Yesterday I got an email from Marcus, my online savings account.

They lowered the interest rate on my savings (and everyone else’s) from 2.25% to 2.15%.

I heard stories from people who use other savings accounts that also saw a drop. These online savings accounts are obviously getting ahead of the possible Fed rate cut because these short-term interest rates typically track the Fed Funds Rate.

I put out the following on Twitter and got some interesting feedback:

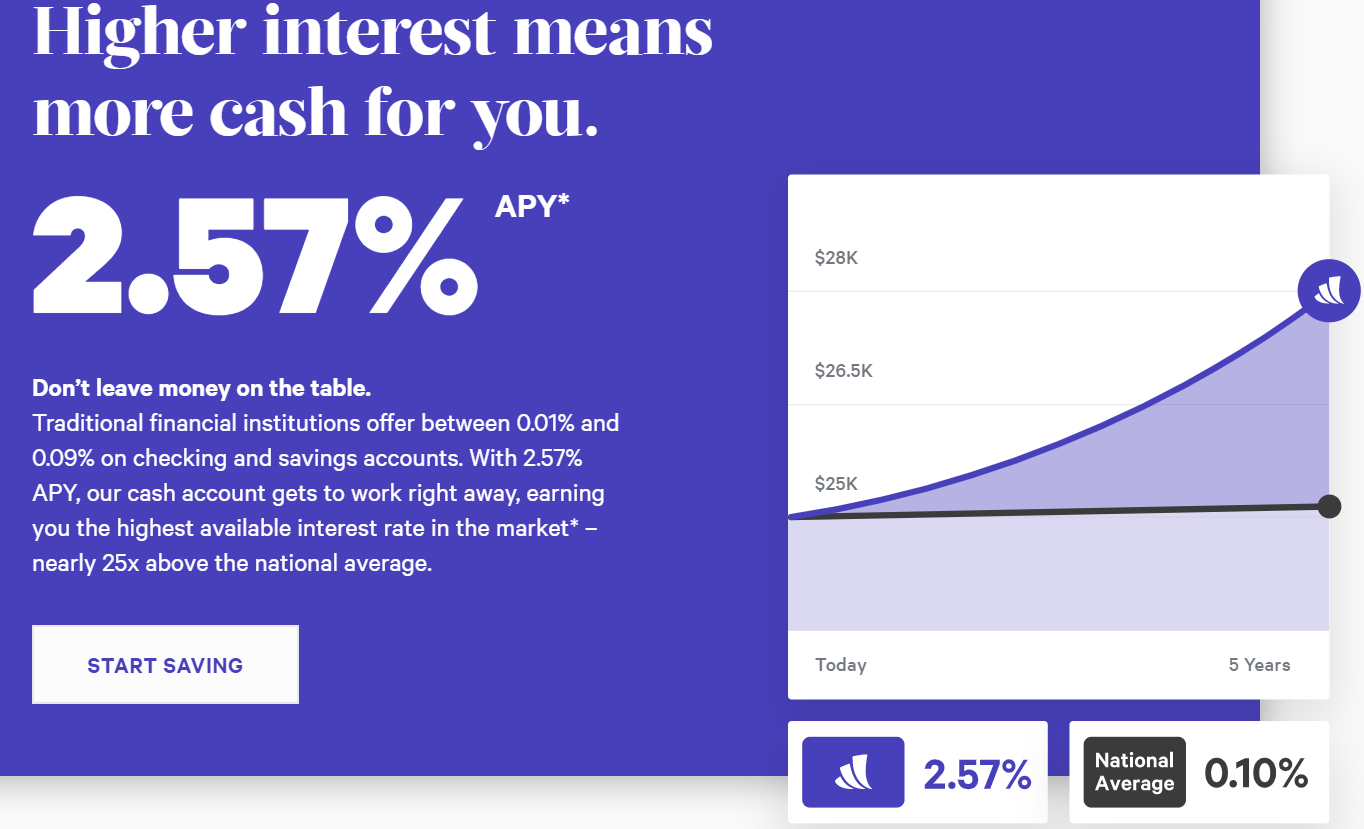

A few people told me to go to the new Wealthfront cash account because they’re actually raising their rates:

Here’s my theory on this: anytime a new online savings account comes out they invariably offer the highest rate on the market, because they know that’s the only way to stand out. The strategy here is the get new clients to sign up and once scale is reached, they cease to be the highest rate on the market anymore.

