One of the biggest flaws in the finance industry is the idea that you have to impress your clients to help them.

People on Wall Street like to use fancy words and financial models to prove their worth.

Our robust optimization score that shows your modified Sortino ratio gives you a more granular risk-adjusted return than the benchmark. If you look on page 127 of your report…

Most people don’t have time for benchmarks, risk scores or optimized models. They just want to know that they’ll be OK.

Will I be OK if I retire tomorrow?

Will I be OK if we take a big family vacation?

Will I be OK if we save a little less?

Will I be OK if we buy a luxury vehicle?

Will I be OK if we buy a new house?

You want to be confident in your decisions so you can move on and enjoy your life.

Unfortunatelty the future is unknowable and investing can be an overwhelming proposition for a large part of the population.

Pontera has a new survey out that seeks to gauge the sentiment of investors in 401k plans to see how confident they are with their decisions.

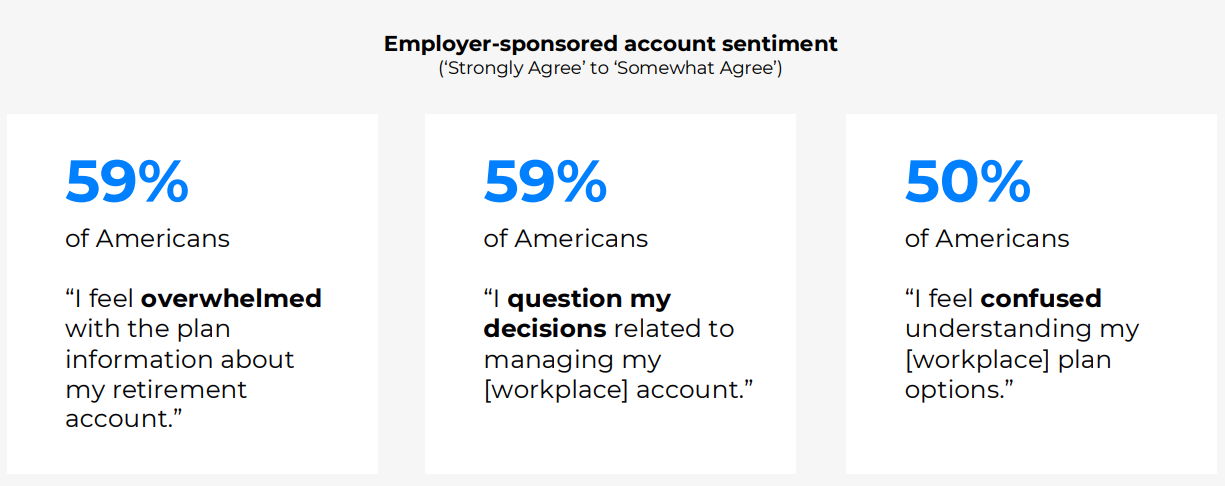

Most of them feel overwhelmed, question the decisions they’re making and get confused with their plan options:

