There’s an old say that, “History doesn’t repeat itself but it does rhyme.”

This one is used quite often in the finance realm. But when it comes to financial news, this phrase needs to be reversed to, “Financial news doesn’t rhyme but it does repeat itself.”

The biggest reason for this is the fact that pundits and investment professionals alike have a hard time changing their mind. This issue has been on full display in recent years. For example, everyone wants to call the next stock market bubble following the meltdown we saw in 2008:

August 9, 2017: Is the stock market a bubble? (USA Today)

June 23, 2016: Uh-oh. Is the stock market in a bubble again? (CNN Money)

September 13, 2015: Fears grow over US stock market bubble (Financial Times)

May 6, 2014: Time to worry about stock market bubbles (New York Times)

December 2, 2013: Nobel prize winner warns of US stock market bubble (CNBC)

March 27, 2012: Robert Shiller eyes another tech bubble (Yahoo! Finance)

May 3, 2011: Why this stock market looks like the tech bubble of 2000 all over again (Business Insider)

January 11, 2010: US stocks surge back towards bubble territory (Business Insider)

On the flip side, apparently this has been the most hated bull market of all-time for a while now:

March 24, 2017: Stocks: Still the most hated bull of all-time? (Barron’s)

July 11, 2016: The most hated bull market keeps chugging along (Wall Street Journal)

December 16, 2013: Will the most hated bull market in history continue in 2014? (Thestreet.com)

July 9, 2013: Most hated bull market ever? Maybe it should be (CNBC)

August 17, 2012: The most hated bull market ever (Forbes)

Not to be outdone by stocks, there has also been chatter about a bubble in the bond market for years:

August 1, 2017: Alan Greenspan: The bubble is in bonds, not stocks (CNBC)

October 9, 2016: Is the bond market in a bubble? (Wall Street Journal)

August 13, 2015: Is the bond market in a bubble? (US News)

October 5, 2014: Bond market may be more fragile than you think (USA Today)

June 9, 2013: When the bond bubble finally bursts a lot of investors will get hurt (Telegraph)

February 24, 2012: Is the bond bubble about to pop? (MarketWatch)

April 4, 2011: Is the bond bubble finally bursting? (CBS)

June 4, 2010: Bonds: Avoid the next great bubble (CNN Money)

It’s also hard to forget the technology bubble in the late-1990s, so plenty of people have been on the lookout for the next tech bubble, as well:

August 5, 2017: When will the tech bubble burst? (New York Times)

May 2, 2016: This tech bubble is bursting (Wall Street Journal)

September 1, 2015: Is Silicon Valley in another tech bubble? (Vanity Fair)

May 8, 2014: Yes, we’re in a tech bubble. Here’s how I know it (Fortune)

December 16, 2013: Will 2014 be the year the tech bubble bursts? (Wired)

March 31, 2012: Are we in another tech bubble? (Business Insider)

February 19, 2011: Is this the start of a second dot-com bubble? (The Guardian)

And it’s not just bubble spotting that people predict on a regular basis. People are really hung up on trying to predict the death of things. The 60/40 portfolio apparently has nine lives:

June 29, 2017: The way Wall Street has taught you to invest for the past 60 years may be dead (CNBC)

June 14, 2016: The 60/40 portfolio is dead and it’s not coming back (Forbes)

November 9, 2015: The 60/40 stock-and-bond portfolio is dead in 2016 (USA Today)

November 16, 2014: Investment managers are ditching 60/40 portfolio in favor of more liquid alternatives (Investment News)

November 27, 2013: Investors sticking to the 60/40 portfolio rule are likely to get badly hurt (Business Insider)

May 17, 2012: Why a balanced portfolio may not work (MarketWatch)

Value investing is in the same boat. Value seems to die every 7 years or so:

September 24, 2017: Is value investing dead? It depends on how you measure it (WSJ)

September 22, 2016: Does recent underperformance mean value investing is dead? (State Street)

May 29, 2015: Is value investing dead? (Globe and Mail)

April 11, 2013: The death of value investing (Business Insider)

January 14, 2010: Is value investing dead? (Motley Fool)

And just for fun, here’s one of these I did before on the Fed:

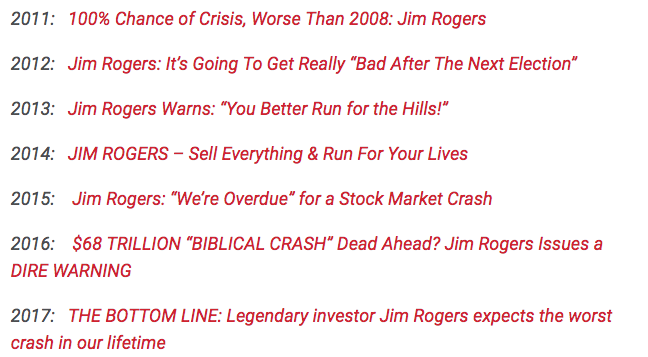

The Jim Rogers crash predictions one was a big hit too:

Maybe all of these things are true but they just haven’t happened yet. There are no counterfactuals in the markets. Stocks or bonds each could have gotten crushed in an alternate universe assuming a few things would have gone differently.

But it’s important for investors to remember that investing based on the headlines is a bad idea. The fact that we have access to more information than ever these days is a great thing, assuming you have the correct filters in place. Most people don’t, so they become consumed by every little snippet or viral headline they glance at.

One of these days one of these warnings will seem prescient. More likely than not, the next person or firm to “call” the next bubble or crash will be more lucky than good.

Further Reading:

How to Read Financial News Headlines