I know this happens because I’ve had accounts at companies that have done this in the past. I don’t blame them because the strategy obviously works.

Yield chasing in online savings accounts and CDs make it feel like you’re doing something to get ahead but I’m not a huge fan of rate chasing. These are the people who should be thinking about making a move:

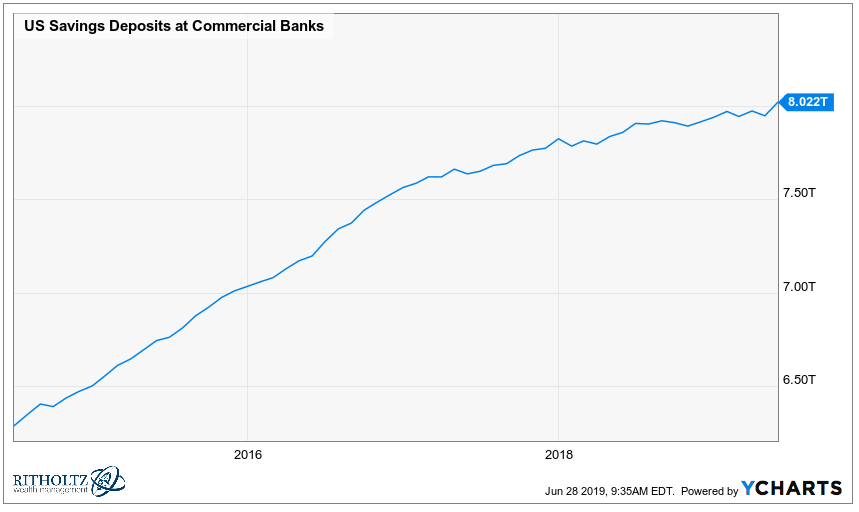

There is over $8 TRILLION sitting in savings accounts at banks that are earning an average yield of 0.10%, which is ludicrous. These people should move their money to an online savings account pronto.

But once you make the leap from the minuscule rates being offered at your brick and mortar bank, jumping around from savings account to savings account isn’t going to provide much bang for your buck.

Let’s say I could earn an extra quarter of a percent by moving my money to another online bank offering better rates. For every $10,000 that would net me a whopping $25 a year in additional interest.

Is it worth it to go through the account opening process, move my money and change my automated savings goals for a measly $25 extra bucks on every ten grand? Even going up half a percent gives you 5o bucks over the course of a year.

I get why people make these moves — it makes you feel like you have some control over your savings. But it just feels like there are far better uses of your time than constantly jumping from savings account to savings account simply to increase your yield by a handful of basis points.

And if the large rate differentials do persist over time that means you’re probably taking more risk with your short-term capital than you realize.

There are other areas of your finances you could be optimizing before trying to add value to a savings account once you’ve already done the heavy lifting.

Your biggest move is going from nothing to something. After you’ve reached something, it’s not that big of a deal to consistently make changes.

Further Reading:

Where to Find Yield on Your Savings

Now here’s what I’ve been reading lately:

- Being average in the age of alpha (Safal Niveshak)

- How Steph Curry became the greatest shooter on the planet (KC ROI)

- How a janitor at Frito-Lay invented Flamin’ Hot Cheetos (The Hustle)

- The unsatisfying certitude of uncertainty (Your Brain on Stocks)

- Aiming for a benchmark (Abnormal Returns)

- Fewer hassles mean greater happiness (Humble Dollar)