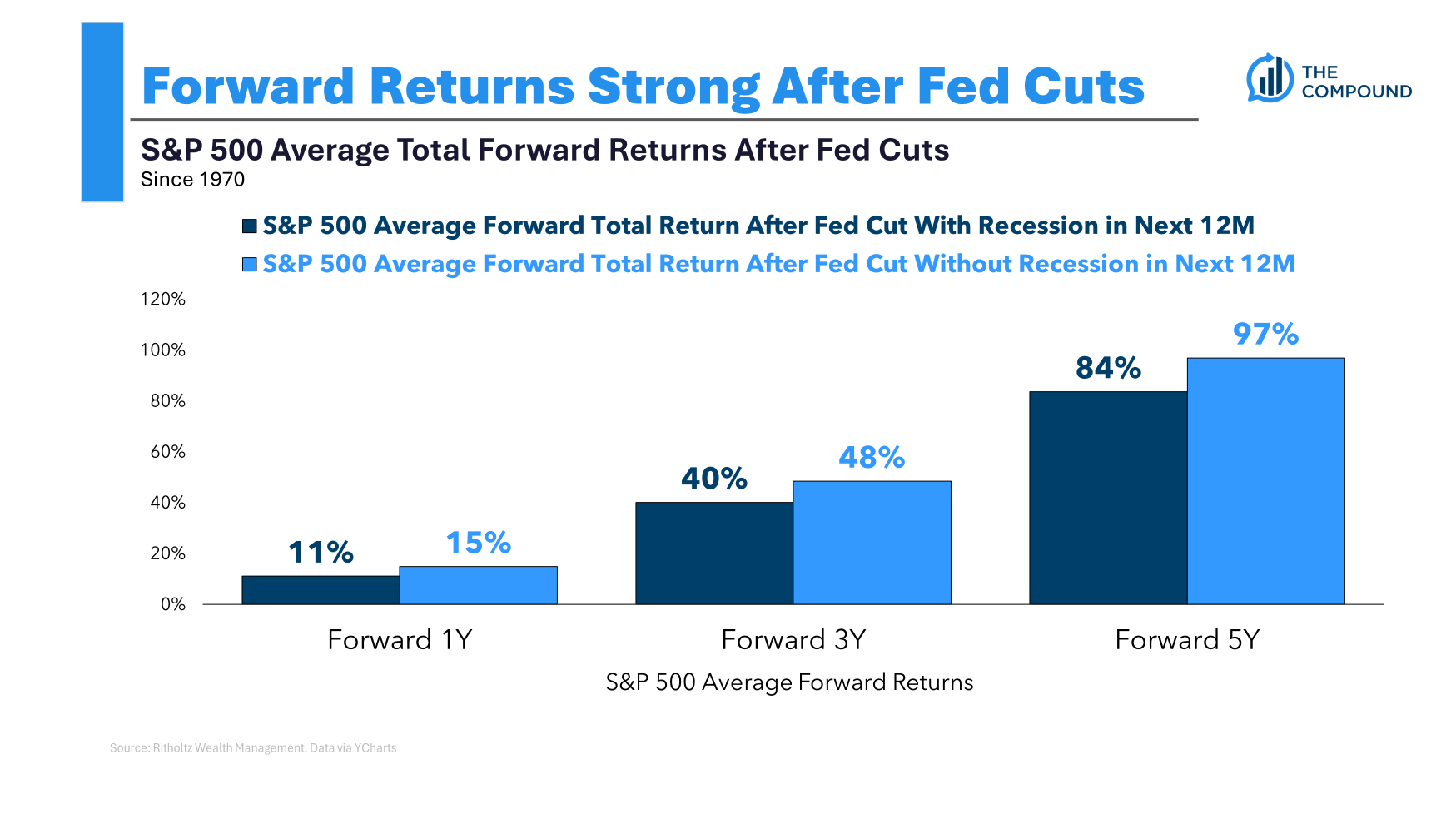

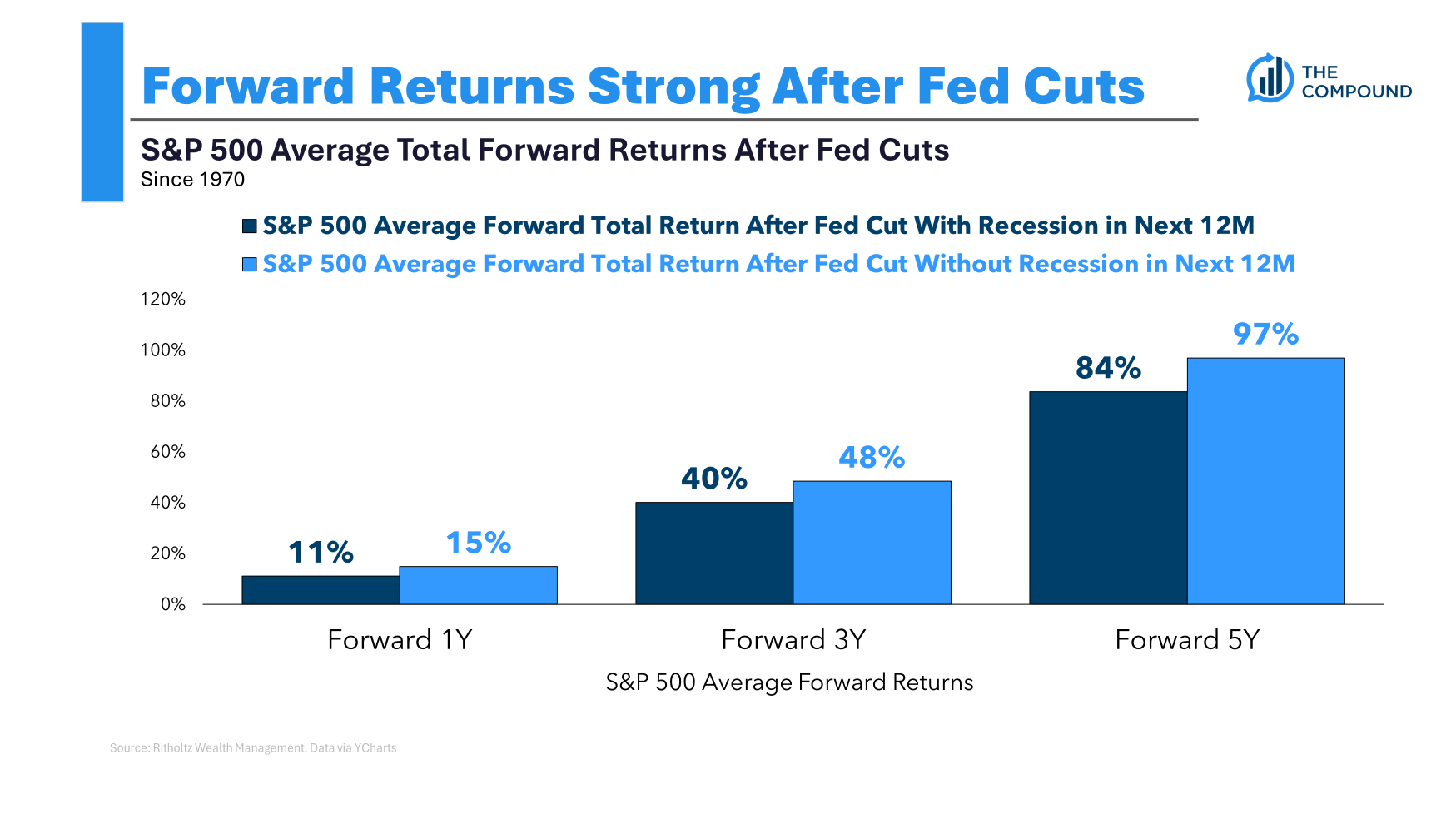

A closer look at the impact of Fed rate cuts on stocks and bonds.

