“We’ll begin with the obvious: about 80% of all mutual funds could shut their doors today and not be missed.” – David Snowball

According to Walter Bettinger, CEO of Charles Schwab, 84% of the $3.7 trillion invested in defined-contributions assets — 401(k)s, 403(b)s, etc. — are in actively managed funds.

I’m not surprised by many retirement statistics anymore, but this one was shocking to me. Everyone assumes that passive indexing is taking over the fund management business, but obviously someone is still buying actively managed funds. But it’s not that actively managed funds are inherently bad. They’re not. It’s that most of the active funds out there, especially those in workplace retirement plans, are high cost closet index funds. These are the funds that need to completely disappear from the industry.

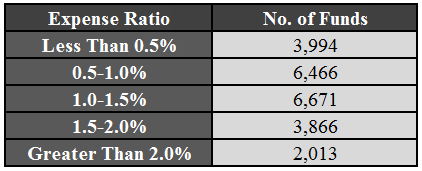

The Reuters mutual fund screener has over 23,000 mutual funds to choose from. I broke out all of these funds by cost:

Less than 20% of these funds offer expense ratios of less than 0.5%, but more than half charge 1% or more in expenses. More than a quarter of these funds still charge more than 1.5% and almost one in ten charges more than 2%. There’s no way that this many funds deserve to be charging this much for their services, especially when you look at the dreadful performance against simple index funds over time.

Here’s David Snowball in the latest Mutual Fund Observer with more:

We’ll begin with the obvious: about 80% of all mutual funds could shut their doors today and not be missed. If I had to describe them, I’d use words like

- Large

- Unimaginative

- Undistinguished

- Asset sponges

They thrive by never being bad enough to dump and so, year after year, their numbers swell. By one estimate, 30% of all mutual fund money is invested in closet index funds – nominally active funds whose strategy and portfolio is barely distinguishable from an index.

Passive investments now make up roughly 30% of all fund assets. So there is just as much money invested in overpriced closet index funds as there is in actual index products. It doesn’t have to be this way.

There are now plenty of active or quant-based ETFs that can be bought at a fraction of the cost of the active funds you will find in most 401(k) plans. It doesn’t have to be active funds versus index funds anymore. That whole debate should be going away as ETFs continue to build market share. It needs to be high cost versus low cost.

But as easy as it is to buy an ETF in an IRA or through a brokerage account, for most retirement savers, their defined contribution plan at work is the simplest way to save and invest. Money can be deducted straight from your paycheck. Many companies offer a matching program. You get a tax break up front. It’s just easier.

I can’t tell you the last time I heard something good about a 401(k) plan. I constantly hear horror stories from people about high-cost funds, terrible fund choices, a lack of basic education and overwhelmed and under-qualified people administering them on the company’s behalf.

The simple solution for the majority of defined contribution retirement plans is to offer robo-advisor portfolios as the default option. Robo-advisors aren’t perfect (what is?), but putting the average investor in an automated, low-cost portfolio is by far the best solution for the majority of retirement savers. Add in a feature that automatically increases the amount people save each year and have the robo-advisors help educate people on the benefits of an automated, disciplined retirement plan and now we’re talking.

The entire space is ripe for disruption. I really hope something like this happens.

Sources:

Inside Schwab (Barron’s)

Mutual Fund Observer

Further Reading:

Why Don’t Scary Retirement Stats Work?

99 Retirement Problems

[…] Fixing the 401K Plan […]

Then I guess I’ll shock you. I love my 401k choices.

Small, mid and large index choices. Stable value, bond and bond&mortgage.

Emerging markets and international developed countries.

And of course the 10 U.S. mutual fund choices which I ignore.

Small privately held German company located in the midwest. I guess I just got lucky.

That’s good to hear. Most of the worst plans are run by small businesses (mostly through no fault of their own — they just don’t have the know how to pick the right options for their employees and they are forced to pay huge fees).

As far as I can tell, the 401k plans for smaller employers are the last frontier for index funds. This is a segment of the industry that is dominated by relationships and broker/dealers and insurance agents. In addition, many fiduciaries at smaller companies have many other issues they deal with and if the employees are not complaining about the plan, nothing gets done. I am not exaggerating when I say I talk with plan sponsors regularly that have not bid their plan in 10 to 20 years. Or, their view of a review is to ask their current vendor if they have anything new to offer.

I would be curious to know how much of the 16% referenced at the top your piece which are in index funds are in insurance based plans, or wrapped plans, or plans with RIA fees that add another 1% or so to the cost of the index?

To be sure, there are good firms out there like Employee Fiduciary, On-Line 401k, Verisight and others that are making some inroads, and some smaller employers have begun to demand better products. But in my experience, it is still essentially a wasteland of unnecessary fees.

I have read many of the reports by journalist which talk about all of the high fees in these plans. I think easy investigative journalism would be for a reporter to simply start calling small firms and ask the fiduciaries basic questions like if they know their fees, how much their advisory firm makes, what share classes they use, the last time they bid their plan, etc… The responses would write the story.

[…] The 401(k) scene is ripe for disruption. (A Wealth of Common Sense) […]

[…] Ben’s piece Fixing the 401(k) […]

Linked back to this from your “Fireside” interview with Bason. Some robo advisers are beginning to make their way into 401k plans. Blooom is one that I am aware of and I am sure more will make it there as well.

There are two other changes that would be significant enhancements in addition to what you mentioned above:

1) Eliminate all revenue sharing. Time to get rid of this. It would promote clarity in plan fees for sponsors and participants and ultimately put downward pressure on fees.

2) Pay flat fees for advisory and record keeper. Far too many plans pay for support fees as a percentage of assets. This is unnecessary and ridiculously costly as plan assets grow. Most service providers should be able to price out their services on annualized flat fee. Mush of their service has nothing to do with the size of assets in the plan.

Great points and I agree on both fronts. The administration side of things should be made much easier for businesses, especially small businesses who are usually the ones paying much higher fees or not offering a plan at all.

I would love to see some technology disruption in these plans to make things easier on both investors and administrators.