The Wall Street Journal has a useful interactive tool that can show investors how sensitive their government bond holdings are to changes in interest rates.

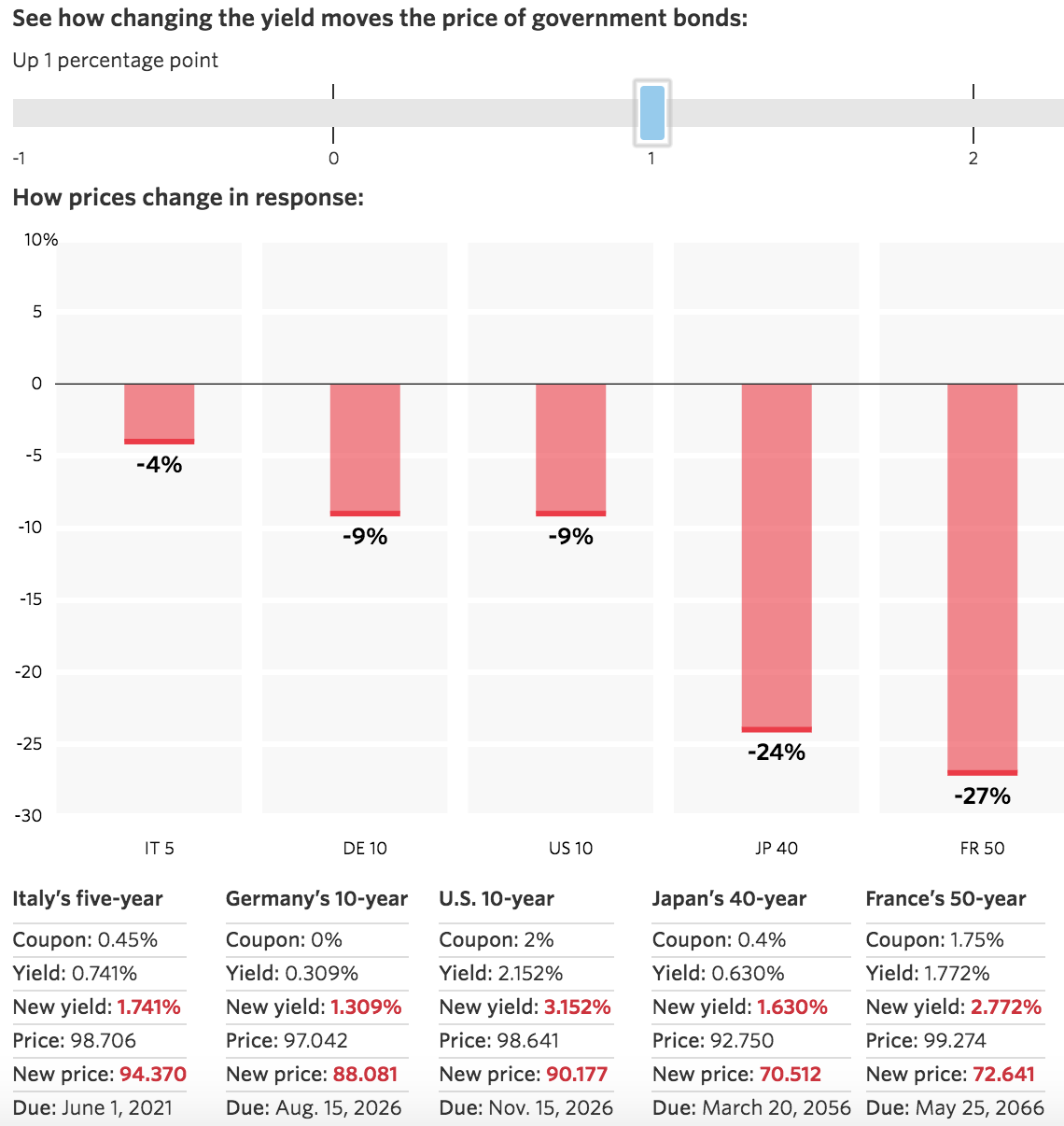

For example, here’s what things would look like if rates rose 1% from current levels on a number of different sovereign bonds at different maturity levels:

