I ran some numbers on Warren Buffett’s performance for a post this week (see Two Finance Phrases I Could Do Without) which led me to run some different calculations on Berkshire Hathaway’s returns over the years.

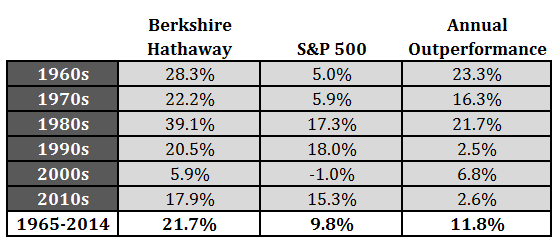

I have never seen Buffett’s performance broken out by decade. These are the annual returns against the S&P 500 starting in 1965 and going through 2014:

The two decades that really stand out to me are the 1970s and the 1980s. The 70s were a terrible decade for the financial markets, in general, as inflation destroyed the returns of both stocks and bonds. Didn’t matter — Buffett still compounded the company’s stock at double digit real returns.

His performance in the 1980s was even more impressive in my opinion because everyone looks at value investing as a style that outperforms during the downturns and tries to keep up during the upturns. Berkshire had 39% annual returns for over a decade! And this was on top of the nearly 25% annual returns already earned from 1965-1979.

At this point just about everything there is to say about Buffett has been said. Some people get rubbed the wrong way by Buffett because there are times when he plays the ‘do as I say not as I do’ card. Regardless of your feelings about the man’s actions or writings (I’ve always been a huge fan) there will never be another Warren Buffet. I will always marvel at his past performance. It’s truly amazing.

Further Reading:

My Favorite Warren Buffett Shareholder Letter

Although we like to use the S&P to compare performance against, one could argue that a large value index is a little more appropriate (though, of course, not the whole story) risk adjusted index with which to compare Buffet.

This article looks at the various factors involved with Buffets’ strategy, while pointing out that his genius was recognizing these factors before anyone else.

http://www.etf.com/sections/index-investor-corner/21477-swedroe-unpacking-warren-buffetts-genius.html?nopaging=1

Good point. I’ve read this analysis before. While I think it’s interesting I think it’s impossible to use factors to recreate something like Buffett created. It’s far too simplistic to me because it doesn’t take into account the timing of his purchases which makes a huge difference. But it is interesting.

I think it’s incredible that we would look his recent performance as “poor” even though most pms would love to have 2% alpha over a decade…

I agree. He’s still outperforming by over 250 basis points and that’s with a firm that’s over $300 billion in market cap. I think that’s almost more impressive.

I like your table.

If we sort-of average out the last two rows, I think we get a decent picture of where Berkshire is today, in terms of relative performance to the broad market.

By the end of the 90s, BRK was already so big that the ‘size anchor’ issue is not radically worse today than it was then. (I.e., it’s not as big a problem as people make it out to be.)

Since ’10, we’ve seen a completely unjustified broad-market rally that has brought most stocks to significant overvaluation, while BRK has only just begun to approach its fair value.

That’s distorted BRK’s real outperformance in the last five years to the downside, while the ‘oughts’ (’00-’10) probably gave a more accurate indication.

OTOH, BRK’s size problem is slightly worse now, and, obviously, BRK’s in transitions in lots of ways.

If you split the difference, and looked for something between the two levels of outperformance going forward, you’re probably in the right ballpark.

Most people seem to expect that BRK is now about as good as an index-fund.

They’re way off.

Warren and Charlie –overly conservative as always– suggest an expectation modestly better than that.

The most likely course is that BRK does a couple points better than they suggest –and what they suggest would probably be a couple points better than the market to start with.

Add it up, and you’ve got 3, or 4, or even 5 points of annual outperformance going forward,

The next 5, or 10, or 15 years will bring lousy returns for the broad market, as it readjusts from artificially overblown earnings, and overblown valuations.

BRK, even at its current humongous size, will continue to beat the pants off the S&P, defying the predictions of damn near everyone.

Interest rates will eventually return to something reasonably sane, which will remind folks of the value of a Hundred Billion in zero-cost float; the ‘New Guys’ will prove a lot better than most (even if they’re not as good as the ‘Old Guys’); distorted valuations will even themselves out; BRK will *continue* to find bargains no one else seems to find….

Broad Market will give, say, 4% for the next 10 years, while BRK yields 9%, or something like that,… and in ten years time, everyone’ll be asking –once again– “How the hell did they do that?”

Right, the level of outperformance will be muted going forward, but that doesn’t mean it has to go away entirely. Buffett himself has even said size is the enemy of outperformance.

I’m saying I think it not only won’t go away entirely, but will actually continue to be quite substantial.

The number you get for this decade (2.6%) is artificially depressed, I think, and the most likely number going forward, for, let’s say, the next ten years, is quite likely to be somewhat greater than that.

People currently referring to BRK as ‘the equal of an Index Fund’ will look awfully dumb ten years hence, when they look back and see that BRK has continued to crush the broad market.

And, again, I think size is less of a problem than people make it out.

Sure, it’ll prevent BRK from outperforming by 10 or points, as in earlier decades, but it *won’t* stop BRK from beating the market by 3 or 4 or 5,… and that’s GIGANTIC.

Thanks.

Gotcha. That makes sense to me. Also interesting to note that Buffett’s largest acquisition (Burlington Northern Santa Fe) turned out to be one of his best investments in recent years.

[…] Buffett’s performance by decade – A Wealth of Common Sense […]

[…] a Wealth of Common Sense, Warren Buffett’s performance by decade at BRK. I wonder, though, if his biggest problem is outperforming bull markets.. or is it the curse of […]

[…] Buffett’s efficiency by decade – A Wealth of Common Sense […]

[…] Reading: Buffett’s Performance By Decade What You Can’t Learn From Your […]