A closer look at the impact of Fed rate cuts on stocks and bonds.

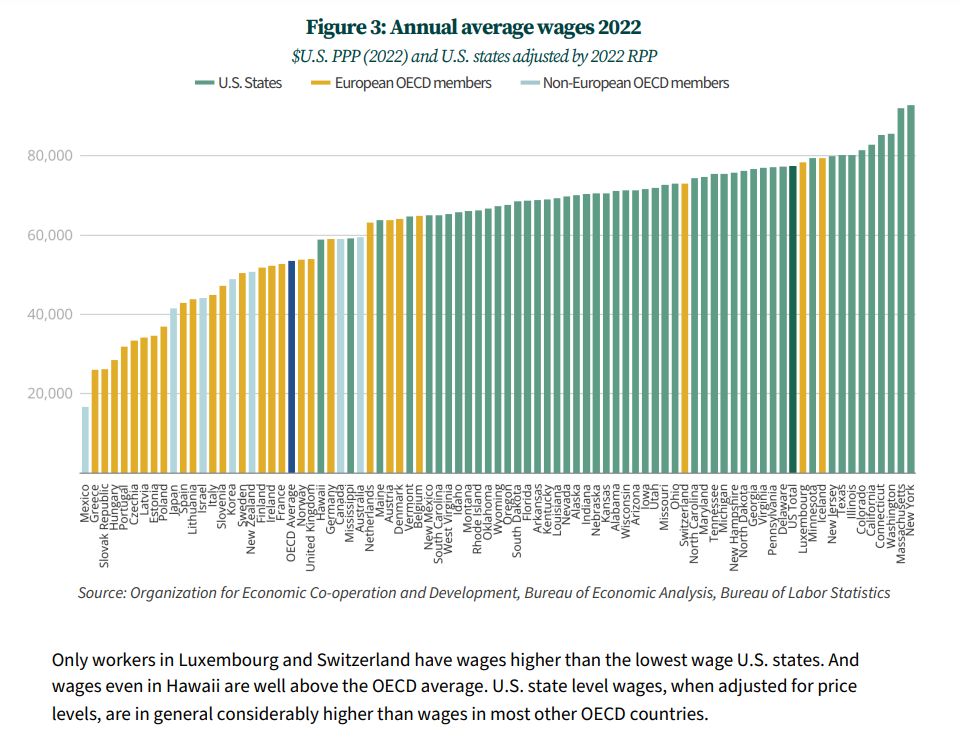

On today’s show we discuss how small cap stocks got so cheap, how to improve your chances of outperforming the market, why investors are rushing into bonds, Americans make more money than you think, good news on gas prices, how the Fed can help the housing market, the best way to eat potatoes, the downfall of Nike, IMAX theaters and much more.

Asking some questions about the Fed, steamers, fire places, small caps and more.