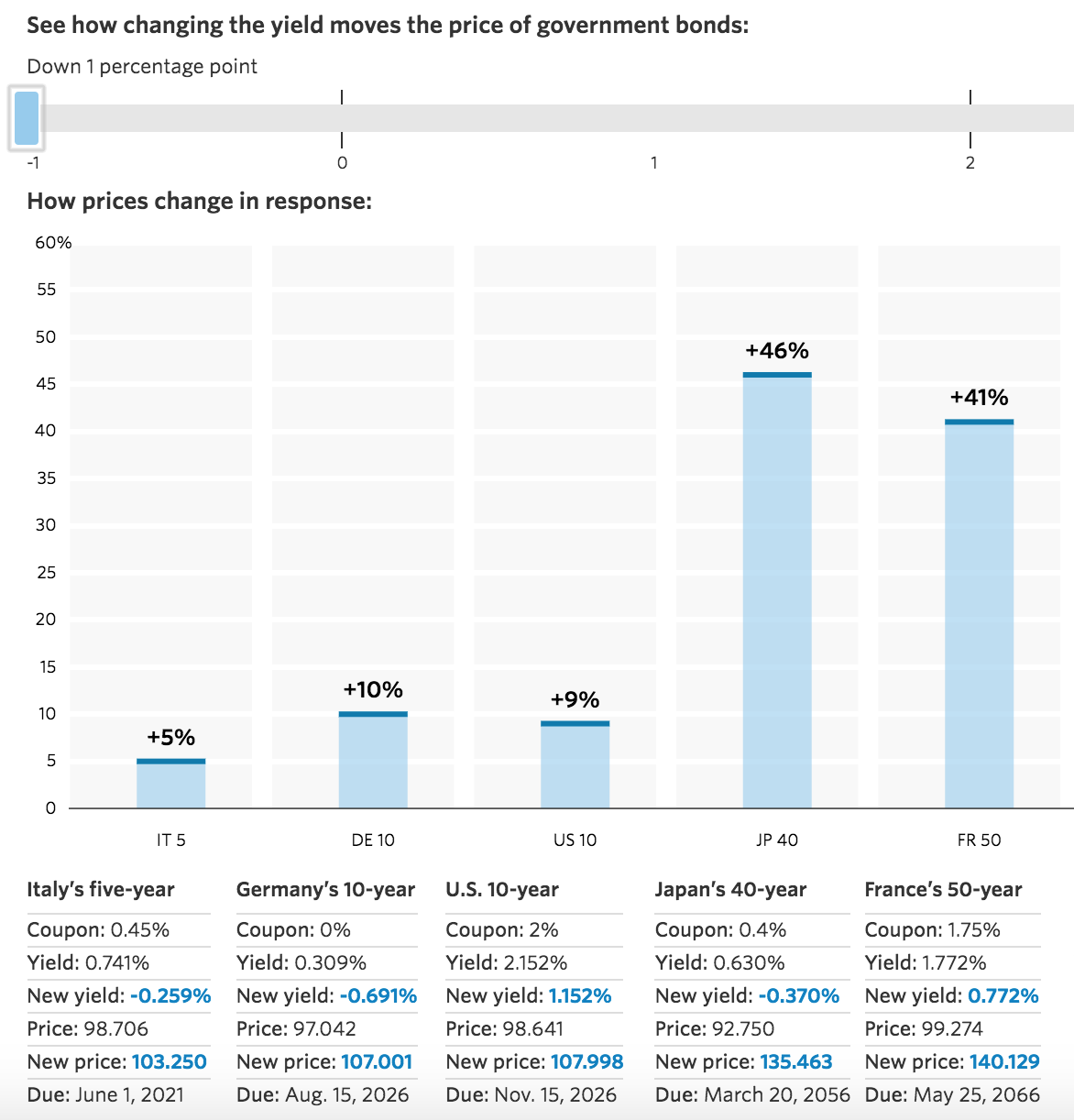

And here’s what would happen if rates fell 1%:

Expected stock market returns a can be tricky to nail down, but bond returns are fairly reliable in terms of how they react to certain variables such as current yields and interest rate movements.

