interesting responses on this idea and your sentiment seems to be right on. Good idea but unfortunately unrealistic.

This show was called Wall Street Week with Louis Rukeyser.

[…] An idea for a weekly show about investing. (A Wealth of Common Sense) […]

[…] see also The Trouble With Shadowstats (Azizonomics) • My Idea for a TV Show About Investing (A Wealth of Common Sense) • FAIL: The IPO is dying. Marc Andreessen explains why. (Vox) but see So far, 2014 is setting […]

I agree that W$W w/Louis Rukeyser was as close this as anything on TV.

I also find it telling that it was on PBS.

[…] read consistently, A Wealth of Common Sense, recently featured on article on how to create a solid television show about investing. Here are Ben’s thoughts on his idea for a financial TV show that will cater to a long-term […]

[…] webcast with MarketWatch on long-term investing that was partly spurred on by a post I wrote about my idea for a TV show about investing. MarketsWatch’s Victor Reklaitis ran the show while I was joined by Tim Strauts from Morningstar […]

[…] Reading: Financial Advice For My Fellow Millennials My Idea For a TV Show About Investing Should Millennials Pay Off Student Loans or Save For […]

[…] Further Reading: My Idea for a TV Show About Investing […]