I’d say once a month for the past 4-5 years I’ve seen some variation of the following prediction:

We think there is now an increased risk for the possibility of an event similar to the 1987 Black Monday crash that saw stocks fall 20% in a single day.

Here’s a prediction you will never see from a market pundit:

We think there’s a possibility for a reverse-1987 melt-up as investors will all turn optimistic at the same time.

I’m not trying to say that a reverse-1987 could ever happen. But doesn’t that say a lot about the way we’re wired as humans? It’s perfectly reasonable for people to assume that we could see a 20% crash in a single day because of herding and panic in the markets. Yet it would basically be impossible for the herd to have the opposite of a panic in a single day and re-price the market to the upside. People have a very easy time defaulting to fear and it can happen in a hurry.

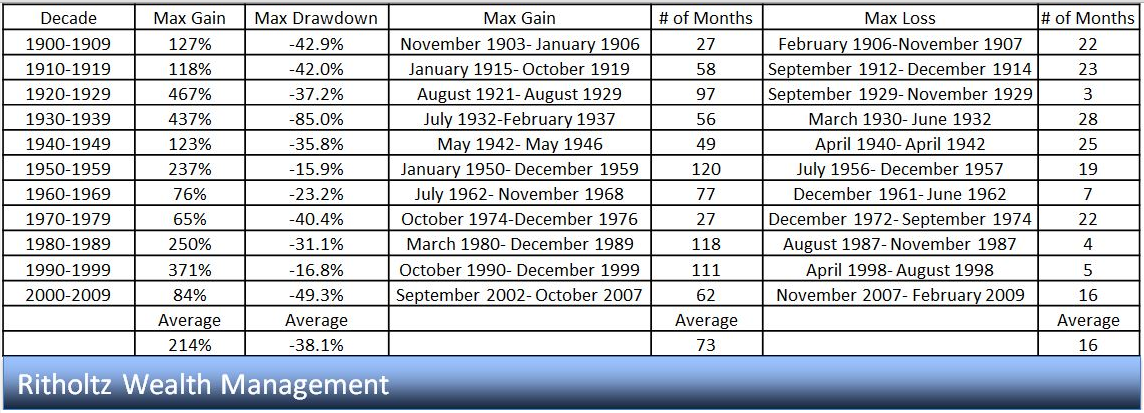

Yesterday our Director of Research, Micheal Batnick, posted a great chart on his blog that dovetails nicely with this idea:

Here he shows the largest gains and losses by decade in the Dow Jones Industrial Average, along with the length of time that each lasted. You can see the average gain far outweighs the average loss, but the interesting stat here is how quickly those average drawdowns occur. On average, the max gains lasted 4.5 times longer than the max losses. Gains are incremental, but losses happen in a hurry. Greed builds up slowly, but fear can happen all at once.

It could be a hangover from the financial crisis, but one of the things I’ve noticed in the past few years is the willingness of prognosticators to assume that our best days are behind us. Just yesterday I read an article from the CFA Institute with the headline: What If Markets Are Bound for Chronic Underachievement? Larry Summers and company have been talking about secular stagnation for some time now.

From a short-to-intermediate term perspective these types of forecasts probably make sense. It’s a good idea to reign in your return expectations after a run like we’ve had in the markets since 2009.

Still, I can’t remember the last time I read an article or saw an interview where someone made a prediction that the future is going to be better than the past. Maybe the only place in Earth right now making these types of claims is those in Silicon Valley. Can you think of any other group besides the tech crowd that actually thinks the future will be better than the past? It’s almost a minority viewpoint these days.

Maybe everyone in the world of finance is right. Maybe our best days are behind us and we’re doomed for decades of slower growth, lower returns and economic headwinds. It’s certainly a possibility.

All I know is that we have roughly 100 years’ worth of financial market history to go on. The U.S. has the largest, most mature economy on the planet and it’s only been operating under its current structure for a couple hundred hundred years. Anyone who thinks they can use the past to make sweeping generalizations about how the next few decades are going to play out in the markets or the economy is going to be surprised by how things actually transpire. There are far too many factors at play.

I’m not saying that growth in the economy or returns in the financial markets will be better than expected in the future. I honestly don’t know. All I know is that pessimism and panic don’t do much good either way.

The glass-is-half-full group in Silicon Valley has had a nice run as of late, so you’ll excuse them for making grandiose statements about how technology is going to make life better for everyone in the future. But I think one of the things that they get right is having an optimistic bent to their world view. It’s much easier to persevere in the face of failure when you have an optimistic view of the future. Giving up easily is a natural extension of a pessimistic worldview.

