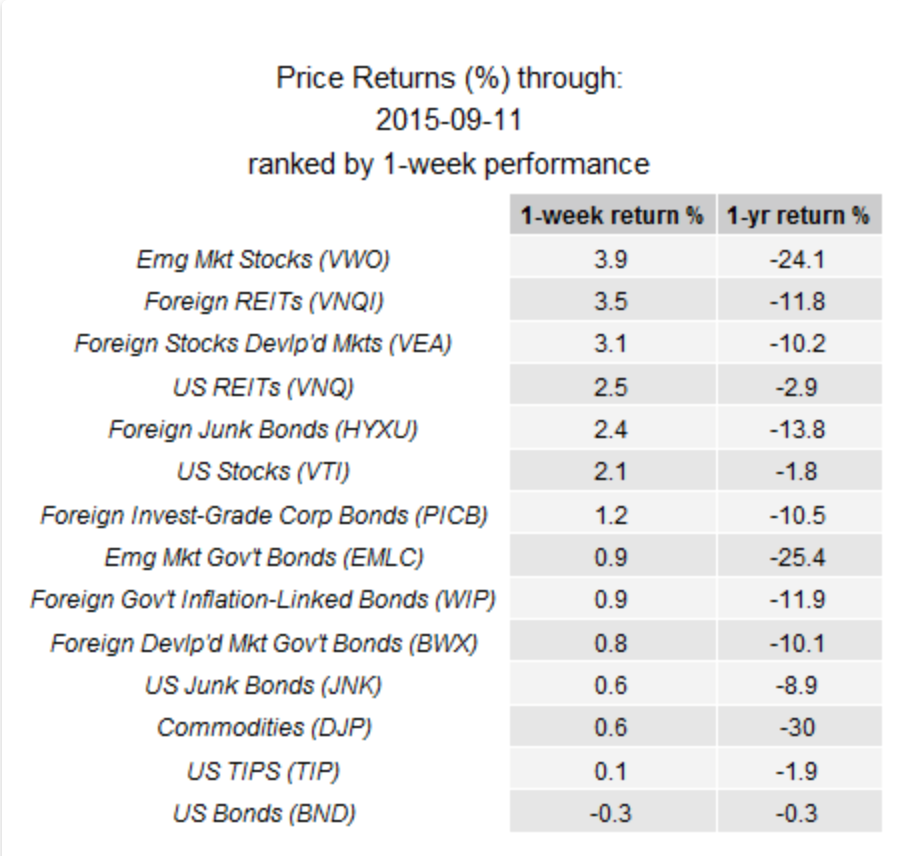

There was a scary chart flying around a couple months ago showing how basically no asset class was working for investors. These numbers, provided by James Picerno at The Capital Speculator, showed that every major asset class or category showed a negative one year return through early September:

This was pretty crazy — stocks, bonds real estate, commodities, foreign, domestic, it didn’t matter. Everything was negative. The knee-jerk reaction by many to when seeing these types of numbers is to call into question everything we thought we knew about financial markets.

Diversification? Worthless.

Cash? Why don’t I hold more of it?

Rebalancing? What’s the point if everything is down?

There’s nowhere to hide; this market is broken.