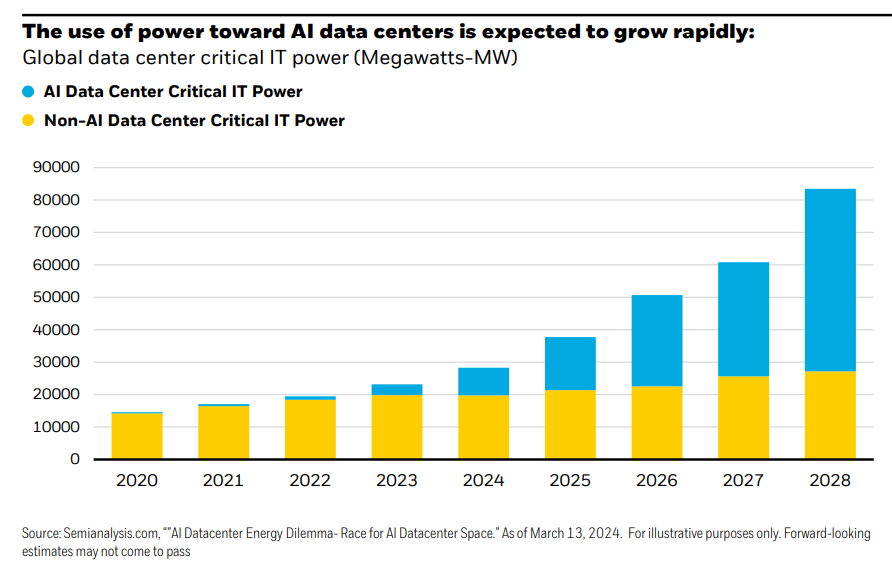

On today’s show, we are joined by Jay Jacobs, U.S. Head of Thematic and Active ETFs to discuss BlackRock’s favorite Mega Force themes to invest in, investing in the reshoring theme, IBIT trading volume, the Ethereum ETF launch and Ethereum use cases, getting cash off the sidelines, and much more!

Why I never want to become a rich guy who complains about taxes or a grey-haired permabear.

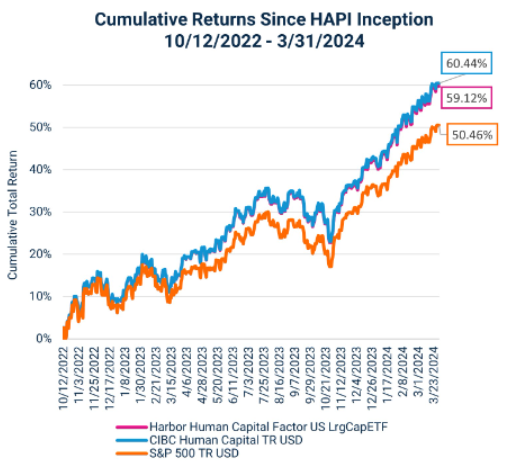

On today’s show, we are joined by Kristof Gleich of Harbor Capital and Scott Colson of Irrational Capital to discuss how the Human Capital Factor was discovered, what is being measured to quantify the Human Capital Factor, how advisors are utilizing this fund, the importance of portfolio construction when utilizing factors, and much more!

