On this week’s Animal Spirits with Michael & Ben we discuss:

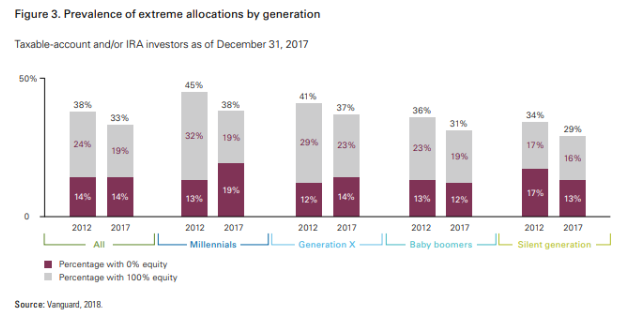

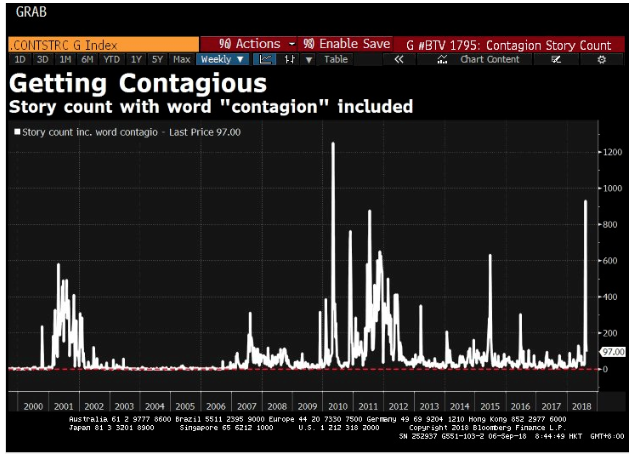

- The lingering impact from the financial crisis on investor risk appetite.

- How a financial crisis in your formative years can leave lasting scars.

- Every generation has their own ‘Death of Equities.’

- Even the Fed makes decisions based on pasts crises.

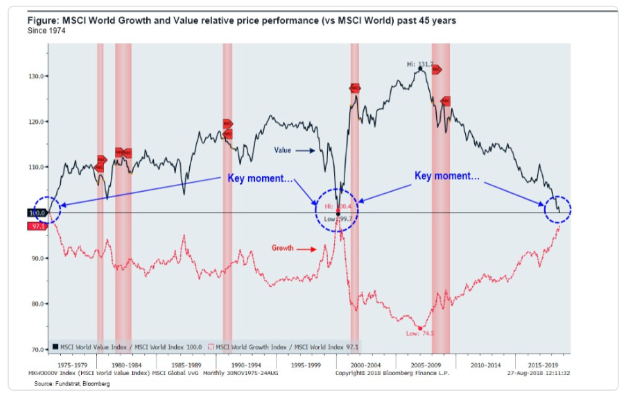

- Cliff Asness on how to think about performance struggles.

- Is there mean reversion in liquid alts?

- Are half of all young people deleting the Facebook app?

- Will half of all colleges be bankrupt in 10-15 years?

- How much money will you spend in retirement?

- Fake day trading guys concoct the worst Ponzi Scheme of all-time.

- Why do athletes keep hiring scumbag accountants?

- Can you use Google trends to invest?

- What if Goldman Sachs would’ve purchased iShares in 2009?

- Some follow-up thoughts on the FIRE movement and much more.

Listen here:

Stories mentioned:

- How the financial crisis still affects investors

- A death of equities redux

- Risk-taking across generations

- The man in charge of TARP

- Liquid alt Ragnarok?

- Life insurance is not for saving

- Facebook exodus

- Half of American colleges will go bankrupt in 10-15 years

- Watch what people do, not what they say

- How to think about healthcare costs in retirement

- Fake day trading platform nets fraud charges

- Oxycontin maker gets patent to treat opioid addiction

- Kevin Garnett sues accountant

- How banks lost the battle for power on Wall Street

Books mentioned:

Charts mentioned:

Tweetstorms mentioned:

@michaelbatnick @awealthofcs On the FIRE topic, know that journalists tend to focus on different things than the actual FIRE people do. I'm one of those, dropped job at 34 (married, two kids), not because I hated it, but because I like *even more* to own all of my time.

— Liberty 💚🥃 (@LibertyRPF) September 5, 2018

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: