“Risk, then, comes in two flavors: “shallow risk,” a loss of real capital that recovers relatively quickly, say within several years; and “deep risk,” a permanent loss of real capital.” – William Bernstein

It’s been a long time since the S&P 500 has experienced a double-digit loss. The last one ended in October of 2011, so we’re coming up on three years of relative calm in the markets.

Markets always seem easier with the benefit of hindsight, but there’s always an economic, market or geopolitical headline at the time that adds to the uncertainty. There have actually been a couple of double digit losses since the market bottomed out in early 2009:

Many thought the European Union was going under in the Summer of 2011. In 2010 we were treated to double-dip recession predictions at every turn.

Looking back at nearly 100 years of stock market data, stocks have averaged a 10% correction once a year and fallen at least 20% once every four years or so. But actual results are anything but average so setting your watch by the averages and waiting for them to happen right on schedule is impossible.

These types of large losses have been seen in all of the biggest bull markets in the S&P 500 since the 1920s.

(Sidenote: Some market purists may quibble with my definition of a bull market, but defining these periods is mainly semantics for finance people to debate. Also, this data uses closing levels in the S&P and doesn’t include intraday declines.)

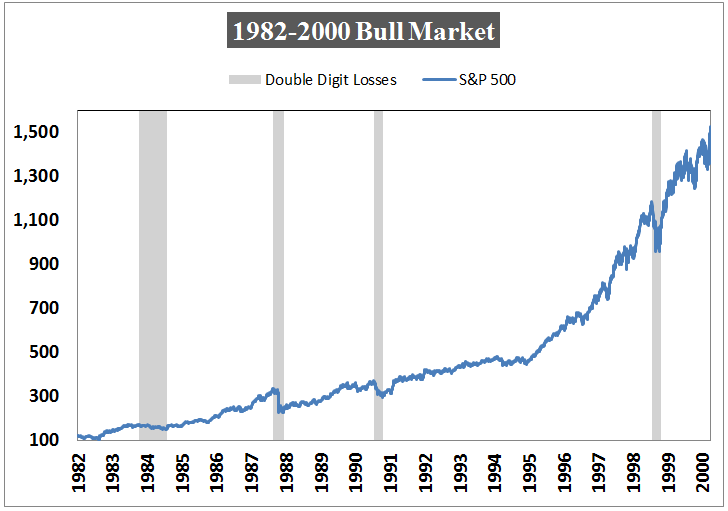

The 17-18% annual returns of the 1980s and 1990s were remarkable, but this period included a period with a double digit unemployment rate, two recessions, the Gulf War, the 1987 crash, Long-Term Capital Management’s blow-up and an emerging markets crisis among other things:

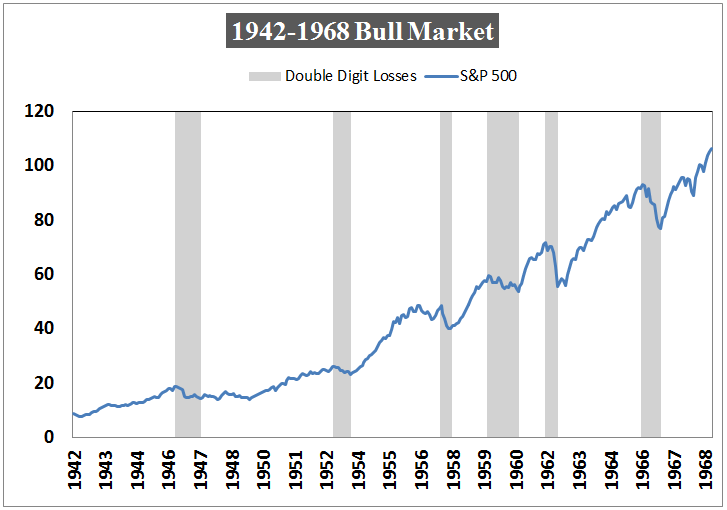

The bull market that started in the early 1940s began during WWII. It also included five recessions, the Korean War, the Vietnam War, the assassination of the president and a number of large losses along the way:

