Bear markets are never any fun to live through but every stock market correction in history has been an opportunity if you’re able to zoom out a little bit.

But how you view the short-term risks involved in big market declines should be colored by where you reside in your investor lifecycle.

With that in mind, I wrote a new piece at Fortune that looks at the present opportunity set through the lens of each generation of investors from young to old.

*******

It’s been a tough year for investors in financial assets.

The U.S. stock market has fallen as much as 25% in 2022. To make matters worse, bonds are also down big this year. Typically, when the stock market falls, bonds act as a shock absorber for diversified portfolios. But since interest rates are rising this year, the Aggregate Bond is down almost 15% this year.

This means any investor who is exposed to traditional financial assets such as stocks and bonds is down somewhere in the neighborhood of 20% on the year.

And if you’re in riskier parts of the market you are down even more. The tech-heavy Nasdaq is down more than 30% from its highs. The Russell 2000 Index of smaller-company stocks is also down more than 30% from all-time highs. And cryptocurrencies such as Bitcoin have fallen 70% over the past year or so.

It’s been brutal out there.

No one likes losing money, but down markets do create opportunities for higher expected returns in the future. It never feels good to be invested when markets are falling, but every bear market in history looks like a buying opportunity with the benefit of hindsight.

I have no idea when this current market environment will turn around. But it can be helpful for investors to think through some of the opportunities the market is throwing at us right now.

Risk means different things to different investors depending on their circumstances or station in life. So let’s look at the current investment landscape through the lens of different generations of investors:

Baby boomers (retirees)

Older generations of investors should have a stockpile of financial assets but not much in the way of future savings. This has presented a conundrum in recent years because yields on safe assets have been so low that it has forced baby boomers out on the risk curve to earn higher expected returns on their portfolios.

For many investors, this has meant the traditional 60/40 mix of stocks and bonds could have been more like 70/30 or 80/20 in favor of stocks since bond yields have been so low for so long. This strategy can help enhance long-term returns, but it also adds a level of volatility most retirees aren’t comfortable with.

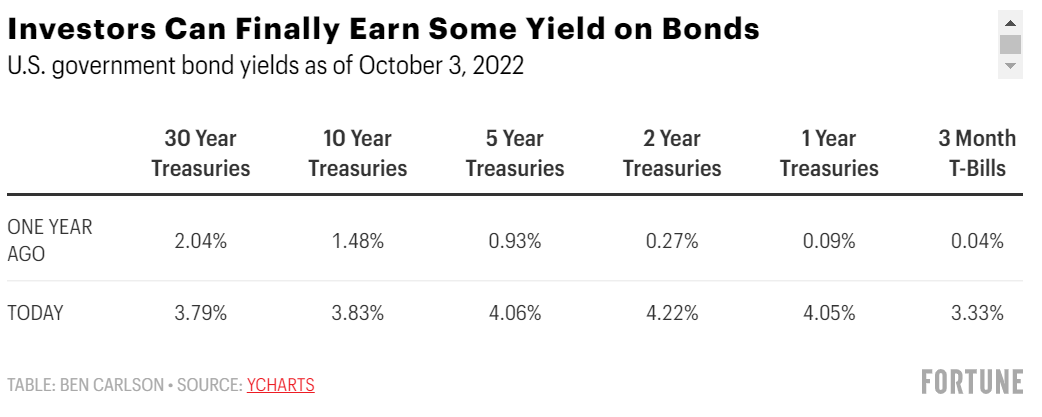

That has changed in a hurry this year. For the first time since before the 2008 financial crisis, investors are finally able to earn some yield. Just look at how much yields have risen across the maturity spectrum for U.S. government bonds in the past year:

The reason bond returns have been so dreadful this year is because interest rates are so much higher and the starting yields were so low. It was really the worst combination you could hope for when it comes to fixed income.

But now that those yields are so much higher, investors have a much bigger margin of safety should rates continue to rise.

And the best part for retirees is short-term bonds such as one- and two-year Treasuries now have higher yields than long-term bonds. This is a good thing because, all else equal, the shorter the duration in the bond or bond fund, the lower the volatility in price when interest rates move.

This means retirees can now lock in 4% yields on bonds that have very little interest rate sensitivity.

The Vanguard Short-Term Bond ETF (BSV) currently has a yield to maturity of 3.7%. The iShares 1-3 Year Treasury Bond ETF (SHY) has an average yield to maturity of 4.3%.

If you need a safe place for the more defensive part of your portfolio, you finally have some options as an investor.

Gen Z / Millennials (younger investors)

Young people are on the opposite end of the risk spectrum than retirees. Young people also need a safe place to park their relatively safe assets when saving for emergencies, down payments, weddings, or any other short-term financial goals.

