Alpha, n. Luck – Jason Zweig, The Devil’s Financial Dictionary

Professional investors are in constant search of the ever elusive alpha. Teams of MBAs, PhDs and CFAs scours every corner of the financial markets looking to outperform. This pursuit of outperformance, after accounting for the risk taken and fees paid, is extremely difficult. For many it’s impossible.

The problem for most investors — large or small, professional or amateur — is that that their efforts for extreme outperformance often work against them and lead to severe underperformance. Trying harder does not always translate into better performance in the markets. In fact, most of the time trying to do more leaves you worse off.

But there are many different ways investors can add alpha to their portfolio without beating the market. Here are some other forms of alpha that are often overlooked, but can have a huge impact on your bottom line:

1. Tax alpha. Most investors don’t spend enough time worrying about Uncle Sam’s cut of their profits and that’s a mistake. Taxes matter much more than alpha to the taxable investor.

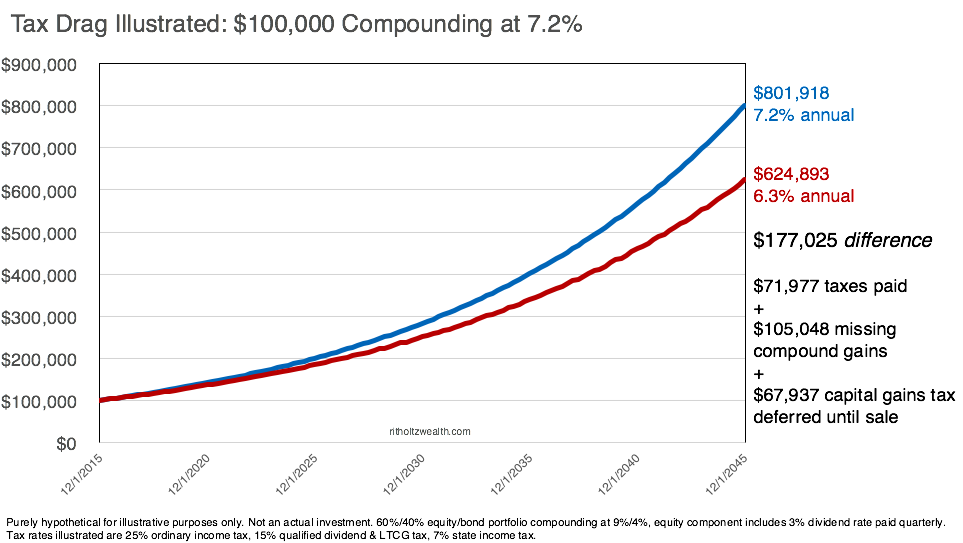

I asked my colleague Bill Sweet, our resident tax expert at Ritholtz Wealth Management, to run the numbers on a couple of simple examples to show how important taxes can be to your bottom line. This first graph shows the importance of maximizing your use of tax-deferred accounts:

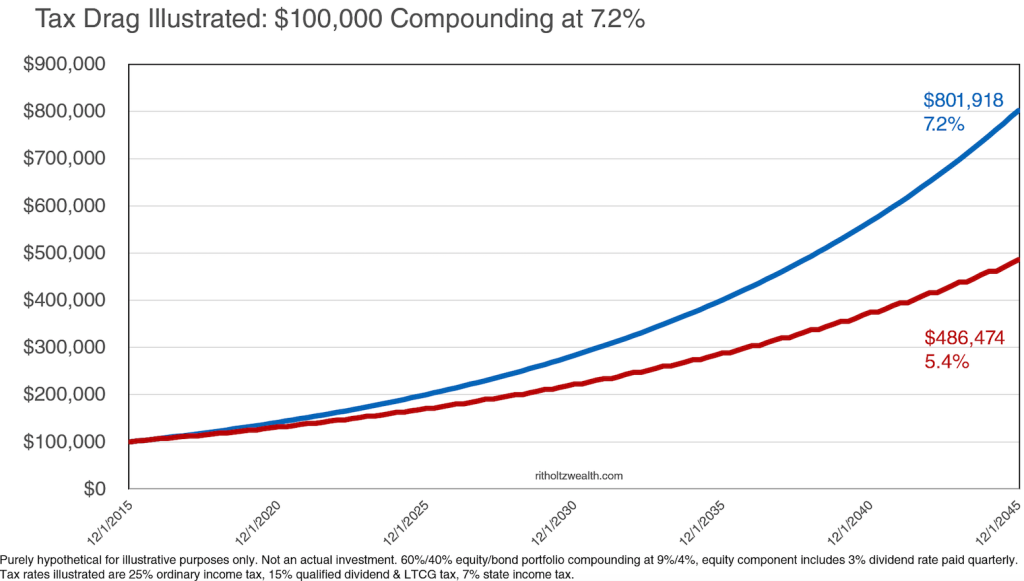

Obviously every investor can’t have all of their money tied up in tax-deferred accounts. If you are using taxable accounts, having a longer time horizon is imperative because short-term capital gains taxes can eat up your returns if you churn your portfolio too often. This graph shows what happens when you’re forced to pay short-term taxes every year:

Ignoring the impact of taxes on your returns is like fighting with one hand tied behind your back. You’re at a severe disadvantage right off the bat. Asset location, tax loss harvesting, portfolio turnover, the structure of your strategy or funds — these things all make a huge difference. Tax alpha is big piece of the portfolio management process.

