A few months ago I looked at what would happen if you only invested at market peaks over a long time frame. It turned out the results weren’t as bad as you would think.

Gaspar Fierro, a blogger at the Spanish website Rankia, decided to run the numbers on the opposite end of the spectrum – someone that only invested near the bottom of the market. Specifically he used MSCI data on a number different of stock markets from around the world going back to 1970.

This was a very long time horizon, roughly 44 years, but that’s about how long a baby boomer would have had if they retire in their mid-to-late 60s. Gaspar compared the difference between an investor that simply dollar cost averaged into the market to one that had the skill to be able to buy within 17% of the market bottom (under the assumption that it would be impossible to nail the exact bottom every time).

In between the market lows the hypothetical market timer would have held cash until the next buying opportunity.

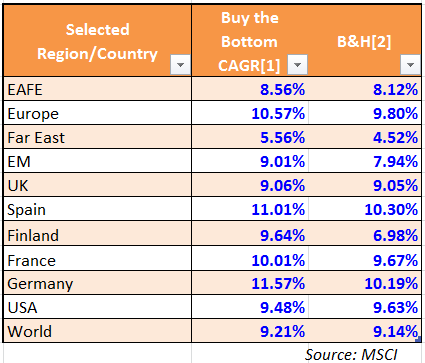

Here are his results from some of the larger markets:

You can see the numbers are all fairly close. Buying near the market bottoms yielded better results in most cases, but it wasn’t huge outperformance from the market timing strategy. Gaspar said he was surprised by these results (I was too):

I want to be honest with you, I did not expect these results. I had always thought that if someone was able to buy near lows continually, then that person would have spectacular returns that would beat almost any investment strategy.

If they work, market timing strategies tend to look better over shorter time frames. These performance numbers show that over longer time horizons just a simple strategy of being in the market can yield great returns. Plus, nailing the market timing calls every sinlge time would be impossible. This was Gaspar’s main takeaway:

The main difference between the two strategies is that the B&H is the easiest and feasible to replicate by any mere mortal, while the market timing strategy is quite difficult and unlikely.

Not many investors have the patience required to put their head down and hold on for dear life over the many ups and downs that come along in the market over multi-decade long holding periods.

But if you have a time horizon that extends beyond a few years, try to remember the power of long-term thinking when you would like to make a short-term tactical move that could potentially backfire on you.

Source:

El major inversor de la historia (Rankia)

[…] Buying Near Market Bottoms […]

That’s really surprising and I didn’t expect that at all. I guess the real advantage comes if you could hypothetically make the correct bottom and top call. Although that is even more unrealistic than just making the bottom call. This reinforces why I try to continually invest month after month.

I think the biggest benefit of a DCA approach is that it’s easier from a psychological perspective. It takes away the second guessing and stress of trying to time those purchases exactly.

This is an interesting and surprising finding. This also helps explain why rebalancing does not improve performance, since buying stocks when they are low does not result in the gains one might think would occur, versus buy and hold. This does not lessen the importance of rebalancing to keep asset allocation at desired levels, but it does further support that rebalancing more than once a year is an unnecessary complication. I support rebalancing only when asset allocation gets more than 5% from desired levels, which usually results in rebalancing even less frequently than once per year. This minimizes unneeded activity, trading costs, and taxes.

I think the dollar cost averaging in this buy and hold was something of a natural rebalancer because you’re buying more shares at low prices and less at high prices.

But I agree with you that there’s no need to over do it. Pick a deviation from target weights or a calendar date and stick to those rules to keep yourself honest.

very interesting and reassuring article

thanks for sharing.

Cannot believe picking bottoms gets you worse off than just a simple DCA strategy. I think it is possible to buy near the bottom, also the question is if you are buying only a bottom vs. a consistent investing (meaning waiting for a bottom, while a second investor investing regularly on a monthly basis for example). Then there may be huge differences. Really interesting finding.

I thought so too. I think it’s really the fact that this time frame was so long that just being in these markets over time meant your results would have been great.

A few authors suggest holding cash until a major correction occurs, or doubling-down by borrowing to invest when the market corrects by 20% or more. The problem, as you’ve identified, is the cost of being out of the market is sure to minimize the gains realized with this strategy. The other aspect is investor behavior: who has the fortitude to sit and wait for years during a bull market while everyone around them is making money, and then have the guts to go all in while everything is falling? It sounds great in hindsight, looking back to March 2009, but few remember what it felt like when the sky was falling in ’08.

Exactly. Investors usually say they will act a certain way when trouble hits but when things don’t go as scripted many tend to freak out and do exactly what they said they wouldn’t.

Also agree with you that the psychological demands of sitting in cash are huge. I’ve talked to plenty of investors that went to cash in the last few years and said they’d buy back in after a 10% crash. Guess what? We haven’t had one and each tick higher makes them more and more nervous. That’s when mistakes happen.

Thanks for writing the summary for your readers. The result isn’t too surprising – there is an opportunity cost to being out of the market and being in cash for so long. But if we relax the assumption that a market timer needs to sit in cash and can invest in other assets that are near their market bottoms at any particular time, the results may be better.

Even a relatively simple market timing mechanism that _has_ to sit in cash while waiting for the next signal outperforms the market on a risk-adjusted basis. That is, the returns aren’t very different, but the volatility is much lower.

For example, here’s a basic timing system using moving average crossovers. The result is not curve-fit; moving averages with other lengths perform similarly.

http://marketsci.wordpress.com/2010/06/30/trading-the-golden-cross/

This result is pretty consistent among market timing systems that switch between stocks and cash. The main benefit isn’t an increase in return, but a decrease in volatility. Of course, this can be converted into an increased return by using leverage, which is why timing systems have higher Sharpe ratios than buy-and-hold. These are the results if the only two choices are being in the market or sitting in cash – again, the results may be better if we relax that requirement.

It is also possible to increase return without lowering volatility by using a rotation system. The results are not curve-fit: all of the lookback horizons in the link below outperform the market.

http://gestaltu.com/2014/03/half-life-of-optimal-lookback-horizon.html

To be clear, I’m not advocating picking tops and bottoms, which is hard if not impossible to do, but instead using a quantitative system. Cliff Asness has written a pretty good paper about this here:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2435323

Having said all this, I agree that most people will do better with dollar cost averaging than trying to time the market. Doing it quantitatively requires research, time, discipline, probably more than most people are willing to put in. We need writers to encourage people to buy and hold (perhaps with an indexing methodology that is better that cap-weighting) as well as writers for the trader audience. Thanks for providing these helpful contributions!

[…] Carlson had an interesting post that looked at what would happen if investors only bought at market bottoms. The study compared the difference between an investor who simply dollar cost averaged into the […]

[…] For long term investors the attractions of market timing fades. (A Wealth of Common Sense) […]

How do dividends figure? It seems like buying during bottoms and then reinvesting all dividends would change results?

These are actually total return numbers. I actually think dividends are one of the big reasons why the DCA is so close. You’re compounding many more dividend pmts over time whereas the mkt timing strategy you don’t get as many reinvested dividends in your favor when you’re in cash.

I think that this has implications beyond just market timing. Recently a lot of people have become indignant about high frequency traders and people that may increase the price fractionally in the short run to make a profit. I’m certainly not saying its ethical, but over the long run, the buy-in price is irrelevant (hence the results of this study). All of the retail investors that claim that all retail investors are dramatically hurt by these trades don’t understand that if you are buy-and-hold, then small short term price movements right when you buy the stock don’t matter. If you buy a company at 21.50 or 21.51, even if you buy 100,000 shares, after long enough, a penny a share won’t matter.

Thank you for the post!