But your biggest assets as a young person are your time horizon and human capital. You have time to allow compounding to be the wind at your back. You have the time to wait out a prolonged bear market. And your future earnings power equates to future savings, which can be put to work periodically, whether markets are high or low.

The advice for young people during a bear market is fairly simple: Keep saving, keep investing, and don’t get scared out of the markets. Patience and a long enough time horizon can smooth out a lot of awful market scenarios.

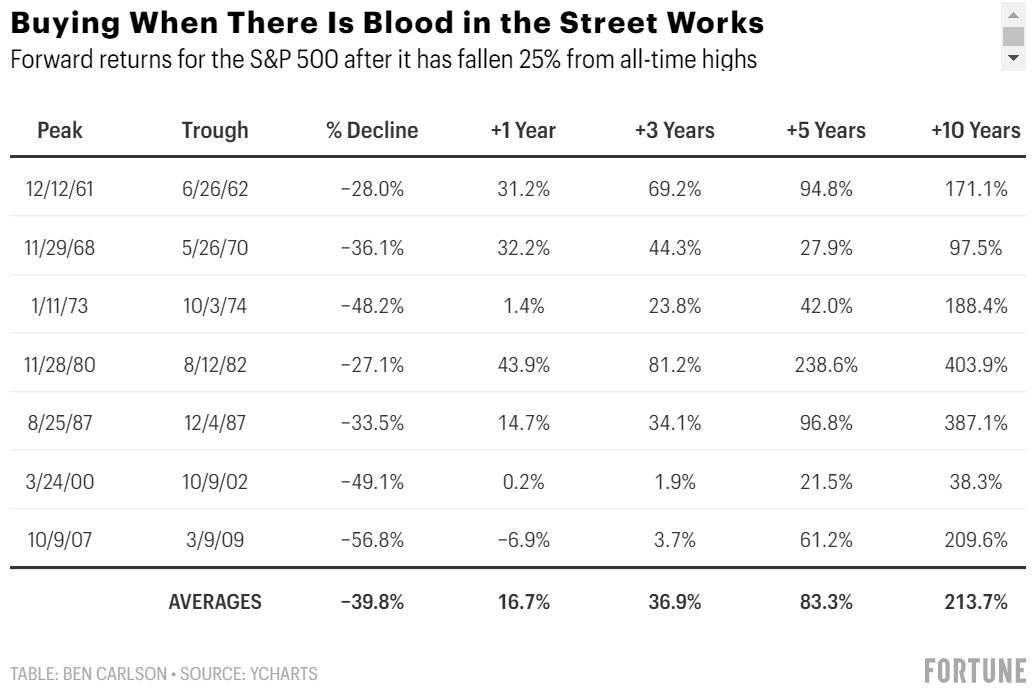

Bad news for those who are fully invested is good news for anyone who is periodically saving into their retirement accounts right now. As of the end of September, the S&P 500 was down 25% from all-time highs.

I ran the numbers going back to 1950 to see what happens to forward returns for the S&P 500 if you would have bought in after it fell 25% from the highs:

You can see all of these instances saw the market fall even further, but future returns going out one, three, five, and 10 years were terrific in most instances. Every period saw positive returns but one 12-month period during the Great Financial Crisis.

There are no guarantees this relationship will exist in the future. But young people should be happy to buy into the pain when stocks fall. That’s how you make money over the long run when you have many decades ahead of you to allow compounding to do the heavy lifting for you.

Gen X (middle age)

Retirees generally have lots of financial assets but little in the way of human capital in terms of future earning power. Young people typically have little in the way of financial assets but plenty of human capital to save in the future.

But what about middle-aged people?

Gen X is often the forgotten generation, since baby boomers and millennials get so much attention. The Reality Bites generation was born somewhere between 1965 and 1980, meaning they range in age from their early forties to their mid-to-late fifties.

Middle-aged people are in a glass-is-half-full vs. glass-is-half-empty conundrum. It stings to see the value of your portfolio go down, but it’s also nice to buy stocks when they are on sale when you actually have some money to do so.

This age bracket should be approaching their peak earnings years, when they are able to put even more money to work in the markets than ever before.

The older Gen Xers should also probably be thinking about slowly but surely getting more defensive with their portfolio as they age. The good news is yields for more defensive assets such as bonds are now much higher and stock prices are much lower.

It’s the best of both worlds.

Risk is often in the eye of the beholder when it comes to investing. It never completely goes away; it just changes shape. But risk also depends a lot on where you are in your life cycle as an investor.

This piece was originally published at Fortune.