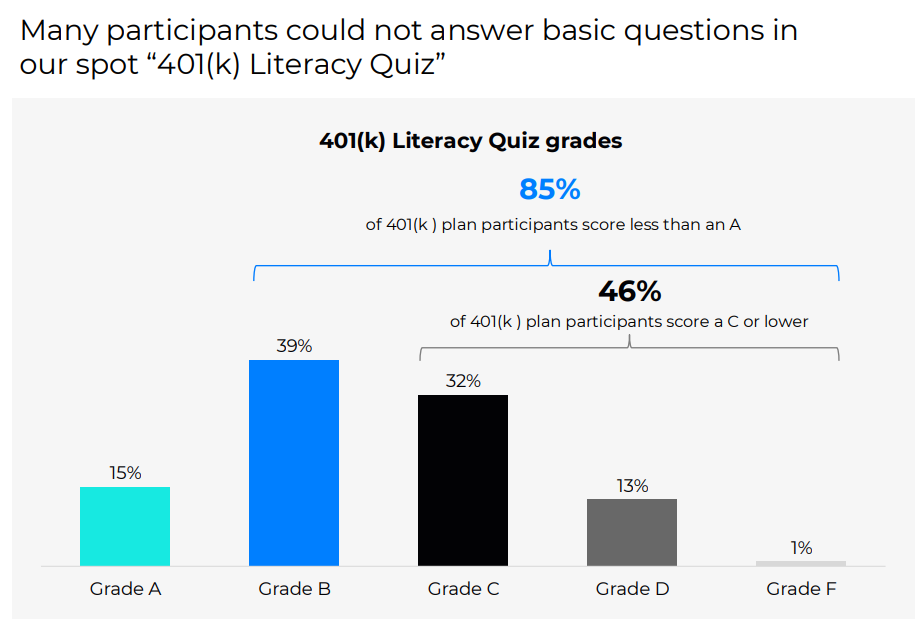

Interestingly, when asked to rate their own financial literacy, 6 out of 10 people in the survey said they were highly literate on retirement investing. But when those same people were given a basic financial literacy quiz1 on 401k plans, a lot of them struggled:

This is a perfect example of the Dunning-Kruger effect, which essentially means we humans are often wrong but always confident. David Dunning, the professor who helped coin the term, says there are four ways to overcome this innate human trait:

- Be your own devil’s advocate.

- Ask yourself how you might be wrong.

- Imagine what could lead to failure based on your decision.

- Seek out advice from others.

When it comes to managing your finances seeking advice from others can be helpful because no one cares about your money as much as you do. That can lead to either overconfidence in your abilities or paralysis by analysis where you can’t make any decisions.

This is where an objective third party comes in handy.

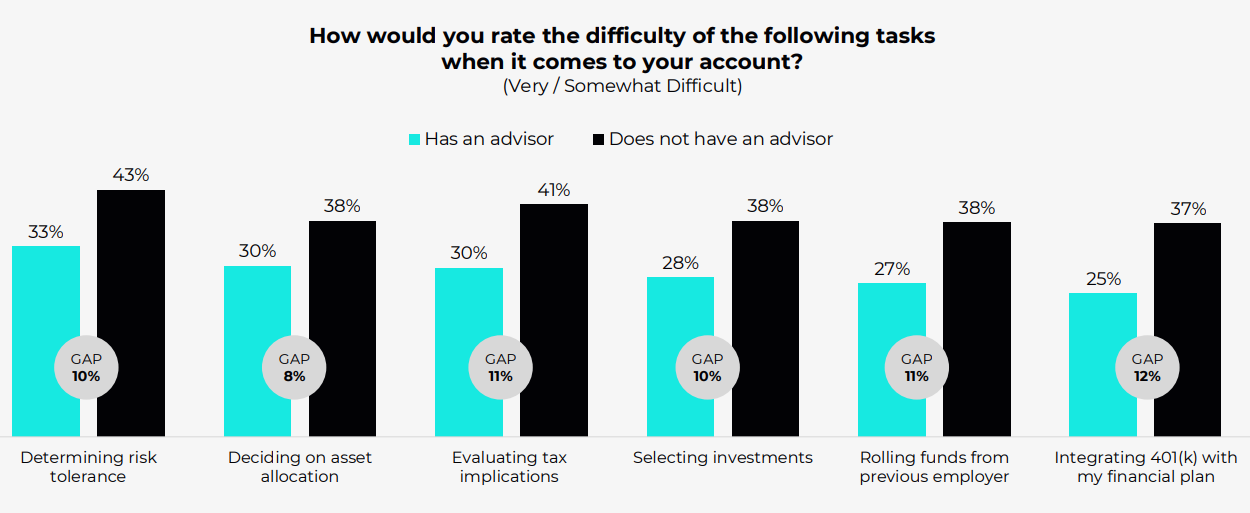

Pontera found 401k participants who had an advisor had an easier time making retirement decisions:

I spoke with Ben White from Pontera about all of their findings and what it means for clients and advisors alike for The Unlock:

Subscribe to The Unlock so you never miss an episode.

If you’re an advisor, sign up for The Unlock Newsletter for all things wealth and practice management. We’ve got some good things coming in the weeks and months ahead.

Further Reading:

The Advisor Cheat Code

1Even a B grade would only be answering 6-7 out of the 9 questions right.