The longer the duration and maturity of the bond or bond fund, the higher the variability of prices to changes in interest rates. This makes sense when you consider shorter duration bonds mature sooner, meaning you don’t have to rely as heavily on interest rate forecasts farther out into the future.

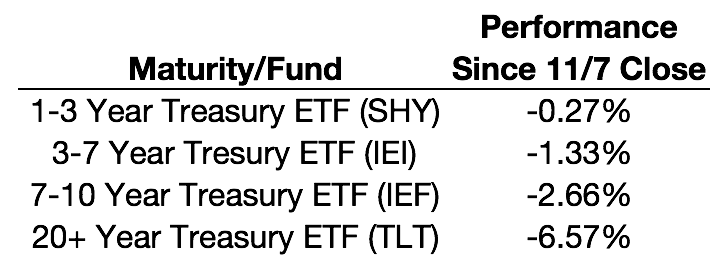

This past week was a good example of how this plays out in the real world. The yield on the 10 year treasury went from 1.83% at the close of business on Tuesday and shot up around 0.30% to 2.12% by Thursday afternoon as investors tried to figure out what a Trump presidency might mean for inflation and interest rates.

It’s still way to early to draw any conclusions about what this all means, but it is instructive to see how various bond maturities performed in this short window of rising rates.

Here’s a breakdown of the losses by various bond maturity ETFs:

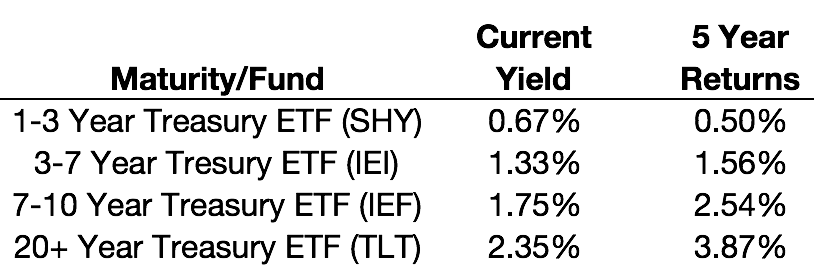

You can see that long bonds saw the biggest losses by far, while short-term bonds barely budged from the rise in rates. This also makes sense from the perspective of the current yields and trailing 5 year performance numbers:

Again, the risk/reward relationship holds where higher yields tend to lead to higher returns (this is of course only a long-term phenomenon). And in return for this higher expected performance at the long end of the maturity spectrum you have to be willing to accept the possibility for larger losses.

Fixed income investors have been worried about rising interest rates for years now. Some think we could finally see a sustained rise from current levels. Like all forecasts, predicting the direction of interest rates is much harder than it sounds. No one can tell you where interest rates are heading or when they will start moving to get there.

But I think the concerns of what happens to bonds from rising rates are probably overblown.

Yes, bond investors will likely see more volatility and short-term losses than they’ve been used to in the past. But if interest rates just stayed at current levels forever, investors are assured fairly low long-term returns based on the current yields. That’s simply how bond math works. The only way bond investors are going to earn higher long-term returns is if rates rise so they can reinvest maturing bonds or new funds at higher yields.

Of course, this means that they will have to experience short- to intermediate-term principal losses to get there. This paradox of short-term pain for long-term gain is the usual trade-off seen in the investment world, but something many bond investors have been spared for some time now.

The size of those losses will be determined by the duration of your bond fund or portfolio.

Higher rates are still not a foregone conclusion. Markets are never that easy. But if higher rates do finally materialize, investors should welcome this development, not fear it. The only path to eventual higher fixed income returns is through higher interest rates.

If you have a time horizon of 5 years or longer, you should actually hope for a rising rate environment. You’ll be better off for it in the end.

Further Reading:

Bond Returns & Rising Interest Rates