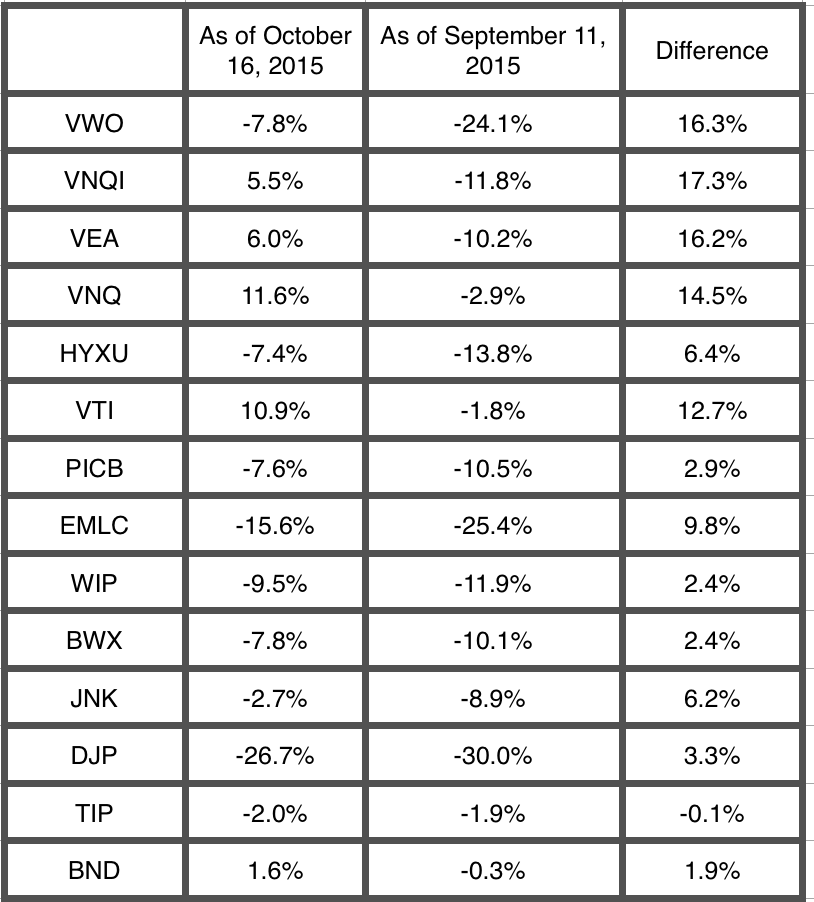

The problem with this line of thinking is that one-year returns in the markets are pretty meaningless. They provide very little signal and plenty of noise. Take a look at what happens when you update these same ETFs for their one-year performance through the end of this past week:

There are still some negative returns on here, but the performance across the board is much better. There are even some fairly decent one-year returns in a handful of markets. There are a number of reasons for these changes. Markets have rallied over the past couple of weeks. It’s possible that there was a poor performing month or so that dropped off from the calculation of the previous period.

The point here isn’t to say, “Look, everything came back like it always does!” The point is that the markets are constantly shifting over shorter time frames. One year numbers could look great one month and terrible the next, depending on what happened before and what happens next. You just never know.

The point is that judging the performance of your securities, funds or entire portfolio over a one-year time horizon doesn’t tell you very much about your success or failure as an investor (assuming you don’t completely blow-up your portfolio). There will be good years and bad years. Sometimes everything works. Sometimes nothing works. Other times there will be a wide dispersion in returns depending on the asset class, style, strategy or geography.

Many investors are worried this year because markets haven’t really gone anywhere or provided much in the way of returns. There are still a couple months remaining before year-end, so you never know what will happen.

However, level-headed investors understand that their one-year returns don’t really matter in the grand scheme of things. As William Bernstein once said, “Investment wisdom begins with the realization that long-term returns are the only ones that matter.”

Further Reading:

The Danger of One Year Performance Numbers

[…] Do Differently (Harvard Business Review) • One Year Returns Don’t Tell You Anything (A Wealth of Common Sense) • Inside the world of audio branding with Skype’s new pings, bounces, and pops (The Verge) […]

[…] One-year market returns don’t matter. (awealthofcommonsense) […]

Measuring periods of shorter duration than an economic cycle are always going to be heavily skewed by where one starts the measurement within that cycle.

One could, in the case of a 1-year metric, average the 1-year performances for each day in the set, going back a year from each day to get the performance for that day, and then average those metrics together, in a sort of crude Monte Carlo simulation … but the results are still going to be skewed by where the year falls in the economic cycle, and will have little relevance to how the next year is going to be.

If one stretches the measurement interval out to many times the length of an economic (or business) cycle, one could arrive at a value that have most of the moise washed out, but with the caveat that conditions at the end of that measurement are going to be radically changed by technology, societal shifts, demographics, etc.

It’s almost as if market performance measurement were operating within the constraints of an Uncertainty Principle, where one can reduce signal noise to get more precise meaning, but only at the cost of also reducing relevance.

[…] One Year Returns Don’t Tell You Anything The Difference Between a Portfolio Manager & Portfolio Management Misconceptions About Individual Bonds vs. Bond Funds […]

[…] Over the short term the market is more noise and emotion than anything else. Even over a period of a year or two, emotions and not much else can drive a stock price. If your holding period is forever, then the share price at “forever” is the one that matters or in this case, the dividend matters more – One Year Returns Don’t Tell You Anything […]

[…] One year returns don’t tell you anything. So true… […]