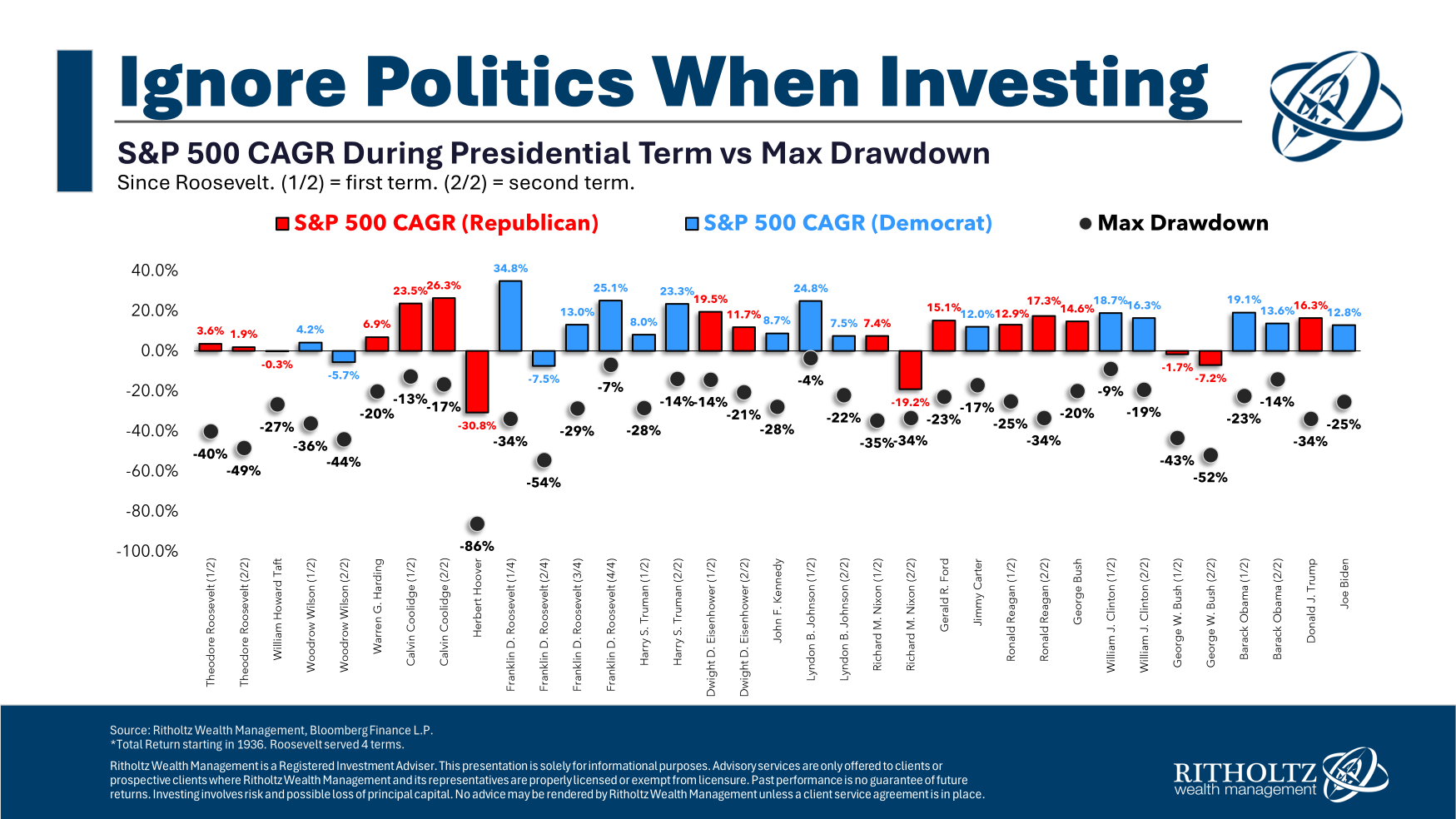

Keep politics out of your portfolio.

