My first boss in this business was not only an intelligent investor but also a great businessman. I learned a lot from him about investing but also about running a business in general.

All of the firm’s client were acquired through word of mouth and client referrals. There were no sales or marketing teams. And the crazy thing is that he was constantly turning down business. He even had a very well-known Major League Baseball pitcher who asked to have the firm manage his money for him. He said he had no desire to work for professional athletes who were notoriously high maintenance clients.

As a young person just starting out in the business this made no sense to me. Why would you turn down business and potential revenue? Why not take on more clients and grow the firm?

He explained to me that it’s not just about growth but the right kind of growth — it’s a waste of time to take on the wrong type of clients. The ones he was turning down had serious red flags. They had people who were difficult to deal with, didn’t accept his investment philosophy or just weren’t the right fit for the way he liked to do things. He’d taken on those clients in the past and all they did was cause extra work, higher stress and constant headaches. It was basically a form of the 80/20 principle where 20% of his problem clients were taking up 80% of his time.

As his business matured he weeded out the bad eggs and focused more attention on the good clients. Not only did this make for a better work environment, but it had the added benefit of increasing referrals from current clients.

Obviously, not every business has the luxury of turning down potential clients, but it always makes sense to define the types of clients that you want to work with when selling a service.

*******

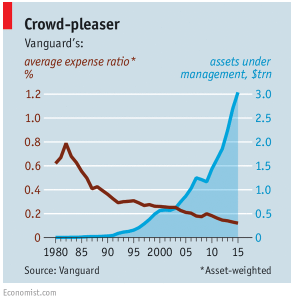

This week The Economist had a nice profile on Vanguard’s continued dominance of the fund industry. Here are a few stats that put Vanguard’s staggering growth into perspective:

- “Vanguard’s investors own around 5% of every public company in America and about 1% in nearly every public company abroad.”

- “One dollar in every five invested in mutual or exchange-traded funds (ETFs) in America now goes to Vanguard.”

Even more impressive than their $3.5 trillion under management is the fact that scale has brought down the costs investors pay for Vanguard’s funds as they’ve grown over time:

Although it may seem like investors are simply shoveling money into Vanguard’s coffers, the firm is still trying to stay true to their long-held principles. The Economist explains that Vanguard has actually turned down money from large investors because it didn’t fit within their long-term mandate:

Its investors stay with it roughly twice as long as the industry average. The firm actively shuns short-term “hot money” because it brings extra trading costs. Mr. McNabb tells the tale of the CEO of a foundation who wanted to park $40m with a Vanguard fund for a few months. When the fund turned him away, he “went ballistic”, complaining to the SEC, but Vanguard did not budge.

Some people may scoff that because they have trillions of dollars under management that Vanguard can afford to turn certain clients away. But this type of thinking is ingrained in their DNA. They have always been a long-term firm who tries to do what’s best for their client’s interests. And sometimes turning down hot money is the best way to protect your current clients.

Most clients assume that because they are the ones paying the fees or buying a product that they have all of the control in the business-client relationship. And most businesses spend all of their time in a sales pitch trying to convince prospective clients that they are the right firm for them. Very few investment firms take the time to figure out if prospective clients are a good fit for the them. Certain people or organizations just aren’t always a great fit personality-wise or because of their circumstances.

It’s actually a good thing to say ‘no’ from time to time because taking on the wrong type of client is a waste of both parties’ time. You can’t always save everyone and you don’t have to take every client that throws money at you. Let someone else deal with the problem clients. This is one of Vanguard’s guiding principles:

As Tim Buckley, the firm’s chief investment officer, puts it: “The biggest advantage Vanguard has, aside from its structure, is the greed of our competitors.”

Running a successful business isn’t just about attracting clients; it’s about finding the right clients.

Source:

Index We Trust (The Economist)

Now here’s the stuff I’ve been reading this week:

- Is your portfolio getting enough sleep? (bps & pieces)

- John Oliver on saving for retirement was pretty spot on (Abnormal Returns)

- Historical returns vs. investor returns (Irrelevant Investor)

- An old interview with Ellis, Buffett, Bernstein Templeton and more (CFA)

- Your personal financial planning CAPE ratio (Bason)

- The psychology of buying and selling a house (WSJ)

- Some proof that investors are their own worst enemy (Forbes)

- Why it’s so difficult to pick the best sectors (Reformed Broker)

- 51 things you shouldn’t do with your money (Jonathan Clements)

- Lessons from a first-time homebuyer (Motley Fool)