This is the craziest market I’ve ever seen.

The pandemic somehow turned a bunch of people into day traders. At first they were buying beaten-down airline and cruise stocks. Now they’ve moved on to buying shares of companies that have filed for bankruptcy.

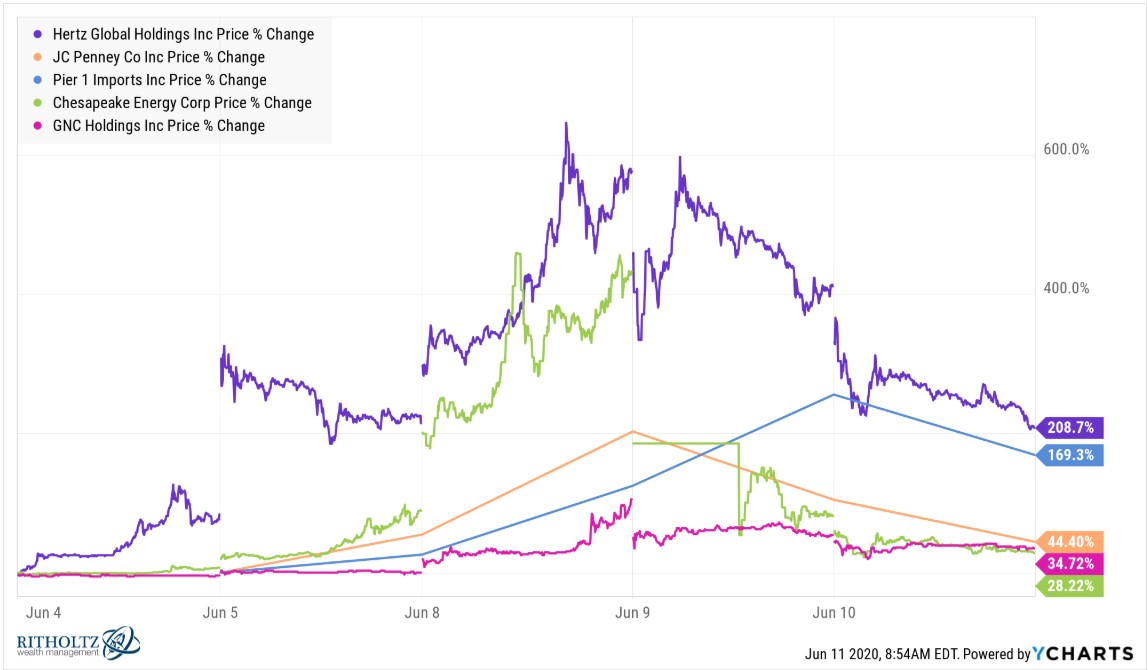

Hertz, JC Penney, Pier 1, Chesapeake Energy and GNC have all filed for bankruptcy recently but have seen massive price swings over the past week:

Granted, these stocks are all in death spirals over the past year:

This makes more sense but it also makes sense that it doesn’t take much of a rise in price to see a massive percentage gain in a stock like Hertz. The car rental company has gone from a high of well over $100/share to a low of $0.55/share.

The past 5 days alone have seen daily price swings in Hertz of -25%, -24%, +115%, +71 and +84%.

According to Bloomberg, nearly 100,000 investors on the Robinhood brokerage platform have instituted a position in Hertz over the past week alone.

There’s been plenty of finger-wagging and head-shaking going on from professional money managers about the increased activity from the likes of Robinhood traders during this market surge. It’s easy to “tsk, tsk” these types of speculative moves in the markets but this type of behavior is nothing new.

This year is unlike anything we’ve ever seen before in terms of market and economic dynamics but there is plenty of investor behavior that has been around since the dawn of markets. Here are some things that will never change about the markets:

Lottery ticket stocks will always find a buyer. Our brains are wired such that expecting to make money feels even better than the act of making money itself. It’s the anticipation that puts your brain on high alert. This is why investors and gamblers alike are rarely satisfied with a single win.

Your brain always needs another shot of dopamine to get that high again. It’s not enough for speculators to simply accept the market’s return during a massive recovery from a bear market. This is why we’ve seen a move from sector ETFs to beaten-down companies to bankrupt companies.

And the temptation to speculate increases when we watch others around us getting rich.

People with no skill or knowledge about the markets can still make money. Some of the smartest, most sophisticated investors on the planet have been caught off guard by the market surge in recent months.

Not only have these titans of the investment industry watched as the market has passed them by, but the biggest beneficiaries of the rise seem to be tiny retail traders.

The market doesn’t discriminate between professional and amateur and there’s no IQ test required to buy a share of stock.

The market cashes checks from anyone who plays, regardless of where they have an account or how much capital they have at stake.

This is not to say this will continue indefinitely but to paraphrase Keynes, “The market can keep the irrational investor solvent as long as you remain bearish.”

The “dumb” retail money will occasionally beat the “smart” professional money. Legendary investors like Druckenmiller, Tepper and Buffett have all admitted to being positioned too defensively during this rally. Here’s a live look at these billionaires:

This doesn’t make these legends idiots just like it doesn’t make Robinhood investors geniuses. This is just the way things work sometimes. No one bats a thousand.

No one is right all the time. Renaissance Technologies, likely the greatest hedge fund machine ever created, has claimed to be right on just 51% of their trades. No one is going to nail every top and bottom, especially in a market environment like this where things are happening at ludicrous speed.

Cycles tend to feel like they will never end. When stocks were getting thrashed on a regular basis in March it felt like the selling pressure would never let up. Lately, it’s felt as if stock gains happen every day.

Markets are always and forever cyclical and no trend lasts forever.

Hindsight capital remains undefeated. It’s easy to look back at what’s transpired this year and come up with perfectly logical reasons for the market’s manic behavior. And there are plenty of logical reasons for a market crash that immediately turned into a roaring bull market in the span of 3-4 months.

But there are no counterfactuals. Things didn’t have to happen this way. Markets have shown this year how they can be equal parts resilient and fragile.

Certain investors will always worry more about being right than making money. Markets would be a whole lot easier if hard work translated into better results; if intelligence guaranteed alpha; if fundamentals always carried the day; and if the markets always made sense.

Unfortunately, that’s not the case.

Simplicity often beats complexity.

Temperament matters more than intelligence.

And sometimes markets just don’t make sense.

Further Reading:

Some Crisis Investing Lessons From My Fun Portfolio