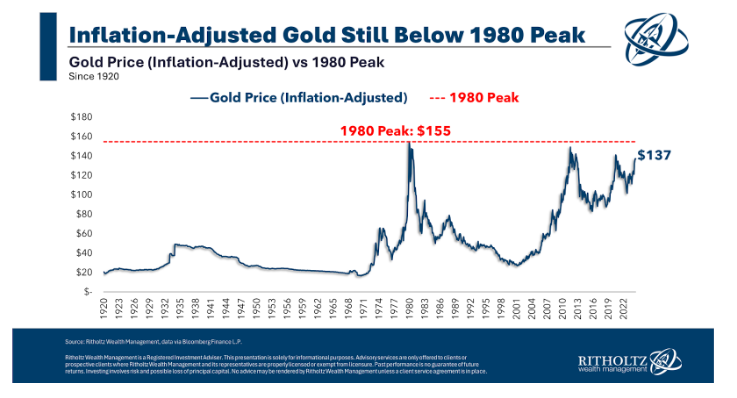

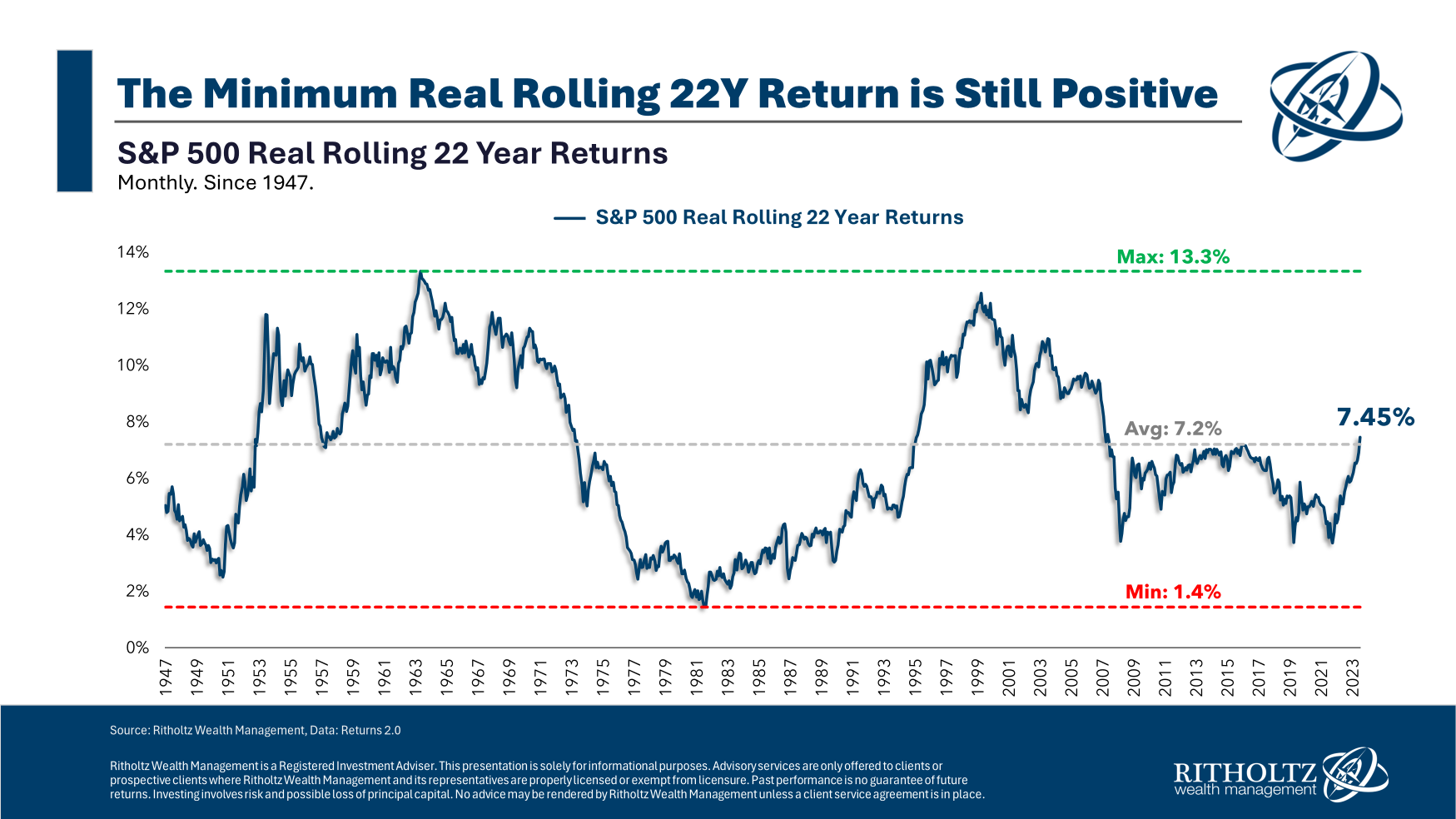

A historical look at long-term real returns on the U.S. stock market.