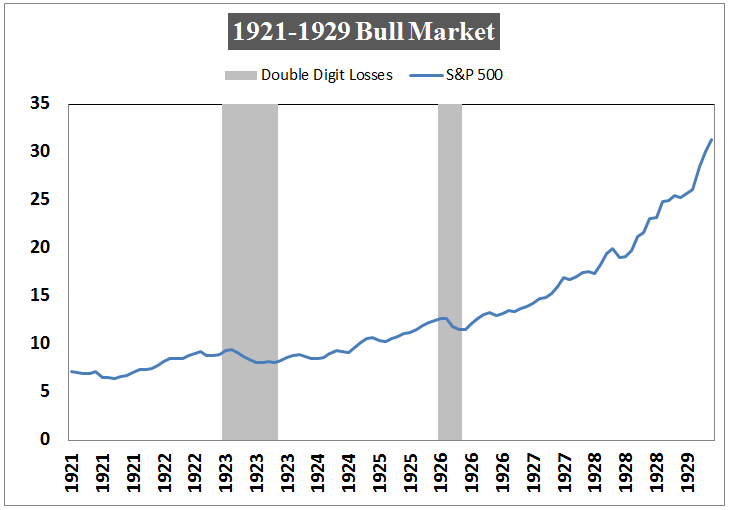

Even 1921-1929 bull market started in the midst of a depression (they used to happen more often than you’d think) and included two more run-of-the-mill recessions:

Plenty of pundits think we’re due for a healthy pullback or even an end to the current bull market. The problem is that healthy turns into scary pretty quickly for most investors when stocks do finally fall.

Investors must remember that losses come with the territory when investing in stocks. It’s always for a different reason, but even when things are rolling along nicely, markets do tend to take a breather on occasion.

As many have learned the hard way since the current rally began, guessing when or why these periodic losses will finally happen is nearly impossible.

[…] Bull Markets are Not Easy […]

[…] Don’t underestimate the anxiety that a bull market can engender. (A Wealth of Common Sense) […]

[…] at A Wealth Of Common Sense shows that even bull markets aren’t easy to navigate. Amidst double digit annual returns during lengthy bull runs is usually several double digit losses […]

[…] at A Wealth Of Common Sense shows that even bull markets aren’t easy to navigate. Amidst double digit annual returns during lengthy bull runs is usually several double digit losses […]

[…] 5 Things to Watch in Friday’s Jobs Report (WSJ) • Even bull markets aren’t easy (A Wealth of Common Sense) see also The stock market may be shrinking, but it’s not broken (Fortune) • Three […]

[…] 5 Things to Watch in Friday’s Jobs Report (WSJ) • Even bull markets aren’t easy (A Wealth of Common Sense) see also The stock market may be shrinking, but it’s not broken (Fortune) • Three […]

[…] Bonus Read: Even Bull Markets Aren’ t Easy by Ben Carlson via A Wealth Of Common Sense […]

[…] Bonus Read: Even Bull Markets Aren' t Easy by Ben Carlson via A Wealth Of Common Sense […]

No market is easy at all

[…] Bonus Read: Even Bull Markets Aren' t Easy by Ben Carlson via A Wealth Of Common Sense […]

[…] Bonus Read: Even Bull Markets Aren' t Easy by Ben Carlson via A Wealth Of Common Sense […]

[…] Bonus Read: Even Bull Markets Aren’ t Easy by Ben Carlson via A Wealth Of Common Sense […]

[…] markets happen in the best of times, but that’s not true, notes portfolio manager Ben Carlson. Writing on his blog, A Wealth of Common Sense, he notes that the market rise we’ve seen in recent years came despite lots of dire headlines. […]

[…] Bull markets are just as difficult as bear markets – especially if you have no plan. (WealthOfCommonSense) […]

[…] fearing that it’s only a matter of time. As reported by blogger Ben Carlson in his post, “Even Bull Markets Aren’t Easy,” during the past century, “stocks have averaged a 10% correction once a year and fallen at […]

[…] Even bull markets aren’t easy — A Wealth of Common Sense […]

[…] Further Reading: Even bull markets aren’t easy […]