2. Savings alpha. Let’s say you make $50k per year and you get a 3% cost of living raise for each of the next 25 years. You decide you can save 10% of your salary. Assuming you can earn a 6% annual return on your portfolio, you would end up with roughly $366k. Not bad.

Now, here’s how you can add savings alpha to your bottom line in this scenario. Let’s say instead of 10% of your salary, you save just 1% more or 11% a year. This is basically the equivalent of increasing your annual return up to 7% a year (the ending balance would now be ~$403k).

Now, let’s say that instead of increasing the amount you save by the inflation rate in your wages you increase that number by 1% a year more. So instead of increasing the amount you save each year by 3%, you decide to increase it by 4%. This would be the equivalent of adding close to another 1% per year to your returns (we’re now up to $450k).

Two simple changes and your annual returns go up by the equivalent of almost 2% per year from the original numbers just from saving a little more. Saving more money each year is not nearly as glamorous as beating the market, but it is something you have control over if you can manage your lifestyle inflation.

3. Crisis alpha. I stole this phrase from my friend Wes Gray, but I’m going to put my own spin on it. I feel very strongly that what separates successful investors from those who are unsuccessful is how they handle themselves during a market crash. Having the ability to keep your wits about you and not overreact when markets are falling can provide investors with a huge advantage over the competition.

There’s something of a safety-in-numbers syndrome that occurs during severe bear markets where people feel more comfortable following the herd and making irrational short-term decisions with long-term capital. Most assume that you make all of your money during bull markets, but I’ve always felt that bear markets are where investors really make or break their performance.

Just minimizing mistakes during these periods puts you far ahead of the majority of other investors. Crisis alpha also requires some combination of liquidity, courage and discipline along with a deep understanding of your process and the potential outcomes.

4. Organizational alpha. The only way to achieve crisis alpha is by having a detailed plan and process in place to follow so you can understand what to do when difficult markets inevitably hit. This requires a documented investment plan with specific checks and balances in place so you can lay out a plan of attack before your emotions come into play.

Building a portfolio, choosing the correct funds or securities, looking for investment opportunities — none of this things matter if you don’t have an effective mechanism in place for making rational decisions. This includes a deep understanding of your true risk tolerance, various time horizons, goals and investment philosophy.

The biggest step is simply having a comprehensive plan in the first place. My favorite quote on this comes from legendary Alabama football coach Bear Bryant:

Have a plan. Follow the plan and you’ll be surprised how successful you can be. Most people don’t have a plan. That’s why it’s easy to beat most folks.

***

Bill has also written an excellent series of pieces on taxes for Barry’s blog that I highly recommend:

Smart Things People Do to Increase Their Tax Refund

Stupid Things People Do to Increase Their Tax Refund

An Investor’s Income Tax Checklist

Now for the stuff I’ve been reading this week:

- Australia’s super solution to the retirement crisis (Institutional Investor)

- Performance vs. outcomes (Motley Fool)

- How do you break a bad investing habit? (A Teachable Moment)

- What’s the perfect asset allocation? (Irrelevant Investor)

- The confusing nature of figuring out the regulatory status of your financial advisor (Alpha Architect)

- What you pay matters less than what you’re paying for (EconomPic)

- Hard work, good luck and life’s potholes (Abnormal Returns)

- Why luck matters more than you might think (Atlantic)

- This is hilarious: Joe Pesci’s advice to Louis CK (Washington Post)

- Slight edges (Reformed Broker) & Confusing sophistication with substance (TRB)

- It sucks to be a millennial (Big Picture)

- Alpha or assets? (The Investor’s Field Guide)

Hi Ben,

Thanks for the commonsense does where it rarely exists. i.e. in equity markets.

Hope to see more form you.

Cheers,

Farhal

http://www.niftytrader.in

I think it might be worth adding “Fee Alpha” to your list. Too often, investors have no idea what they are paying in fees, the total of which in a “wrap” account can be in the 2-3% range. As you well know, a small difference in the amount of fees paid annually can lead to a significant ending dollar value over time.

Makes sense to me

In your crisis alpha, I assume the mistakes you are referring to are selling on the way down and/or at the bottom?

That would be the big one. I think abandoning a plan, completely changing your strategy or panic selling would all work here.

Did you catch the interview he did. Hat tip to Bankers Anonymous for that one

http://fivegoodquestions.co/season-2/s2e21

Missed this will check it out. Thanks

These are some very good common sense points to help an ordinary person reach their financial goals.

Plenty of people talk about investing, but not many understand that saving a high percentage of your income in a tax-deferred vehicle such as a 401K plan is something you have more control over say future investment returns.

Agreed. Focusing on what you control is one of my favorite pieces of financial advice, but it’s not easy for people sometimes.