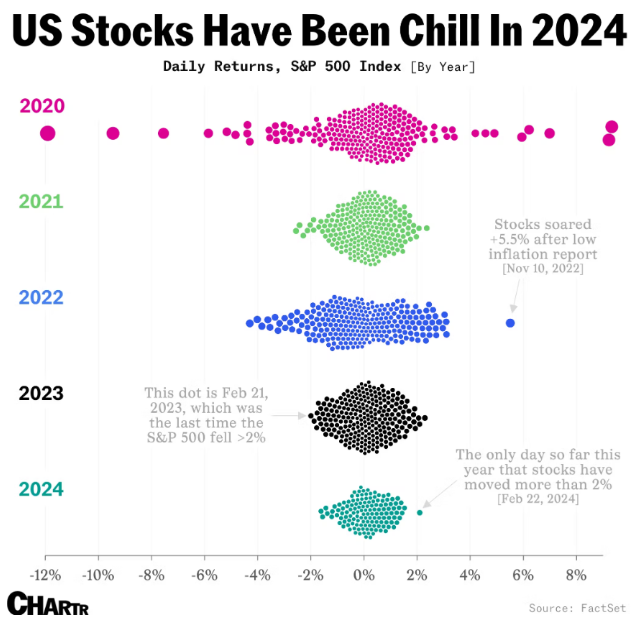

On today’s show, we discuss why the stock market doesn’t care who the president is, the U.S. stock market is having a boring year, the biggest winners in stock market history, the economics of a martini, the best comedy movies of all-time, the broken beer bottle economy, Nvidia employees are rich and much more.

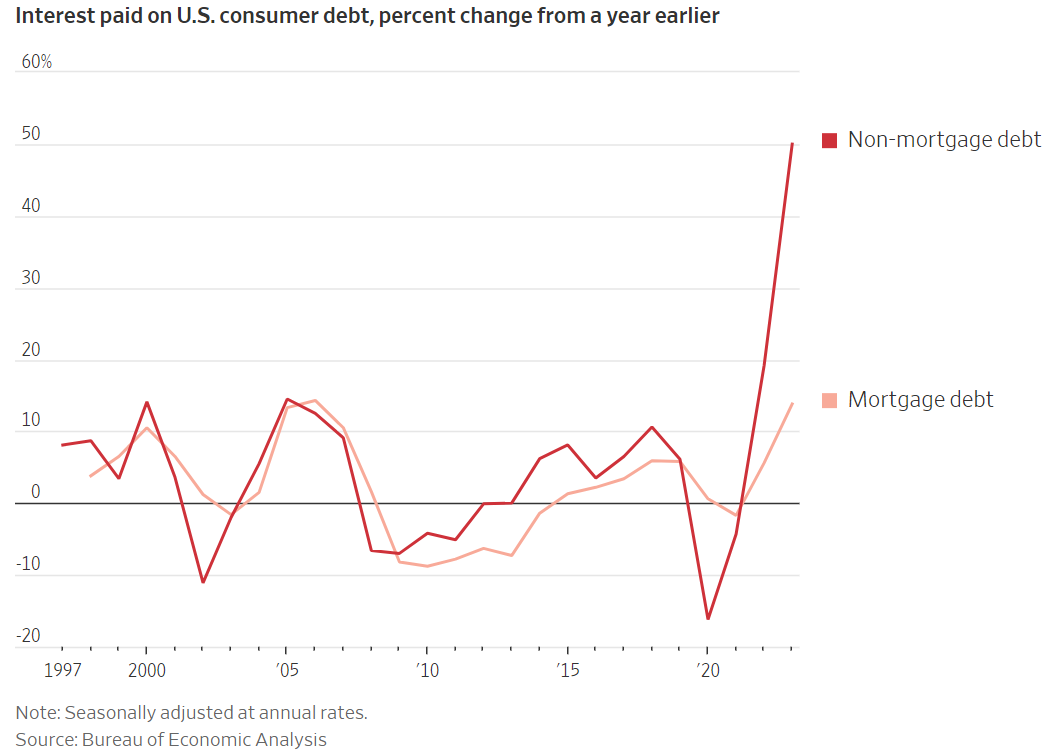

An update on the state of the U.S. consumer balance sheet.