Of course there will be recessions and market crashes along the way. But I can think of far worse outlooks than being rationally optimistic about the fact that most people want to improve their standing in life. Here’s a prediction you’ll be hard pressed to find in today’s negatively-skewed society:

What if the future is better thank we think?

Sources:

The Power of Defense (Irrelevant Investor)

Further Reading:

What if the Future is Better Than We Think?

Mathematically, prospects for bonds (at 2% yield) and stocks (at a CAPE of 24) are boring at best.

A stock bear market featuring a 30-50% decline might drive Treasury yields to near zero. But it certainly would improve the outlook for cyclical gains in equities. Plus it might finally put in a low for commodities.

Nothing interesting’s gonna happen until we hike down from this permanently high plateau.

Could be but we’re a far more globalized world than we were in the past. Although the US still has by far the strongest economy in the world, I think the best opportunities in the coming decades could be outside of the US.

Maybe I’m wrong but didn’t Great Britain have one of the best stock markets from 1900 to 2000? They saw their empire largely disappear and were in two world wars. Of course they country suffered comparatively little damage from the wars and more importantly the basic structure of government remained stable.

Great Ben!

Remember we can not predict future but we can prepare. We have to look for long symphonies that are in risonance and use them.

Best Regards!

Great Sentiment! In the weight room at my school there was a beat up old sign that read “Luck is when Preparation meets Opportunity”. I believe genuine optimism makes it’s own kind of luck, and research seems to support this viewpoint.

Applied to my simple little portfolio, US equities might not do so well going forward, but EM and REITs seem poised to take off at some point. A balanced portfolio should be all right, and maybe better than all right, even if all expectations are confounded. Optimism doesn’t mean I assume sunshine and roses – I still need to prepare for the worst case scenario as best I can, which is why I do my best to build a low volatility portfolio – but fear blinds one to opportunities that curiosity and optimism drop in your lap, which is why I include a variety of US equities plus EM plus REITs – high growth investment options to drive robust growth, but with relatively uncorrelated returns.

Agreed. I love the phrase “expect the best but plan for the worst.”

no one can buy and hold for ever! So yes our world is getting better, but reality is that the stock markets have barely performed this year YTD. Investors who bought at the YTD highs have sold with stop losses or are trying to hold forever. Did any of you think that Volkswagen would be a cheat? That leaves my mind boggled as when blue chips start deceiving (Goldman sachs consulting gig with the Malaysian Fund- currently under investigation) it makes stock picking a game of bingo. I think that every investor is investing because he expects a rosier future making question: What if the Future is Better Than We Think? invalid.

But thanks for the positive noise!

this is where diversification comes into play…

[…] Predictions No One Ever Makes (Wealth of Common Sense) […]

“…doesn’t that say a lot about the way we’re wired as humans?”

We actually are hard-wired to be pessimistic and naturally/innately focused on the negative (e.g. danger). It’s what’s kept us alive for the past 200,000 years.

It’s a very tall order to ask people to deny their DNA, especially when it’s constantly being pandered to by the Doom & Gloomers (including the nightly news).

Would be interesting to research the times throughout (American) history when the future was NOT better (Civil War) vs better (the ’50s).

true, in some ways this has helped us survive over the years. it’s just that our natural instincts can be hurtful to our finances since it’s a completely different ballgame

Engineers sometimes predict that a bridge might collapse overnight, but they seldom predict that one will construct itself overnight.

I am a nobody which is why you do not recall it, but in a comment to a blog post of yours sometime in the past year, I made a prediction very similar to the prediction you correctly point out that no one ever makes.

The 1987 one?

Yes, that one.

Great minds…

Indeed!

[…] Does anybody think the future will be better than the past? – A Wealth of Common Sense […]

[…] Doom and gloom sells….but what if the future is better than we think? (awealthofcommonsense) […]

[…] But Also Read: What If The Future Is Better Than We Think? by Ben Carlson via Wealth Of Common Sense […]

[…] But Also Read: What If The Future Is Better Than We Think? by Ben Carlson via Wealth Of Common Sense […]

[…] But Also Read: What If The Future Is Better Than We Think? by Ben Carlson via Wealth Of Common Sense […]

[…] But Also Read: What If The Future Is Better Than We Think? by Ben Carlson via Wealth Of Common Sense […]

[…] Predictions No One Ever Makes (Ben Carlson en A Wealth of Common Sense) […]

[…] Bullish vs. Bearish Predictions: Predictions of A Strong Up Move Are Much Less Frequent Than Prediction of a Strong Down Move (Ben Carlson at A Wealth of Common Sense) […]

[…] to crash get far more air time over those who say things are just fine and will get better – Predictions No One Ever Makes. “What if the future is better thank we […]

[…] no one ever makes. This dude blogging at A Wealth of Common Sense is just killing […]